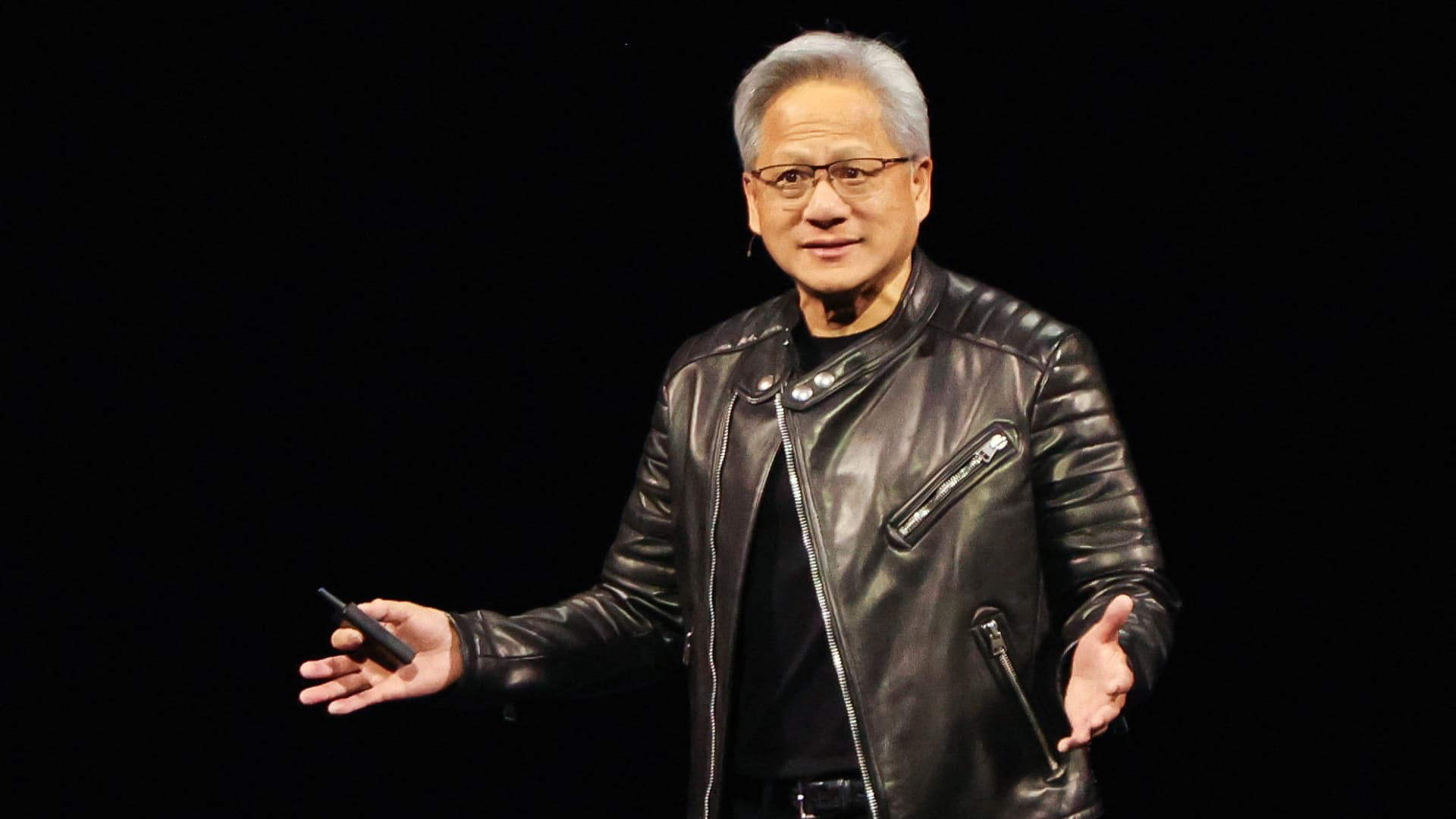

Nvidia CEO Jensen Huang delivers the keynote for the Nvidia GPU Technology Conference at the SAP Center in San Jose, California, on March 18, 2025.

Brittany Hosea-small | Reuters

Technology stocks declined Wednesday, led by a 5% drop in Nvidia, as the chipmaking sector signaled that President Donald Trump‘s sweeping tariff plans could hamper demand and growth.

Nvidia revealed in a filing Tuesday that it will take a $5.5 billion charge tied to exporting its H20 graphics processing units to China and other countries and said that the government will require a license to ship the chips there and other destinations.

The chip was designed specifically for China use during President Joe Biden’s administration to meet U.S. export restrictions barring the sale of advanced AI processors, which totaled an estimated $12 billion to $15 billion in revenue in 2024. Advanced Micro Devices said in a filing Wednesday that the latest export controls on its MI308 products could lead to an $800 million hit.

Chipmaking stocks have struggled in the wake of President Donald Trump’s sweeping U.S. trade restrictions, sparked by fears that higher tariffs will stifle demand.

The disclosures from Nvidia and AMD are the first major signs that Trump’s fierce battle with China could significantly hamper chip growth. The administration has made some exemptions for electronics, including semiconductors, but has warned that separate tariffs could come down the road.

Adding to the sector worries was a disappointing print from Dutch semiconductor equipment maker ASML. The company missed order expectations and said that tariff restrictions create demand uncertainty. Shares fell about 5%.

The VanEck Semiconductor ETF fell more than 4%, with AMD plunging more than 5%. Micron Technology, Marvell Technology and Broadcom sank about 2% each. Equipment makers Applied Materials and Lam Research fell about 3% each.

The declines spilled over into the broader market and tech-heavy Nasdaq Composite, which dropped nearly 2%. Meta Platforms, Alphabet and Tesla lost about 2% each. Amazon, Microsoft and Apple were last down about 1% each.