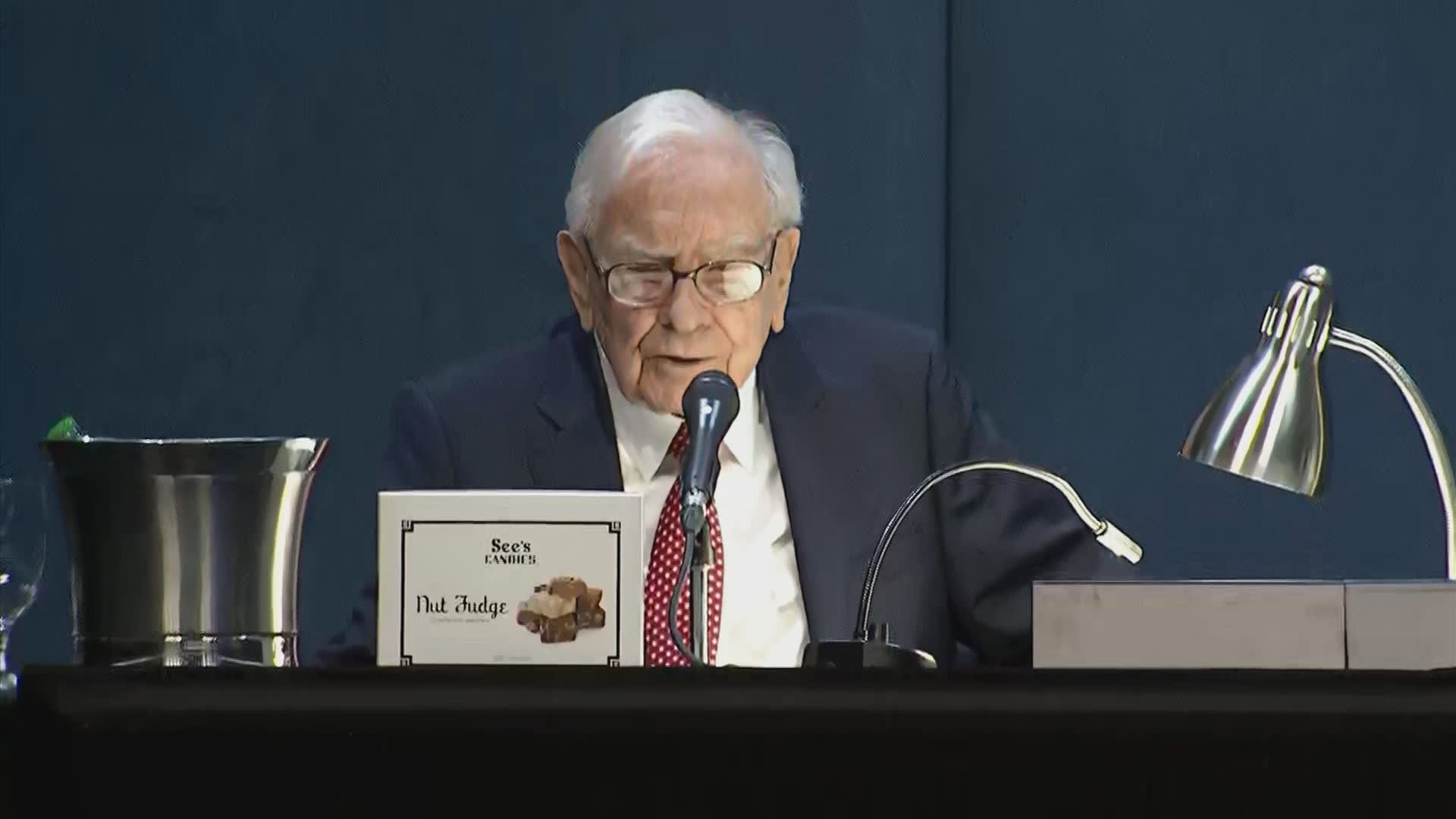

Warren Buffett’s Berkshire Hathaway fared better than the S & P 500 in a brutal week as investors embraced the safety of a cash-rich conglomerate while President Donald Trump’s aggressive tariffs wreaked havoc on Wall Street. Class B shares of the Omaha-based parent of Geico insurance and BNSF Railway fell 6.2% last week, less than the 9.1% selloff in the S & P 500 and a 10% drawdown in the tech-heavy Nasdaq Composite . Domestically-oriented Berkshire, which also owns large manufacturing, energy and retail businesses, is still up about 8% this year. The stock is also the only one of the 10 largest companies in the S & P 500 that’s still trading above its 200-day moving average, a popular momentum indicator, according to Evercore ISI’s head of technical analysis Rich Ross. BRK.B YTD mountain Berkshire Hathaway in 2025. While the 200-day moving average “isn’t everything, it is an important thing, and BRK/B is the only ‘Top 10’ stock in the S & P above it,” said Ross. Berkshire is outperforming at a time when the economic outlook has been shaken by Trump’s shocking move to start a global trade war. In response, the stock market entered a tailspin, with the S & P 500 plummeting 10% in just two sessions. The blue-chip Dow Jones Industrial Average suffered its first ever back-to-back losses of more than 1,500 points. Some investors seeking relatively safe places to hide find Berkshire appealing because of the defensive nature of its huge insurance empire and the conglomerate’s unmatched balance sheet — boasting $334 billion in cash at the end of 2024. Ritholtz Wealth Management CEO Josh Brown said Berkshire is one of the few stocks in the market right now that doesn’t hinge its livelihood on Trump’s unpredictable policies. “It’s one of the biggest publicly traded companies in the world, huge exposure to the U.S. economy obviously,” Brown said. “The market is correctly sorting out that there are certain companies that do not have to go hand in hand to the White House to get a carve out, certain companies that do not live or die based on where the 10 year [Treasury yield] is, or what China does next, or how the Canadians feel.” On Friday, the 94-year-old Buffett denied remarks allegedly made on social media by him. That came after President Donald Trump shared on Truth Social a fan video that claimed the president is deliberately tanking the stock market, with the endorsement of the legendary investor. Buffett said he won’t comment on the markets or tariffs between now and Berkshire’s annual meeting on May 3.