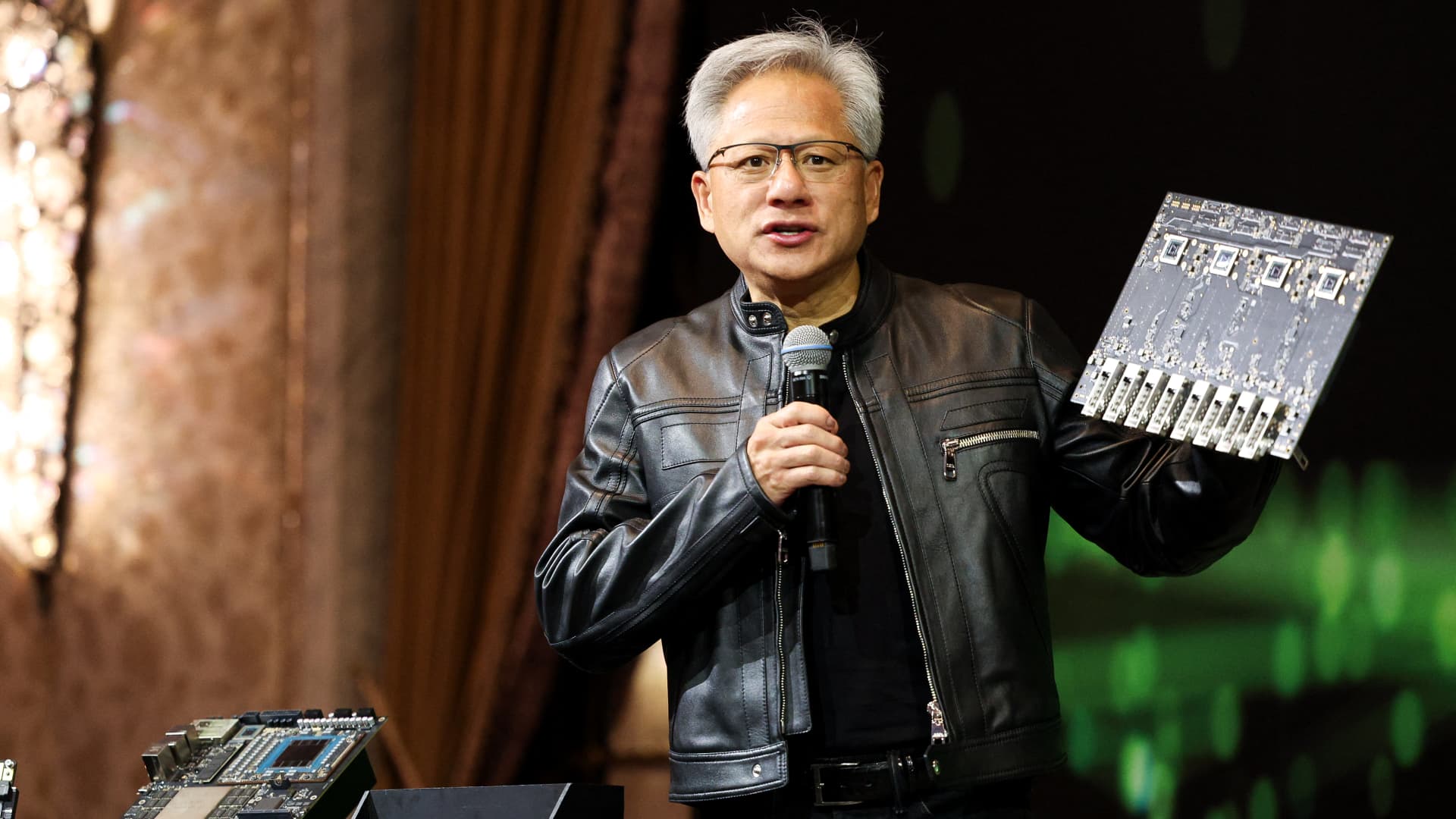

My top 10 things to watch Thursday, July 10 1. Stock futures were little changed as President Donald Trump ramped up the tariffs pressure. The Pentagon, meanwhile, will become the largest shareholder in American rare earth miner MP Materials , via a $400 million investment in preferred stock. Shares surged more than 60% this morning. The deal is aimed at reducing U.S. dependence on China for rare earths, which are key to manufacturing electronics, automobiles, and defense systems. 2. The Nasdaq hit a record high yesterday, with Nvidia topping a $4 trillion stock market value. The Club stock closed just below that milestone. Shares were making another run today. Nvidia CEO Jensen Huang plans to attend the International Supply Chain Expo in Beijing next week, according to the Financial Times . The visit comes ahead of a retooled China chip launch as soon as September. 3. The other big story of the morning is airline stocks. Delta reinstated its full-year profit outlook and reported better-than-expected quarterly earnings and revenue. Shares of Delta soared 13% this morning. 4. Wedbush analyst Dan Ives said Club name Microsoft will be the next $4 trillion company “this summer.” Over the next 18 months, it could make a run at $5 trillion, he predicted, saying the AI boom is just getting started. 5. Goldman Sachs put out a big note on semiconductors. Buys included Nvidia and our other chipmaker Broadcom . Holds included Arm , Advanced Micro Devices , and Marvell . 6. Taiwan Semiconductor Manufacturing, which produces Nvidia chips and many others, reported better-than-expected quarterly revenue, up nearly 39%. Next week, it will deliver the whole quarter and its outlook. 7. KeyBanc hiked its price target on Synopsys to $610 from $520. The analysts see benefits from the U.S. lifting China trade controls from chip design software. What Synopsys and Cadence do is crucial to Nvidia. 8. Piper Sandler upgraded Oracle to an overweight buy rating from neutral and raised its price target to $270 per share from $190. The stock closed at $235 yesterday. The analysts see a bullish backdrop, citing their CIO survey. 9. Bank of America raised its price target on Club name Meta Platforms to $765 from $690. The analysts cited benefits of recent Meta investments in Ray-Ban and Oakley parent EssilorLuxottica for smart glasses. 10. KeyBanc raised its price target on Netflix to $1,390 from $1,070. The analysts said a “combination of live events, price increases, and an ad ramp support low double-digit revenue growth over the medium term and nearly $40 in EPS.” Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free (See here for a full list of the stocks at Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.