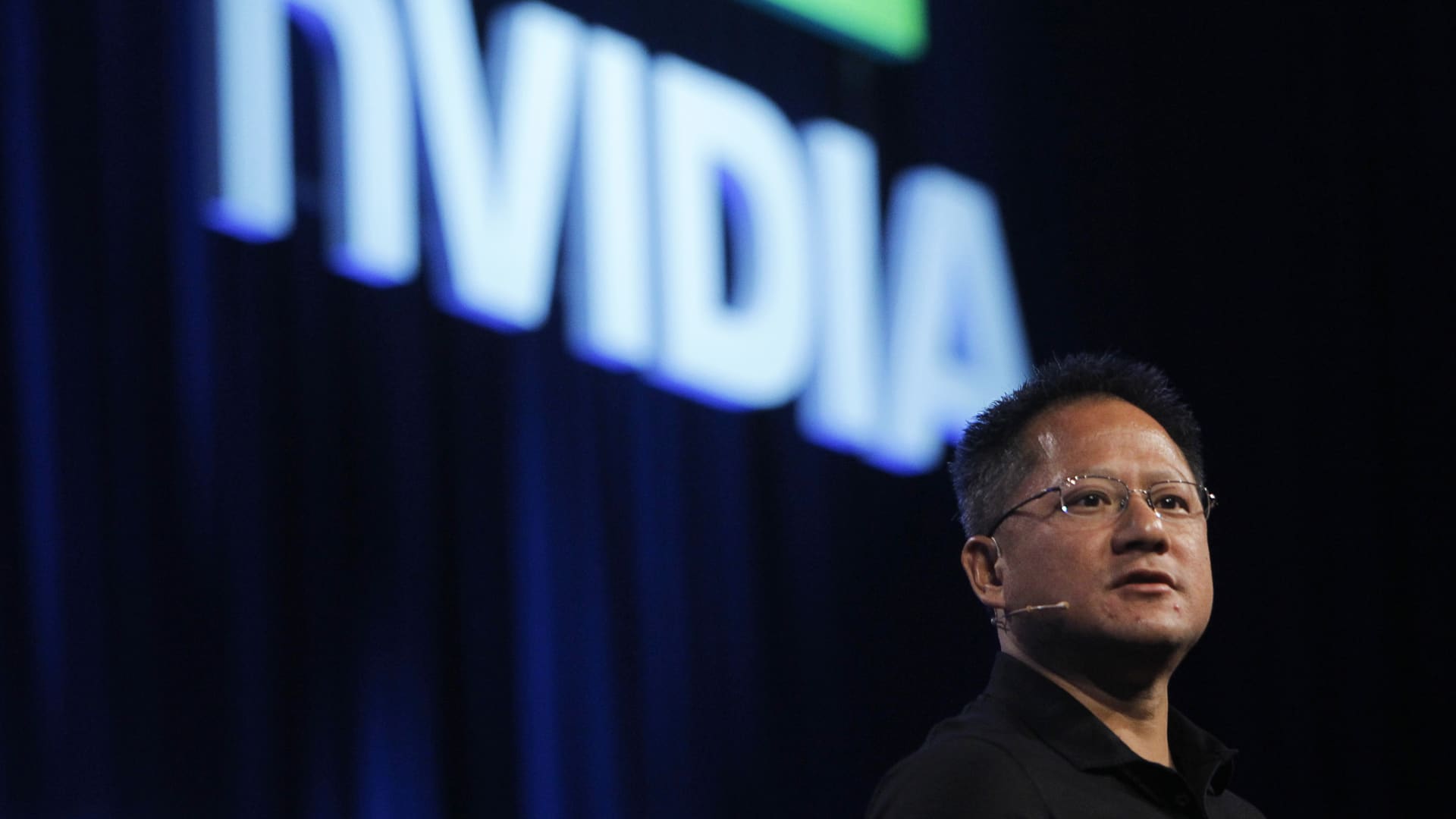

Here are Thursday’s biggest calls on Wall Street: Wolfe upgrades Equinix to outperform from peer perform Wolfe said the macro weakness could benefit data centers for the digital infrastructure company “With this report, we are upgrading Equinix Inc. (EQIX) to Outperform from Peer Perform.” Morgan Stanley upgrades Liberty Energy to overweight from equal weight Morgan Stanley said the energy company is a data center beneficiary. “Earnings prospects for LBRT’s new Power Generation Services (PGS) business and the value that these investments create seem underappreciated, in our view.” Bank of America reiterates Nvidia as buy The firm said Nvidia shares are “compelling.” “Meanwhile, we believe the stock is providing a particularly attractive opportunity for one of the most unique, high-quality tech franchises leading the largest and fastest growing secular trends.” Bernstein reiterates Ferrari as outperform Bernstein said it thinks Ferrari is well positioned to withstand any tariffs. “Ferrari manufactures all its highly desirable cars in Maranello, Italy and so it is clearly in the cross-hairs of the 25% tariff on auto imports that President Donald Trump announced yesterday. By the same token, we are hard-pressed to think of any customer cohort in the US that is better placed than Ferrari’s to absorb higher prices.” Jefferies downgrades Advanced Micro Devices to hold from buy Jefferies said street estimates remain too high for the chip company. “We are also moving AMD to Hold given limited traction in AI, Street estimates too high, and expectations of mounting competition from Intel.” Bernstein reiterates Robinhood as outperform Bernstein said investors “under-appreciate HOOD’s broader Financial/Money platform, beyond its core focus on active traders.” “Last night, Robinhood (HOOD) announced three disruptive products in wealth management & banking.” HSBC reiterates Tesla as reduce HSBC lowered its price target on the stock to $130 per share from $165 and says there are “no quick fixes.” “Tesla eschews many of the industry norms (holding list prices firm, making regular facelifts and model renewals) and has to date seen only minimal impact, but tougher competition and brand erosion is likely to see the impact of its strategy hurt more.” RBC upgrades Northrop Grumman to outperform from sector perform RBC said the defense company is “well positioned relative to shifting DoD [Department of Defense] priorities.” “We are upgrading shares of Northrop Grumman to Outperform from Sector Perform.” Stifel initiates Roper as buy Stifel said the industrial software company has a differentiated offering. “We are initiating coverage of Roper Technologies with a Buy rating and a $685 price target.” Bank of America reinstates Roku as buy The firm said Roku is “poised to enter the next phase of monetization which will drive revenue and profitability growth for the foreseeable future.” “We are reinstating coverage of Roku with a Buy rating and $100 PO, based on ~27x our CY26 FCF/share forecast.” Goldman Sachs upgrades Par Pacific to buy from neutral Goldman said the energy company has an attractive risk/reward. “We highlight PARR’s Hawaii refining business as positioned to benefit from a recovery in margins.” JPMorgan initiates Mereo BioPharma as overweight JPMorgan said it sees an attractive entry point for the biopharma company. “We are initiating on Mereo (MREO) with an Overweight rating and a December 2025 price target of $7.” KeyBanc reiterates McDonald’s as overweight KeyBanc raised its price target on the stock to $340 per share from $335. “Based on our industry conversations and proprietary data, we are lowering our 1Q25 SSS growth for McDonald’s USA to -2%. But we are raising our 2Q25 SSS [same-store sales] growth estimate to 3.5% to reflect our optimism surrounding the innovation/marketing calendar.” Bank of America upgrades Check Point Software Technologies to buy from neutral Bank of America said in its upgrade of Checkpoint that the network security solutions software company is in the midst of a turnaround. “We believe new CEO Nadav Zafrir has started taking steps to fundamentally change the outlook and our upgrade is based on two factors.” JPMorgan reiterates General Motors, Ford and Ferrari as overweight The firm lowered its price target on a slew of automakers amid tariffs. “We are lowering our December 2025 price target for GM by -17% to $53 from $64, for Ford by -15% to $11 from $13, and for Ferrari by -12% to $460 from $525, effected by decreases in our chosen target multiples to reflect less confidence in earnings estimates that are for now unchanged, given the highly volatile regulatory backdrop with regard primarily to tariffs but also EV subsidies and potential consumer tax deductibility of vehicle interest expense for US-built vehicles.” Mizuho upgrades Chemours to overweight from neutral Mizuho said the chemicals and paint company has upside potential. “When it rains, it can pour. But, cloudbursts can be followed by sunshine. Chemours is the leading global producer of fluorine-based refrigerants & specialty plastics, and #2 global producer of TiO2 pigments (paint is its largest use).” RBC downgrades Lockheed Martin to sector perform from outperform The firm said it sees U.S. budget pressures for the defense contractor. “We are downgrading shares of Lockheed Martin (LMT) to Sector Perform from Outperform. We believe the F-35 faces greater headline risk for international sales (while we see little risk to actual order cancellations) and increased US budget pressure.”