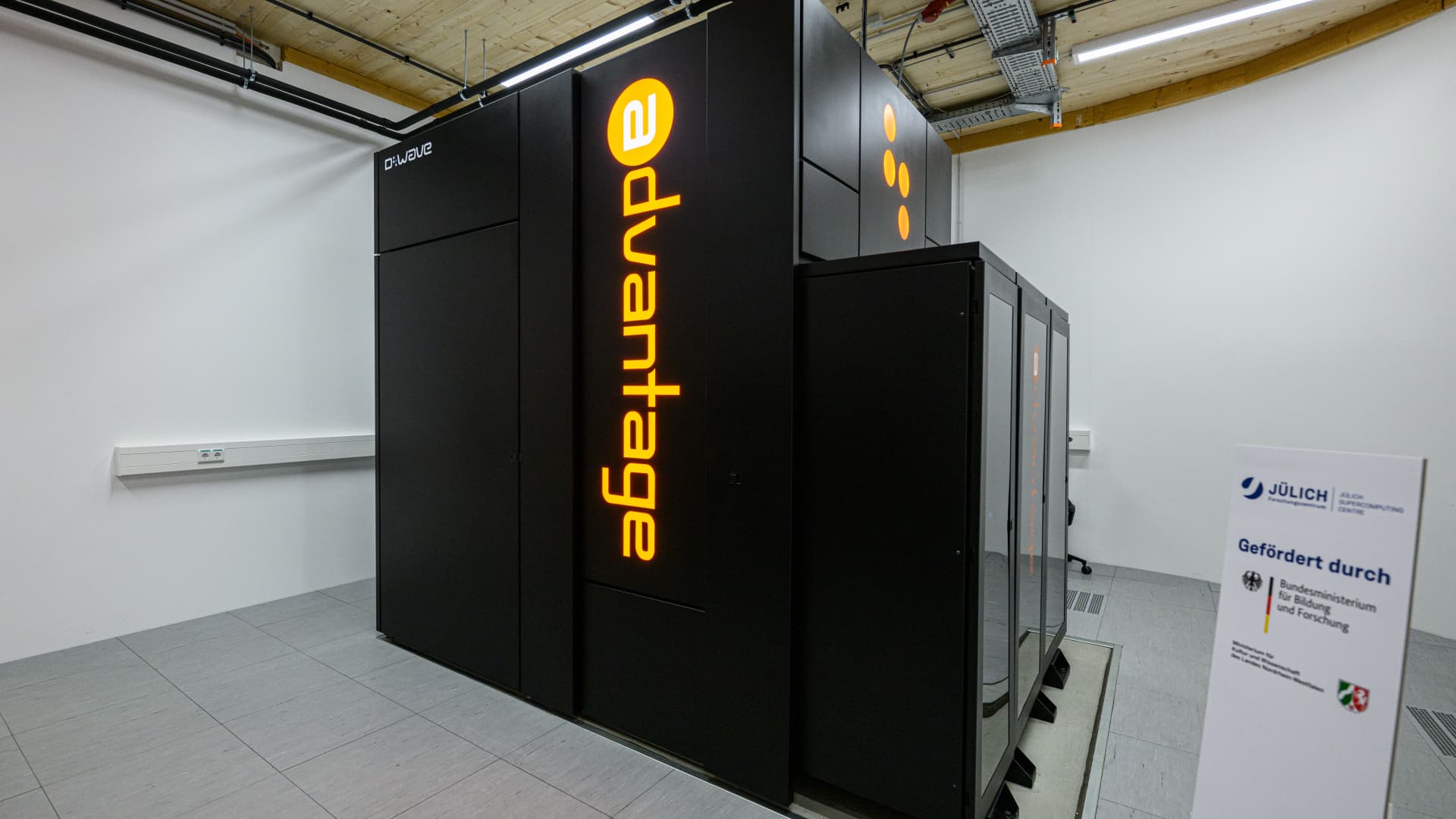

Check out the companies making headlines in midday trading. D-Wave Quantum — The quantum computing stock surged more than 26% after announcing its latest computing system called Advantage2. Agilysys — The enterprise software developer for the hospitality industry rallied 21% after topping analysts expectations in its latest quarter. Agilysys reported fiscal fourth-quarter adjusted EBITDA of $14.8 million, more than the FactSet consensus estimate of $11.3 million. Revenue of $74.3 million exceeded the Street estimate of $71.4 million. Amer Sports — The sports and fitness equipment maker soared 17% after first-quarter adjusted earnings of 27 cents per share topped the 15 cents estimated by analysts polled by FactSet. Revenue of $1.47 billion neat the $1.39 billion consensus estimate. Amer also raised its full-year guidance, noting it is well positioned to navigate tariffs due to strong pricing power and diverse global footprint. Moderna , Pfizer — Vaccine maker Moderna jumped more than 9% after the Food and Drug Administration outlined new regulatory guidance for future Covid-19 vaccine boosters. The FDA recommended different standards of evidence for approval based on patients’ risk of getting severely sick from Covid. The news also lifted Pfizer, which rose nearly 2%. Tesla — Shares gained more than 1% after CEO Elon Musk said he’s committed to leading the electric vehicle company for the next five years. ImmunityBio — The cancer vaccine research company climbed more than 5% after Piper Sandler raised its rating to overweight from neutral, with a $5 price target implying more than 70% upside from Monday’s close, according to FactSet. Pony AI — The autonomous driving company rose more than 5% after revenue in its fledgling robotaxi services unit surged 200% year over year in the first quarter. Pony AI still reported less than $14 million in total revenue for the quarter, and a net loss of about $37 million. Viking Holdings — The cruise line operator dropped 5% after signaling slower pricing growth in future bookings, according to Stifel, even as first-quarter results topped expectations. Viking lost 24 cents per share on an adjusted basis, on revenue of $897.1 million. Analysts polled by FactSet estimated a loss of 29 cents per share on revenue of $841.2 million. Eagle Materials — The building materials maker slid 7% following weaker-than-expected fiscal fourth-quarter results. Adjusted earnings of $2.08 per share missed the $2.48 per-share earnings estimated by analysts polled by FactSet, while revenue of $470.2 million trailed a consensus estimate of $481.6 million. Schrodinger — The chemical simulation software company dropped more than 9% after the CFO Geoffrey Porges said he will leave. The company also reaffirmed its full year 2025 guidance, as well as its second quarter 2025 software revenue forecast. Victoria’s Secret & Co. — The lingerie company rose more than 2% after its board adopted a limited-duration shareholder rights plan, effective immediately and expiring in one year, aimed at deterring hostile takeovers. Bilibili — The Chinese video sharing company’s U.S.-listed shares rose 2% following stronger-than-expected first-quarter results, with daily active users rising to 106.7 million compared to 102.4 million a year ago. Hewlett Packard Enterprise — Shares added 2% after Evercore ISI upgraded to outperform from in line. Evercore ISI said HPE has several routes available that would allow growth to return. — CNBC’s Michelle Fox, Alex Harring, Yun Li and Jesse Pound contributed reporting