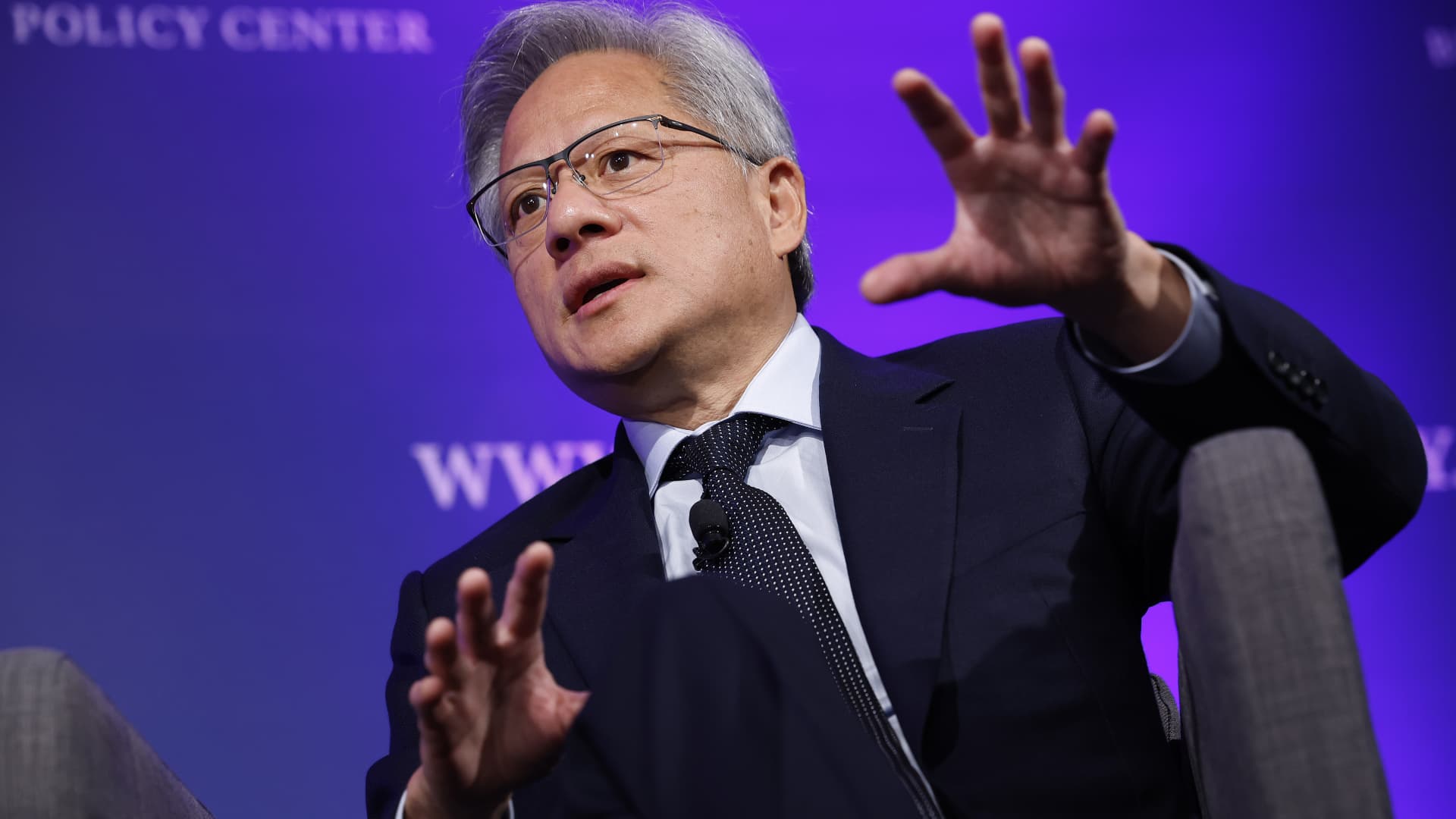

Investors are looking ahead to Nvidia CEO Jensen Huang speaking at the Consumer Electronics Show and what that could mean for the artificial intelligence trade. CNBC’s “Worldwide Exchange” also looks at tech top picks outside the “Magnificent Seven” where investors see big upside in 2025. Nvidia and an AI inflection point? Nvidia Chief Executive Jensen Huang will speak at the Consumer Electronics Show (CES) with some investors and analysts viewing it as an inflection point for the AI trade. “This stock really hasn’t done anything [since the election], it has trailed Marvell and Broadcom ,” Joel Kulina of Wedbush said on “Worldwide Exchange.” “People have been waiting for a catalyst.” Kulina added: “Tonight there is a lot of expectations that maybe Jensen will tease a little bit about the AI robotics strategy, maybe we will get some more granularity on the Blackwell ramp … also gaming and some other aspects of the business. But clearly the bulls want to hear some color on how Blackwell is going so far in terms of supply and demand.” ‘Worldwide Exchange’ pick of the day: Axsome Therapuetics Kevin Mahn of Hennion & Walsh said the biotech name has traded lower since the election, but he sees big upside in its pipeline and believes it could be a target for M & A. “They provide treatments for central nervous system disorders such as Major Depressive Disorder and Alzheimer’s Disease,” said Mahn on the show. “All of these areas are likely to be attractive to larger cap Pharmaceutical companies.” Citi names Take-Two Interactive as a top pick Jason Bazinet of Citi named video game maker Take-Two Interactive as a top pick for 2025 with a price target of $225. But the call largely hinges on the highly anticipated release of “Grand Theft Auto VI.” “It’s integral. The thesis is the game will be released this year,’ Bazinet noted. “Having said that, if you look at Take Two’s stock when they have delayed other games, you take a tactical hit, but the stock tends to rally right back.” Bazinet added he thinks Vivid Seats could be an attractive target for private equity. The stock has rallied on reports of a possible acquisition since Dec. 30.