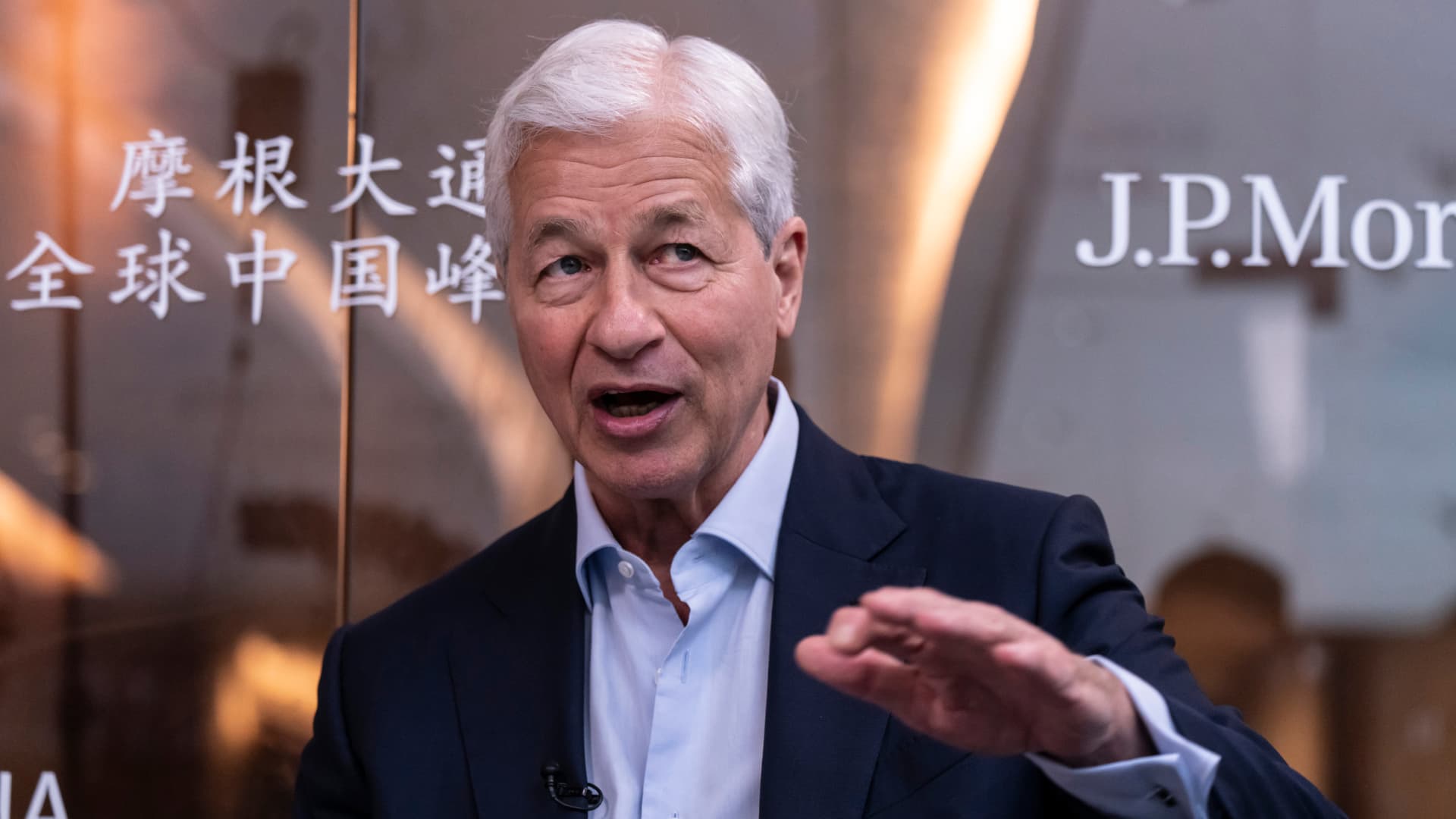

It’s that time again. The second-quarter earnings season kicks off this week with 37 companies that are members of the S & P 500 index set to report. Among the most notable companies outlining how they performed in the quarter ended June 30: big banks, led by JPMorgan Chase , the largest in the land, and streaming giant Netflix. Expectations heading into the season are muted as companies navigate an ever-changing tariff landscape. According to FactSet, second-quarter S & P 500 earnings are expected to have grown 4.8% from the same period a year ago. If that’s the case, it would end with the lowest quarterly growth rate since the fourth quarter of 2023. Take a look at CNBC Pro’s breakdown of what to expect in this week’s key reports. All times are ET. Tuesday JPMorgan Chase is set to report earnings before the bell, followed by a conference call at 8:30 a.m. Last quarter: JPM reported better-than-expected earnings and revenue, but CEO Jamie Dimon warned of ” considerable turbulence ” ahead. This quarter: Analysts polled by LSEG expect a sharp year-over-year decrease in earnings. What to watch: Bank of America analyst Ebrahim Poonawala sees solid results coming at JPMorgan Chase. But Federal Reserve rate cuts could dampen the outlook for the company, he said, adding that, “While mgmt. is unlikely to provide guidance for 2026 just yet, commentary from investor day + recent industry conferences suggest a sharpened focus on expenses.” What history shows: JPMorgan earnings have beaten estimates in the last five quarters, according to Bespoke Investment Group. Wells Fargo is set to report earnings premarket, with a call slated for 10 a.m. Last quarter: WFC shares fell on lower-than-expected revenue and a decline net interest income . This quarter: Revenue is forecast to have remained flat year over year, according to LSEG. What to watch: David Long of Raymond James downgraded Wells Fargo last week to market perform from outperform, noting the market has priced in stronger future earnings now that an asset cap on the bank has been removed. Still, he raised his second-quarter earnings estimate. What history shows: Wells Fargo has posted an earnings beat in eight of the last nine quarters, according to Bespoke. Citigroup is set to report earnings before the stock market opens. A call with analysts is set for 11 a.m. Last quarter: C results beat expectations thanks to strong fixed income and trading revenue . This quarter: Analysts polled by LSEG expect earnings to have increased by about 5% year over year. What to watch: Wells Fargo bank analyst Mike Mayo lowered his second-quarter estimates for Citigroup, “largely reflecting higher 2Q expenses and provisions than previously est., partially offset by decent capital markets.” To be sure, Citigroup shares have outperformed those of other major banks, up more than 23% so far this year. What history shows: Bespoke data shows Citigroup beats Wall Street analysts’ earnings estimates 78% of the time. Wednesday Bank of America is set to report earnings in the premarket, followed by a call at 8 a.m. Last quarter: Strong net interest income and trading revenue led BAC results to top expectations. This quarter: Earnings and revenue are expected to have grown by less than 5% year over year, according to LSEG. What to watch: Bank of America shares have underperformed other major banks this year, up 6.3% in 2025. ” Investors lean bullish given YTD underperformance vs. peers, but expense growth and [near term net interest income] are debate points,” wrote Piper Sandler analyst R. Scott Siefers. “We have noted some concern among investors that N-T NII could be a little weaker than hoped, though our best guess is that management will stick to the FY25E guide here (i.e. +6% to 7% in 2025E and a 4Q25E NII of ~ $15.5B to $15.7B).” What history shows: Bank of America tops earnings expectations 80% of the time, but the stock averages a loss of 0.7% on earnings days, according to Bespoke. Johnson & Johnson is set to report earnings before the market’s opening bell, with a conference call scheduled for 8:30 a.m. Last quarter: A jump in medical device sales led to JNJ beating earnings estimates. This quarter: Earnings are expected to have declined by nearly 5%, LSEG data shows. What to watch: Tariffs will be top of mind for J & J investors as the company reports earnings, with President Donald Trump threatening last week to impose a levy of up to 200% on imported pharmaceutical products . What history shows: J & J has beaten earnings expectations every quarter since 2011, Bespoke data shows. Morgan Stanley is set to report the latest financial results in the premarket, followed by a call with analysts and investors at 8:30 a.m. Last quarter: MS earnings beat expectations thanks in part to a 45% jump in equity trading revenue . This quarter: Analysts polled by LSEG expect earnings and revenue to increase by more than 6% each. What to watch: Morgan Stanley’s results could get a boost from the bank’s wealth management business, according to Jefferies analyst Daniel Fannon. “MS’s [wealth management] transactional revs should benefit from elevated commission activity (est +30% y/y ex-DCP), with some revenue offset from the 1-month billing lag in WM mgmt fees that will miss out on June’s big rally in equity markets,” he said. What history shows: Morgan Stanley shares average a 1% advance on earnings days, per Bespoke. Goldman Sachs is set to report earnings in the premarket, followed by a call at 9:30 a.m. Last quarter: A boom in equities trading revenue led to GS topping expectations . This quarter: The banking giant is expected to report a 10% increase in earnings from the year-earlier period, according to LSEG. What to watch: Goldman shares have been on fire this year, up 23%. Can the investment banking behemoth’s results add to that momentum? What history shows: Goldman Sachs earnings have topped earnings expectations 86% of the time, but the stock is usually little changed on earnings days, Bespoke said. Thursday Netflix is set to report earnings after the stock market closes at 4:00 p.m. A call by management with analysts and investors is scheduled for 4:45 p.m. Last quarter: NFLX posted a large earnings beat as revenue grew by 13% . This quarter: Analysts expect a 45% year-over-year increase in earnings, according to LSEG. What to watch: Here’s what Citigroup’s Jason Bazinet had to say last week about Netflix’s upcoming report: “We expect NFLX to report 2Q25 revenue and EBIT modestly ahead of sell-side estimates driven by FX tailwinds. Beyond results, investor[s] … will likely focus on updates to [the] firm’s ad-tier, subscriber trend commentary and the firm’s evolving live content strategy.” What history shows: Bespoke data shows Netflix has beaten earnings expectations 82% of the time.