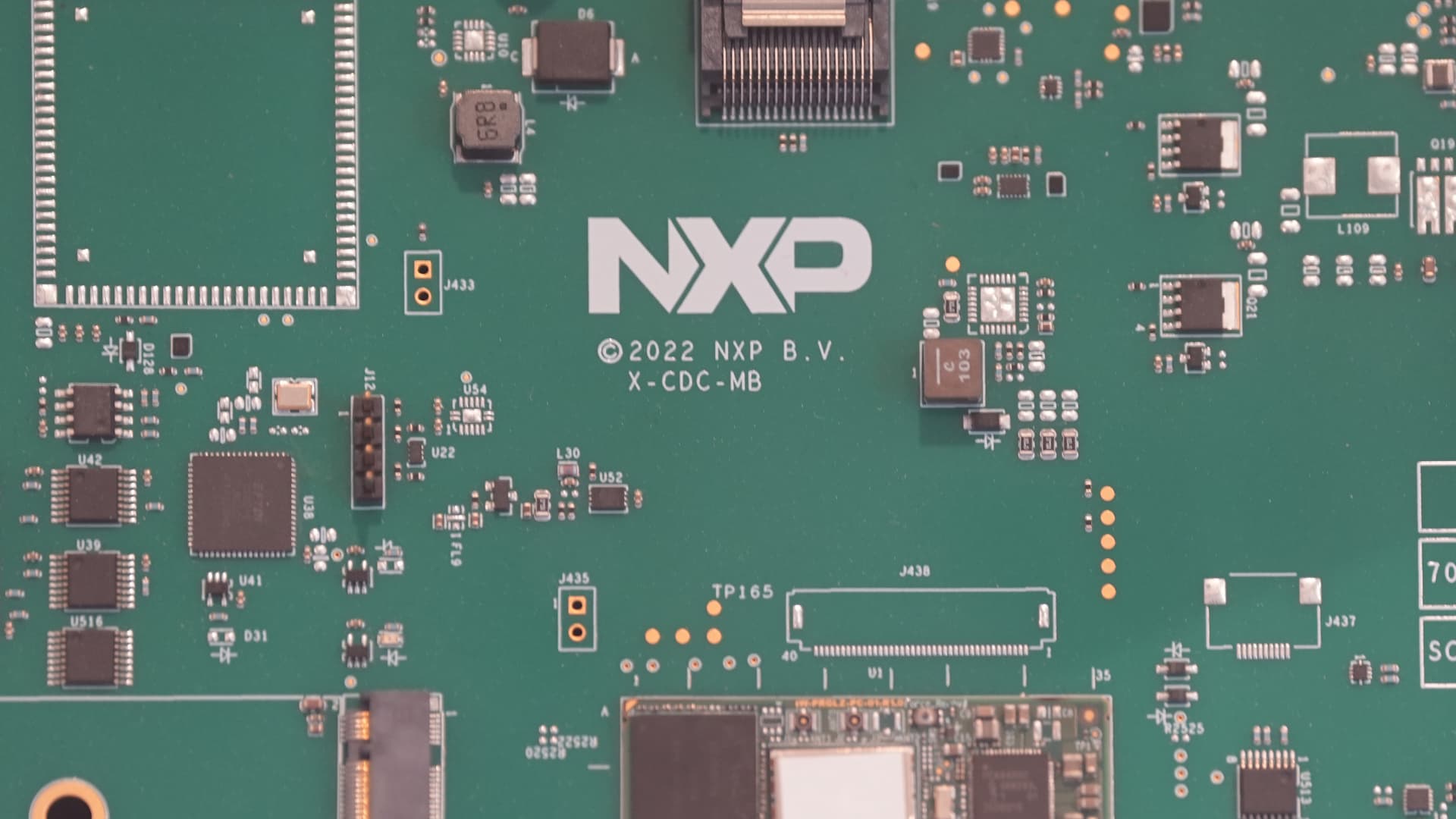

Deutsche Bank is laying out its top semiconductor picks for 2025 as the sector helps power major stock market averages to new highs. Artificial intelligence mainstays such as Nvidia have taken center stage since the launch of ChatGPT in late 2022. But with the dominant maker of artificial intelligence chips up more than 180% this year alone, and outperforming the rest of the market for a second straight year, Deutsche Bank believes it is time to pivot toward other companies in the industry. ” Consequently, we expect stock picking selectivity to remain paramount in 2025, with us preferring broad-based names with conservative growth expectations, underappreciated structural improvements and reasonable valuations, as well as AI beneficiaries where growth is accelerating, customers/technologies are diversifying and sustainability questions are thereby minimized,” wrote analysts led by Ross Seymore. They also see a favorable setup for the sector given the recent underperformance of the 30-stock PHLX Semiconductor Sector Index over the past five months. The index as a whole is up 17% this year, far below the 26.5% advance in the S & P 500, “with the majority of that deficit emerging in 2H24 when the SOX underperformed for five consecutive months (July-November), a historically rare duration for an inherently volatile sector,” Seymore wrote. .SOX YTD mountain PHLX Semiconductor Sector Index this year Within a group of favored stocks, Seymore highlighted integrated circuit maker Marvell Technology . Shares have rallied 76% this year as the company benefits from meeting the connectivity needs of AI growth. The stock rallied earlier this month on strong earnings and bullish Wall Street commentary surrounding the company’s product pipeline. NXP Semiconductors and On Semiconductor were also recommended by Deutsche Bank. The semiconductor suppliers have underperformed this year, falling 5% and almost 21%, respectively.