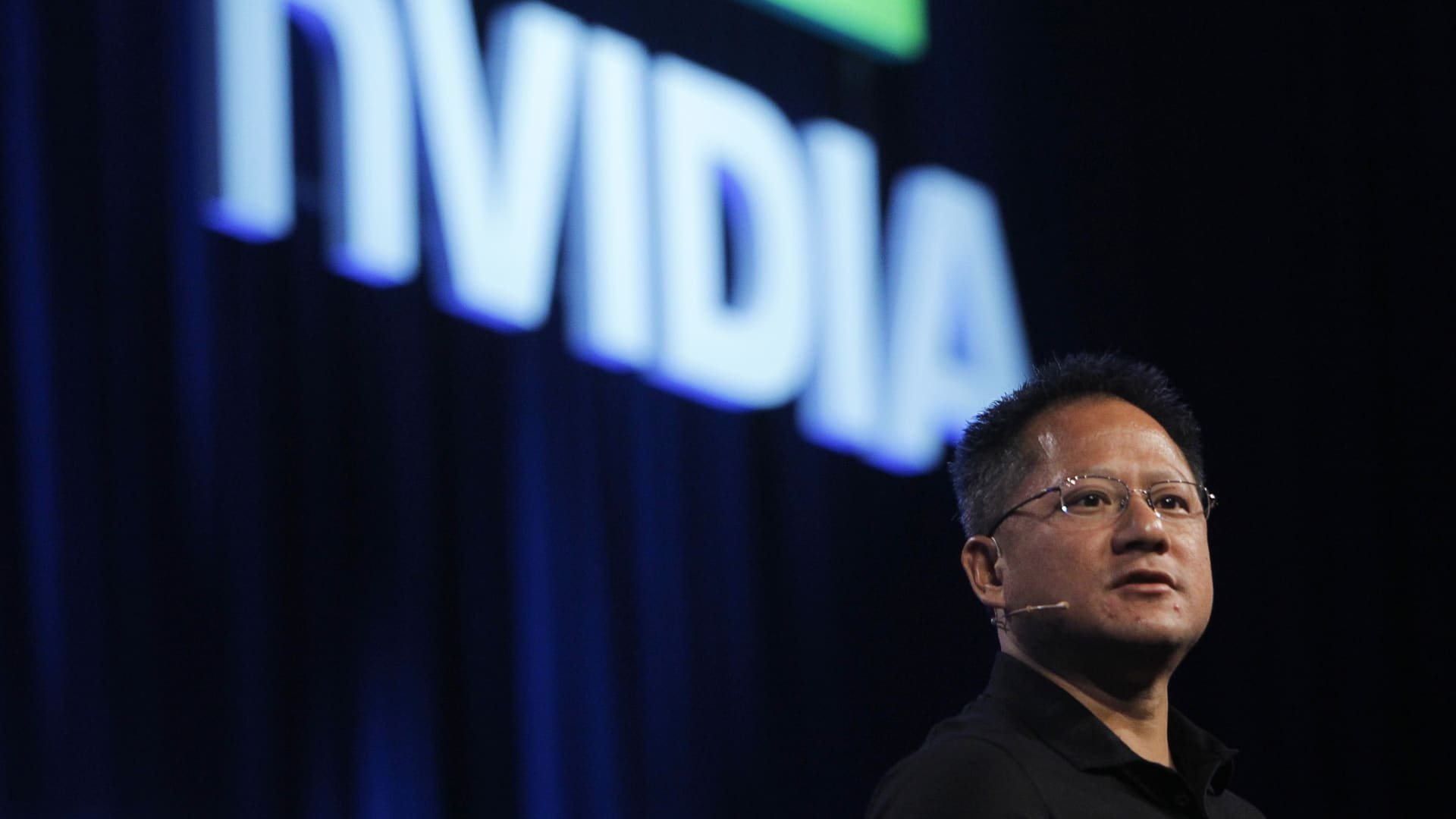

Here Tuesday’s the biggest calls on Wall Street: Loop initiates Advanced Micro Devices as buy Loop said the stock has “dominant revenue exposure to mature end markets.” “We are initiating coverage of AMD with a Buy rating and $175 tgt.” Mizuho initiates Maplebearas buy Mizuho said the company has a “category-leading position.” “We view competitive concerns overstated given CART’s deep technology integration with grocers on inventory, and combined with its largest transactions data and specialized delivery workforce, the business model creates an unparalleled user experience…” Wells Fargo upgrades Air Products to overweight from equal weight Wells Fargo said the company’s turnaround is underway and is answering shareholder concerns. “We upgrade APD to OW from EW and set a 12-month PT of $350 based on FY25E EV/EBITDA of 16.0x.” Wells Fargo reiterates Netflix as overweight Wells said it’s standing by the stock ahead of earnings next week. “We think NFLX could beat on Q4 subs, but upward ’25 revisions could be constrained by the stronger USD + investing in the ad strategy. The stock has rerated to 35x P/E on sports/live. We like the long term, but we’re less favorable on the setup.” Goldman Sachs upgrades Hesai to buy from neutral Goldman said it’s bullish on shares of the self-driving tech stock. “We upgrade Hesai to Buy (from Neutral) with a revised 12-month target price of US$18.4, implying 35% upside potential. Wells Fargo reiterates Microsoft as overweight Wells Fargo said it’s bullish on the stock ahead of earnings later this month. “From our recent field work, we’re expecting a balanced FQ2 w/o any major surprises from MSFT. See any clearing of AI capacity debate ( & clarity on Azure re-accel) as likely to unlock more significant 2H upside. Reiterate OW & $515 PT.” Morgan Stanley upgrades Acuity Brands to overweight from equal weight Morgan Stanley said it’s bullish on shares of the lighting company. “Structurally higher growth + gross margin not reflected in Consensus estimates nor AYI valuation.” Goldman Sachs reiterates Meta as buy Goldman said it likes Meta ahead of earnings later this month. “We believe META mgmt remains focused on long-term opportunities (artificial intelligence & Reality Labs), with an increased focus on aligning investments across a world-class compute infrastructure, open-source software initiatives and a raised range of forward capex.” JPMorgan reiterates Nvidia as overweight The firm said it’s sticking with the stock following a meeting with Nvidia management at the JPMorgan healthcare conference. “The healthcare vertical business is estimated to drive $1B+ of annual recurring revenues in FY26, making it one of the top vertical market segments within Nvidia’ s datacenter business.” Deutsche Bank initiates Pony.ai as buy Deutsche said the China robotaxi tech company is best positioned. ” Pony is a global leader in large-scale commercialization of autonomous mobility, mainly ‘level 4’ robotaxis. It is the only robotaxi technology company that has obtained all available regulatory permits in tier-1 cities in China, including public facing, fare-charging robotaxi services without safety drivers in Beijing, Guangzhou and Shenzhen, and public-facing road-testing robotaxis in Shanghai.” BTIG upgrades Instacart to buy from neutral The firm said in its upgrade of the stock that it’s a category leader. “We upgrade CART from Neutral to Buy and initiate a 12-month PT of $58. Highlights: 1) The immediate catalyst for the upgrade is a stepup in estimates with our tracking pointing to strong order growth, putting us above consensus for 4Q and 2025; 2) Bigger picture, CART is a leader in a secular growth category…” Bernstein reiterates Robinhood as outperform Bernstein said the stock is a top idea in 2025 and is well positioned in crypto. ” Robinhood is our new Best Idea in our Global Digital Assets coverage. It has so far operated a constrained crypto business, but we expect this to change as the regulatory environment for crypto becomes more favorable.” Barclays reiterates Netflix as underweight The firm raised its price target on the stock to $715 per share from $550. ” Netflix’s premium valuation is predicated on revenue growth being at least in the low double digit range.” Jefferies names Broadcom a top pick Jefferies said the semis company is a top idea in 2025. “AVGO Top Pick but Plenty of Growth to Go Around.” Bank of America names Ferrari a top pick Bank of America said the luxury auto company has a “strong product, pricing, tech, and earnings.” “We have a Buy rating on RACE, which is a unique asset with significant intangible brand value and a true luxury status.” Truist initiates Lockheed Martin as buy Truist said it sees an attractive entry point for the defense company. “We initiate coverage on LMT with a BUY rating/$579 PT. We believe LMT’s recent 24.5% pullback off its recent high has created a compelling entry point.” Seaport upgrades Visa to buy from neutral and downgrades Mastercard to neutral from buy The firm said it prefers Visa over Mastercard due to U.S. exposure. “We’ve upgraded Visa to Buy from Neutral – this year, we prefer it on a relative basis over Mastercard (downgrading Mastercard to Neutral from Buy). This is primarily due to Visa’s more significant US exposure (a key theme of ours in ’25) – we expect upside vs. consensus revenue/EPS for Visa this year.” Morgan Stanley downgrades Las Vegas Sands to equal weight from overweight Morgan Stanley said it sees a more “balanced risk/reward.” “As such, we downgrade LVS to EW from OW as consensus appears to already reflect strong underlying market growth plus share gains in Macau, resulting in less upside to #s and a more balanced risk-reward.” Bank of America reiterates Alphabet as buy The firm raised its price target on the stock to $225 per share from $210. “With search still far overshadowing value of other businesses, we view 2025 as a pivotal year, which could help establish Google as either an Al leader (via AI Overview traction) or see elevation in search disruption risk.”