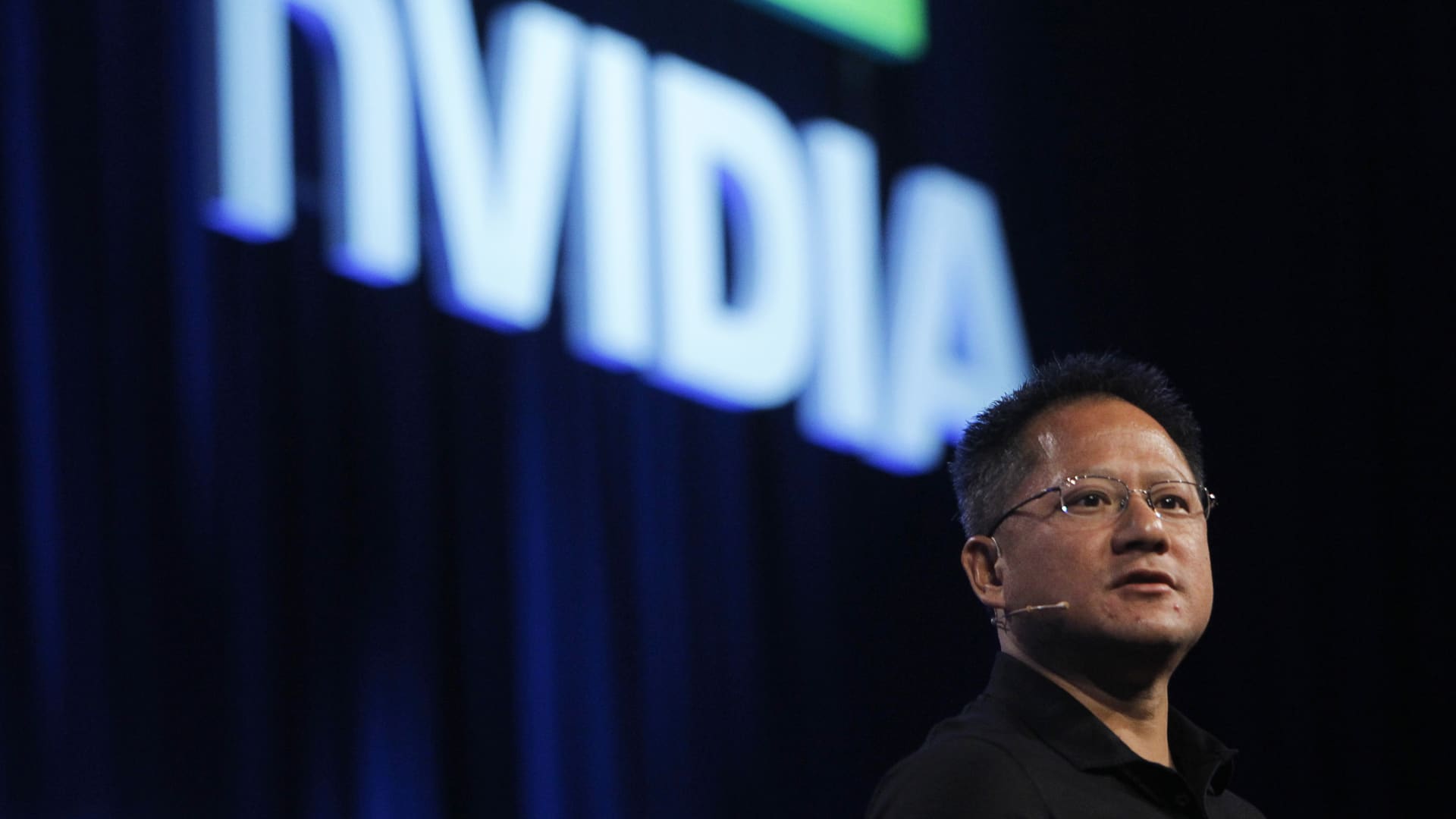

Here are Tuesday’s biggest calls on Wall Street: UBS upgrades Mettler-Toledo to buy from neutral UBS said the lab instrumentation medical company has resilience and pricing power. “We’re upgrading Mettler-Toledo (MTD ) to Buy supported by a constructive view of: 1) incremental opportunities for service sales, 2) industry leading pricing power, 3) beneficial portfolio exposure, and 4) a medium-term tailwind from reshoring.” Deutsche Bank upgrades MKS to buy from hold Deutsche said it sees an attractive entry point for the semicap company. “We upgrade MKSI to a Buy. Elevated sub-system inventories at semicap customers appear to have abated as of its most recent earnings report, one of our biggest concerns facing its core semiconductor sub-systems business when we initiated coverage June 2024.” Bank of America reiterates Nvidia as buy The firm said it came away feeling more bullish after the CEO’s keynote address at the Computex conference. ” NVDA’s key differentiators include its ability to: 1) expand its addressable market across multiple vectors of silicon, systems, software and services, 2) drive scale with global supply-chain partners, and 3) solid balance sheet to make strategic investments in the ecosystem.” Goldman Sachs reiterates Microsoft as buy Goldman said it has “increasing conviction” in Microsoft’s AI investments. “We reiterate our Buy rating while raising our PT to $550 (vs. $480 prior) as we mark-to-market our multiples.” Wells Fargo reiterates JPMorgan as overweight Wells said the banking giant is firing on all cylinders following its investor day on Monday. “JPM further showcased “Goliath is Winning,” given likely ongoing share gains with superior returns and efficiency, consistent w/our preview…” BMO reiterates Alphabet as outperform BMO said its survey checks of fears over Alphabet search competition are unwarranted. “Fears that Google Search will be disrupted by AI Search competitors are overblown, as users report higher levels of loyalty to Google and satisfaction with Google’s AI Overviews. Reiterate Outperform and $200 Target Price.” Wells Fargo initiates SAP as overweight Wells said the software solutions company is defensive. “SAP stands out as a defensive horizontal story w/ vertical (or at least idiosyncratic) traits likely to resonate in a fluid tape. See cloud migration momentum driving cont. growth re-accel & closing margin gap w/ mature peers.” Morgan Stanley reiterates Tesla as overweight Morgan Stanley said it’s sticking with top pick Tesla. “We find market expectations around Tesla’s near-term automotive business remain too high and do not fully reflect the quantum of incremental capacity and competition coming out of China, ultimately having an impact in international markets.” Wolfe upgrades LivaNova to outperform from peer perform Wolfe said the med-tech company is well positioned for growth. “What’s sustainable organic growth for LIVN? 2025 guide is 7%-8% but we view real growth this year as 6%+ (not inclined to look through shut down of a smaller business). Is 6%+ a good zip code 2026+? Yes…do not believe this is crazy.” Citi upgrades Kinetik Holdings to buy from neutral Citi said investors should buy the dip in the nat gas pipeline company. “We upgrade KNTK to Buy from Neutral following an > 20% decline in the stock price which we now believe has created a more attractive risk-return proposition.” Wells Fargo reiterates Dell as a top pick Wells said it’s sticking with the stock ahead of earnings next week. “Dell remains Top Pick – AI momentum (best positioned for materializing Blackwell cycle) + pos. trad’l server demand.” KBW upgrades Blue Owl to outperform from market perform KBW said the alternative investment company is best positioned. ” OWL is well positioned to benefit from growing retail demand for direct lending/credit strategies.” Bernstein reiterates Boeing as outperform Bernstein raised its price target on Boeing to $249 per share from $218. “Key events over the last ten days have been: Qatar Airways widebody order, AviLease 737MAX order, IAG 787 order, UAE Chinook helicopter order, restart of deliveries to China, restart of KC-46 tanker deliveries, and some loosening of tariff concerns.” Citi upgrades Air Lease to buy from neutral Citi said the air craft lessor is well positioned. “Buy-rated Air Lease should benefit from a global air travel resurgence, especially in Asia. Morgan Stanley reiterates Salesforce as overweight The firm said it’s sticking with Salesforce heading into earnings next week. “Low investor expectations, matched with achievable targets and an undemanding multiple yield limited downside, framing a positive risk/reward. OW.” Evercore ISI upgrades Hewlett Packard Enterprise to outperform from in line Evercore said it sees an attractive risk/reward for the stock and lifted its price target to $22 per share from $17. “Net/Net: We view the current risk/reward as favorable, with multiple pathways to upside if investors have the duration. Therefore, we’re upgrading our rating on shares of HPE to Outperform and raising our target to $22.” Loop downgrades MongoDB to hold from buy Loop said AI tailwinds are emerging slower than expected for the software company. “We are downgrading our rating on MDB from Buy to Hold and lowering our PT from $350 to $190.”