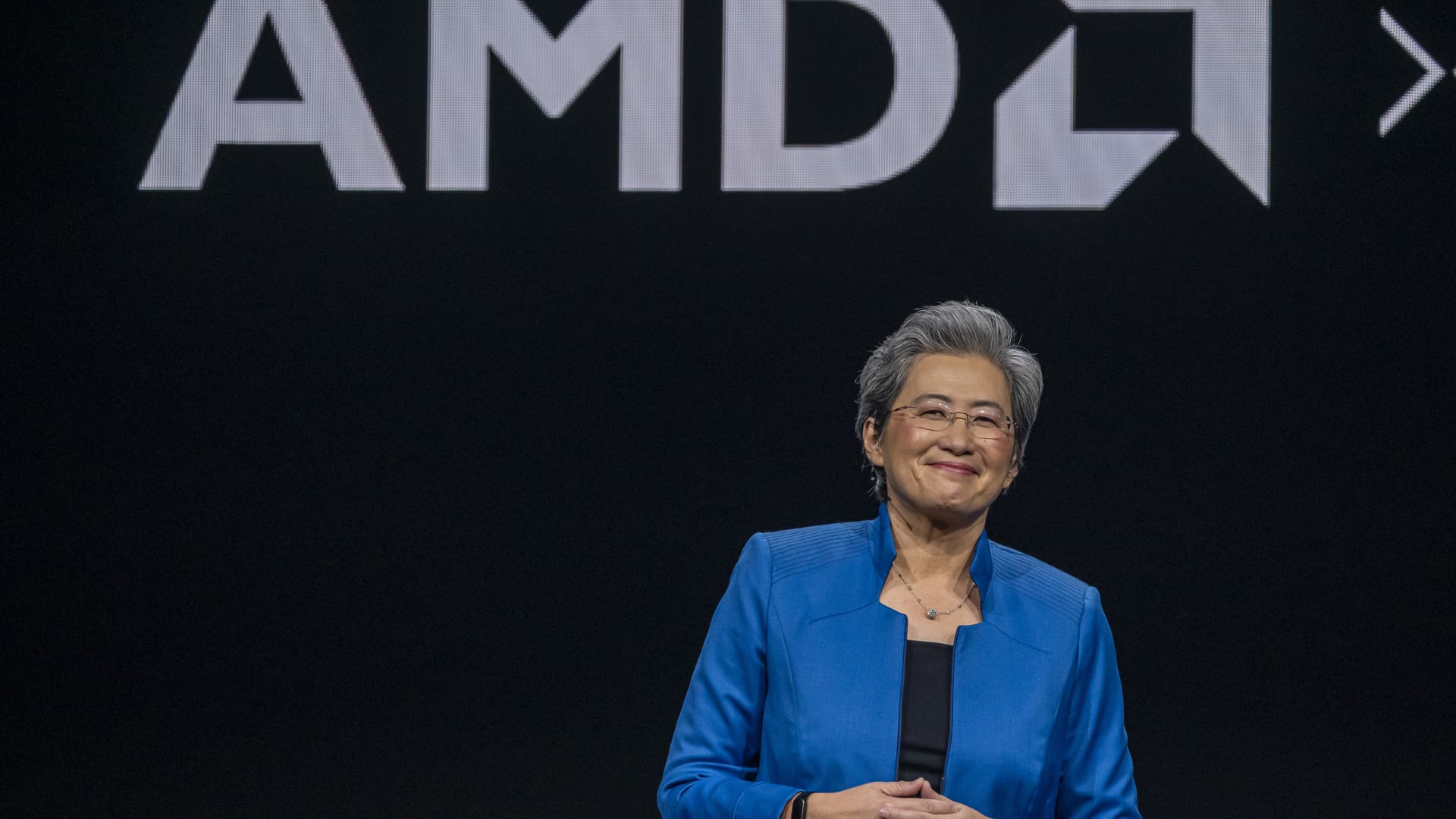

Advanced Micro Devices first-quarter results had enough for both bull and bears on the Street to gnaw at going forward. The semiconductor stock added 2% in after the company reported earnings and revenue that topped analyst expectations. The quarter was driven in part by data center revenue of $3.7 billion, which exceeded estimates as well. However, CEO Lisa Su said AMD sees around $700 million in lost revenue this quarter due to export controls. For the full year, it expects a $1.5 billion hit. Many analyst reiterated their hold-equivalent ratings on the stock following the release. Those include Bernstein, Citi and Deutsche Bank. Morgan Stanley also kept its equal weight rating and trimmed its price target on the stock. Others, however, were more constructive. Bank of America upgraded shares to buy, while UBS upped its price target following earnings. Take a look at what some of the biggest shops on the Street had to say. Bank of America upgrades shares to buy from neutral, lifts price target to $120 from $105 Bank of America’s new target implies upside of 21.7%. “We rate AMD Buy. It serves a multi-hundred billion addressable market opportunity in PC, server, high-end gaming, deep-learning and related markets where AMD has less than 30% value share currently,” wrote analyst Vivek Arya. “While AMD’s data center accelerator products are still 1yr behind leader’s roadmap, we see continued demand for a stable second source alternative in GPUs and potentially share gain opps as AMD narrows the product/systems gap. On the CPU front, we see continued share gains against the incumbent.” Bernstein maintains market perform rating, $95 price target Analyst Stacy Rasgon’s target implies about 4% downside from Tuesday’s close. “Overall the take appears very similar to last quarter, i.e. a big client beat fueling sustainability worries, lukewarm DC/GPU vs expectations, rising spending that limits leverage, and a need for a 2H hockey stick, and now accompanied by larger concerns on the macro front especially into the 2H.” Citi reiterates neutral rating and price target of $100 Citi’s forecast is just 1% higher than AMD’s current price. “We adjust estimates and maintain our Neutral rating on AMD given AMD’s slowing AI growth and poor margin leverage.” Deutsche Bank stands by hold rating and $105 per share price target Deutsche’s forecast corresponds to upside of around 6%. “Overall, we applaud AMD’s ability to deliver relative stability to its aggregate revenue in the face of so many macro cross currents. However, with steep ramps in DC/Embedded built into our ests and sustainability questions likely to persist in Client/Gaming, we leave our CY26 estimates largely unchanged.” Barclays keeps overweight rating, $110 price target Analyst Tom O’Malley’s target calls for 12% upside going forward. “The company is managing to only decline one quarter y/y in DC GPU despite $1.5B China export headwind. The Client business again impresses, driven by significantly higher ASPs and the initial foray into the high-end commercial market. We would argue the combination of these is a much better result than anticipated, even with the full year DC GPU number moving closer to $6B.” Wells Fargo maintains overweight rating and $120 per share forecast The bank’s $120 per share target implies a potential upside of 22%. “We are positive on AMD’s ability to continue gaining share in the server and PC CPU markets, increasing traction in datacenter GPUs, positive / accelerating incremental operating leverage, and ultimately, earnings power in excess of $6/share by 2025.” JPMorgan reiterates neutral rating, trims price target to $120 from $130 “AMD is improving its competitiveness across CPU and GPU products with Ryzen, EPYC, and Radeon Vega platforms and is on track to improve its market share and drive meaningful revenue growth in the near term. Long term, we believe share gains are less certain. AMD will have to invest heavily in operating expense (especially R & D) in order to keep pace with the market leaders, potentially limiting operating leverage. AMD is executing well toward its target financial model, but we remain Neutral as shares appear to be nearly fully valued,” wrote analyst Harlan Sur. Morgan Stanley keeps equal-weight rating, lowers price target from $137 per share to $121 The bank’s updated forecast is 23% higher than the stock’s Tuesday close. “AMD posted a strong quarter, with strength in PC client driving the upside; despite a $700 mm 2q headwind from export controls, the company remarkably still guided above. AI progress, and PC client durability, key from here,” wrote Joseph Moore. UBS stands by buy rating and lifts price target to $155 from $150 Analyst Timothy Arcuri’s updated forecast corresponds to a 57% rally ahead. “The story in our eyes still hinges on the new family of AI solutions coming next year, but customer traction among U.S. hyperscalers is gaining momentum, and AMD may be able to draft off of NVDA’s ‘growing pains’ in ramping these new system solutions this year, and we remain constructive on the overall data center capex and AI backdrop into 2026. With the noise from this ban now out of the way and some forthcoming clarity on tariffs, the bias for the stock seems to be to the upside — especially into its AI Event in mid-June where it will likely provide more detail on these new solutions (MI400) ramping next year.”