What to do with Nvidia after a terrible week? Nvidia has been a huge winner for the Club — and, deservedly so. The company is behind the two most important trends in tech: accelerated computing and generative artificial intelligence. For that, it has been rewarded with, at one time, the largest valuation in the world. Even after this week, it’s still among the top three with a market capitalization of more than $2.9 trillion. We have embraced Nvidia like no other. And, we’ve embraced it for years. But, when it got to be too big in the portfolio at the start of this year, we trimmed it , pretty much at the high. Remember, Nvidia surged more than 170% in 2024 following a nearly 240% surge in 2023. NVDA 5Y mountain Nvidia 5 years Now we have a Chinese startup DeepSeek that may cause some Nvidia customers to pause their ordering of the company’s latest chips, which are quite expensive, especially for the new Blackwell platform. But the pricing has much to do with Nvidia’s dominant status. There are several companies, customers of Nvidia, that know if they want to be the leaders in AI they must pay full freight, including Meta Platforms. Tesla hinted that it, too, must order hundreds of thousands of Nvidia chips to run the neural networks needed to power full self-driving electric vehicles. Most companies — and countries, also big customers — will want to question their spending for accelerated computing and generative AI after what they have read about the Chinese invention from DeepSeek. Nvidia shares are priced for the language that CEO Jensen Huang said about the demand that there is an insane amount of it. It may, however, take only one large customer to say it is pausing to cut Nvidia stock down maybe another 10%. Shares of the AI chipmaker are already down 16% week to date on DeepSeek concerns, which has reversed a modest gain for 2025 as of last Friday close to a 10% year-to-date decline not even a week later. NVDA YTD mountain Nvidia YTD That potential pause calls into question the valuation of Nvidia, and that’s something we cannot ignore. While believing Nvidia should still be “owned, not traded” that does not give us license to turn a blind eye to a change in the facts. We can own Nvidia, of that there is no question. But to own this amount of Nvidia, to me, is to ignore the possibility that tech customers will pause or bargain with Nvidia for better pricing or seek out less powerful chips from Advanced Micro Devices . Bottom line Therefore, I believe we need to make the position smaller, given that it is priced, even here, for perfection, and the story is no longer perfect. The position is still too big in the portfolio relative to the stock’s gains and market capitalization accumulation over the past few years. Sure, by trimming we could give up some of our upside should it recover. However, discipline demands making a sale to shield us from losses in case our worst fears are realized. We would be making a trim on Thursday if not restricted by our Club rules. (Jim Cramer’s Charitable Trust is long NVDA, META. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

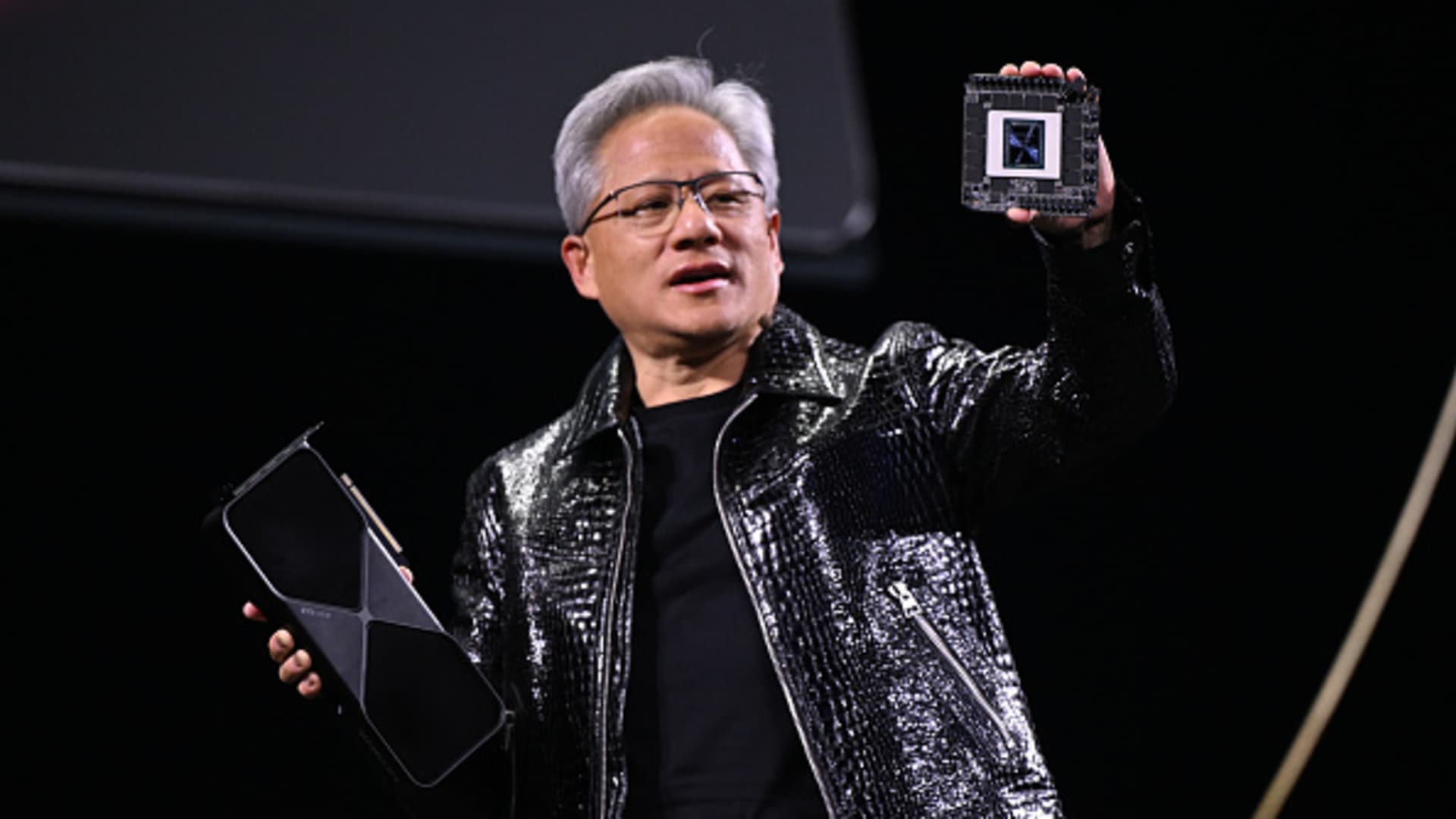

Nvidia CEO Jensen Huang delivers a keynote address at the Consumer Electronics Show (CES) 2025, showcasing the company’s latest innovations in Las Vegas, Nevada, USA, on January 6, 2025.

Artur Widak | Anadolu | Getty Images

What to do with Nvidia after a terrible week?