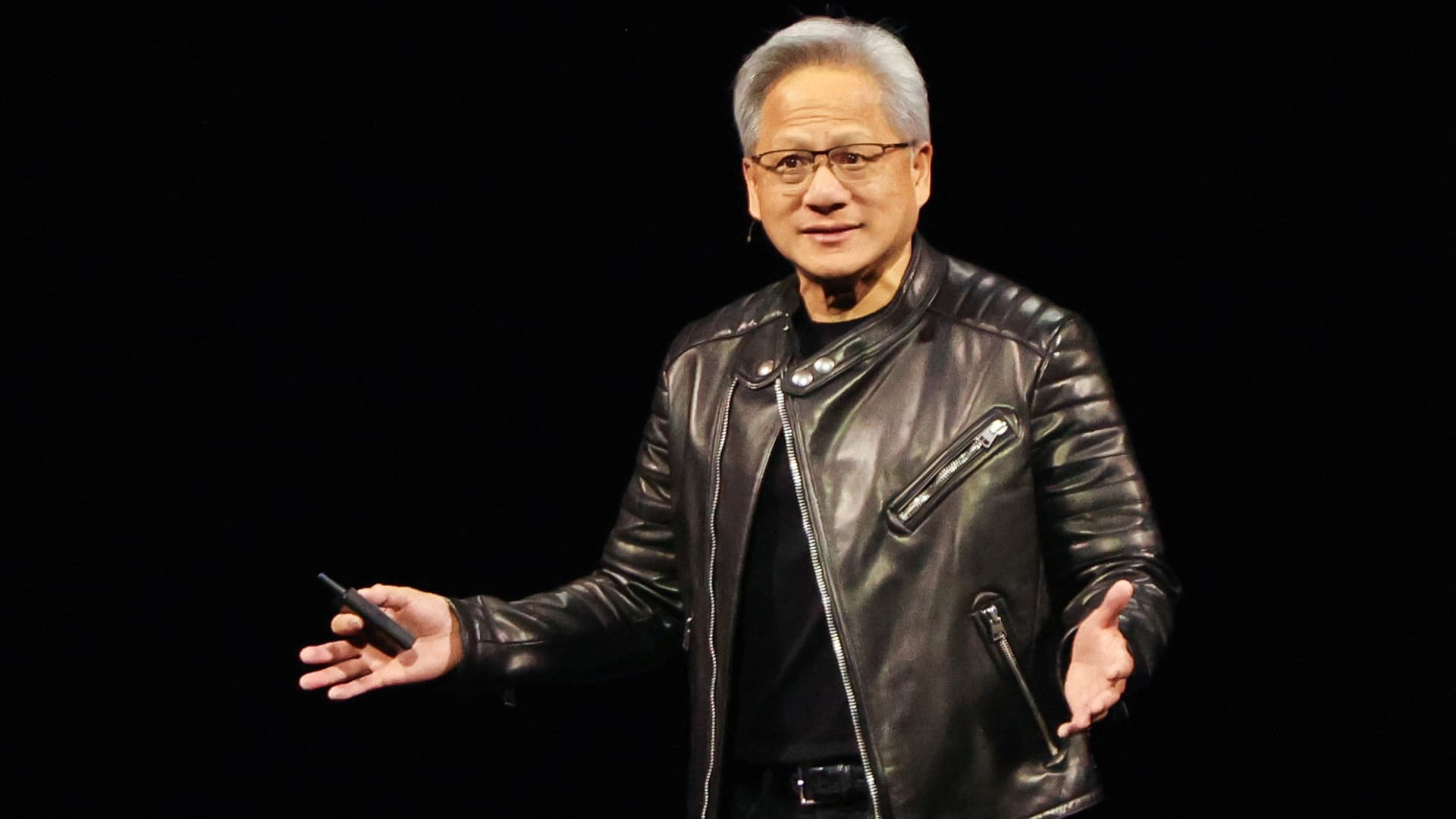

Wall Street analysts left Nvidia ‘s flagship GPU Technology Conference on Tuesday feeling generally optimistic on the AI darling’s future. During a keynote speech, CEO Jensen Huang announced new chips for deploying artificial intelligence models. These models are expected to ship in 2026, he said. However, some were left underwhelmed. The stock dropped more than 3% on Tuesday, bringing its year-to-date losses to more than 14%. This is a departure from previous years, as the GTC conference had been a positive catalyst for shares in previous years . Jefferies analyst Blayne Curtis noted that while “the rate of innovation on all fronts continues to impress and suggests a growing moat vs. peers … we were hoping for more proof points for TAM expansion and TCO advantages.” Still, Curtis maintained his buy rating on the stock and $160 price target, which points to 60% upside. Others also stuck to their bullish theses. Here’s what the analysts had to say. Bank of America maintains buy rating, price target of $200 The bank’s price target signals 73% upside. “We maintain Buy, $200 PO following slate of product/partner announcements at flagship GTC conference in addition to post keynote meeting with CFO that demonstrate NVDA continuing to deepen its competitive moat in a $1T+ infrastructure/services TAM,” wrote analyst Vivek Arya. Citi stands by buy rating, price target of $163 Citi’s target points to a 41.2% gain. “Net-net, we came out of the keynote reassured in NVIDIA’s leadership which if anything seems to be expanding. We view positively NVIDIA’s push for inference which per company comments now requires significantly more compute. Maintain Buy,” said analyst Atif Malik. Evercore ISI reiterates outperform, price target of $190 Evercore ISI’s price target implies a gain of 64.6%. “NVDA CEO’s keynote at its annual GTC conference reinforces our view that no one is investing at the pace or magnitude NVDA is in building out a full-stack chip+hardware+networking+software ecosystem for the AI computing era, consistent with quotes we recently heard from hyperscalers that “NVDA has an 8-year lead” and “NVDA’s ecosystem is on a different continent,” wrote analyst Mark Lipacis. “We view the recent weakness as a particular buying opportunity.” Deutsche Bank keeps rare hold rating, $145 price target The price target points to 25.6% upside. “Overall, NVDA conveyed strong-but-warranted bullishness about the strength of its product roadmap, with the company clearly maintaining a strong lead in its systems-based approach to serving AI compute needs. We applaud the company for maintaining this lead and for enabling explosive growth in the AI ecosystem. With relatively few surprises to us from this GTC keynote, we maintain our Hold rating,” analyst Ross Seymore wrote. JPMorgan reiterates outperform rating, price target of $170 JPMorgan’s price target implies 47% upside. “With leading silicon (GPU/DPU/CPU), hardware/ software platforms, and a strong ecosystem, Nvidia is well-positioned to benefit from major secular trends in AI, high-performance computing, gaming, and autonomous vehicles, in our view. NVIDIA continues to remain 1-2 steps ahead of its competitors,” wrote analyst Harlan Sur. Morgan Stanley maintains overweight, $162 price target The price target points to 40% upside. “While there were no big surprises in the keynote aimed at developers, the company made a strong case that there will continue to be multiple waves of AI scaling requirements, that they are delivering product leadership through 2027, and that near term cloud demand is strong,” analyst Joseph Moore said. UBS keeps buy rating, $185 price target The bank’s forecast signals a gain of 60%. “Overall, NVDA did a nice job laying out the roadmap and debunking the narrative that compute demand and scaling is seeing any slowdown,” wrote analyst Timothy Arcuri.