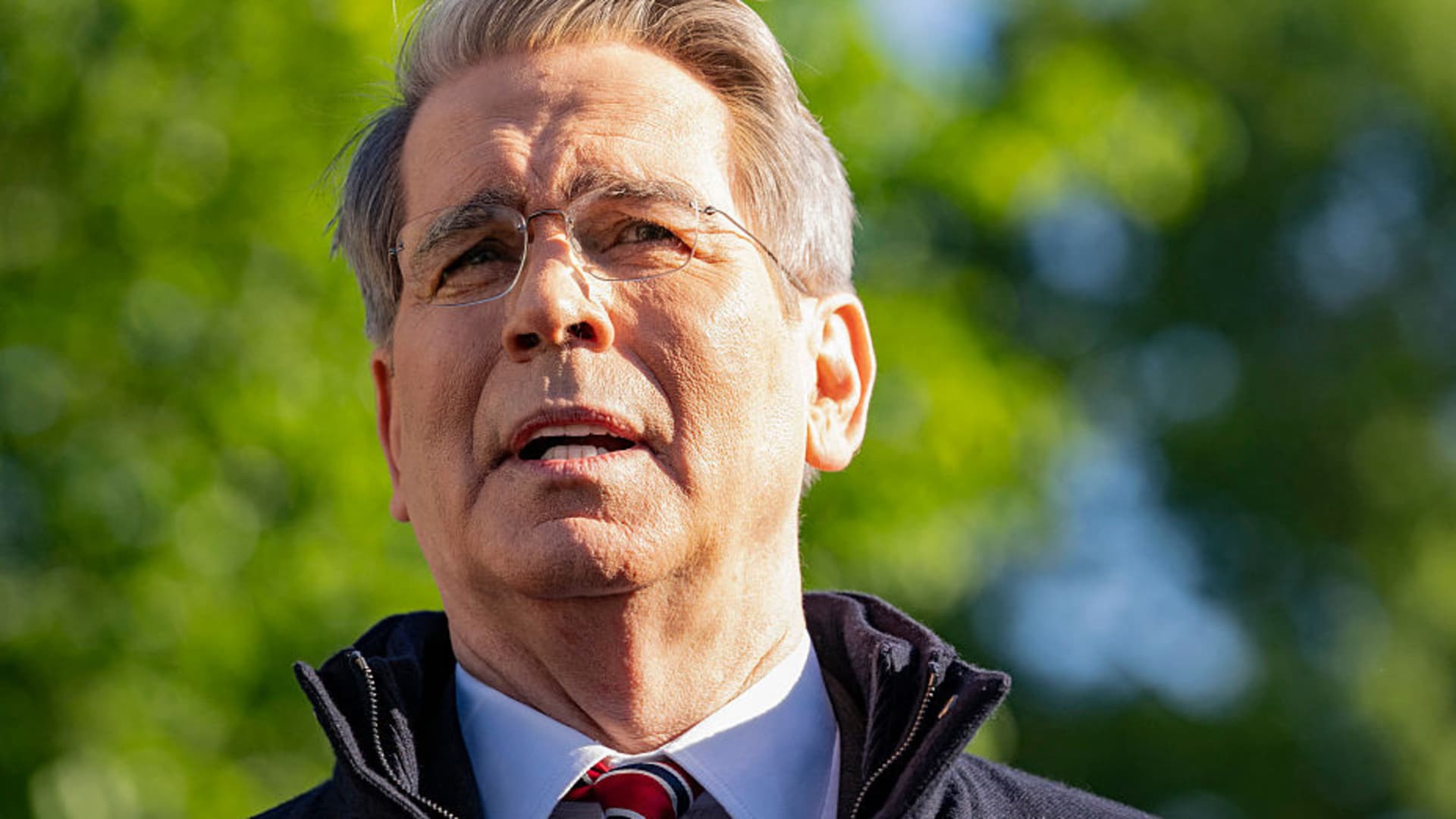

Treasury Secretary Scott Bessent said Tuesday that individual investors, who have largely been holding their positions through the recent market turmoil, have faith in President Donald Trump’s tariff policy.

“Individual investors have held tight, while institutional investors have panicked … individual investors trust President Trump,” Bessent said during a press briefing alongside White House press secretary Karoline Leavitt.

“Vanguard, one of the largest money management firms in America, said that over the past 100 days, 97% of Americans haven’t done a trade,” Bessent, a former hedge fund CEO, said, citing a Washington Post story with the data.

Trump’s rollout and subsequent suspension of the highest tariffs on imports in generations, fueled the worst sell-off in stocks since the onset of the pandemic in 2020. The S&P 500 briefly tumbled into a bear market before recouping some of the losses, and the equity benchmark is now about 10% off its February all-time high.

During the depth of the April rout, retail investors swooped in to snap up stocks at depressed values. At the same time, hedge funds and professional traders ran for the exit while piling on bearish wagers against the market.

Institutions have grown increasingly worried that steep tariffs will weigh heavily on consumers and slow down the economy, possibly tipping it into a recession.

Torsten Slok, chief economist at Apollo, now sees a summer recession hitting the U.S. as consumers start to see trade-related shortages in stores next month. Ken Griffin, founder and CEO of Citadel, said Trump’s global trade fight risks spoiling the “brand” of the United States and tarnishing the allure of U.S. Treasury debt.