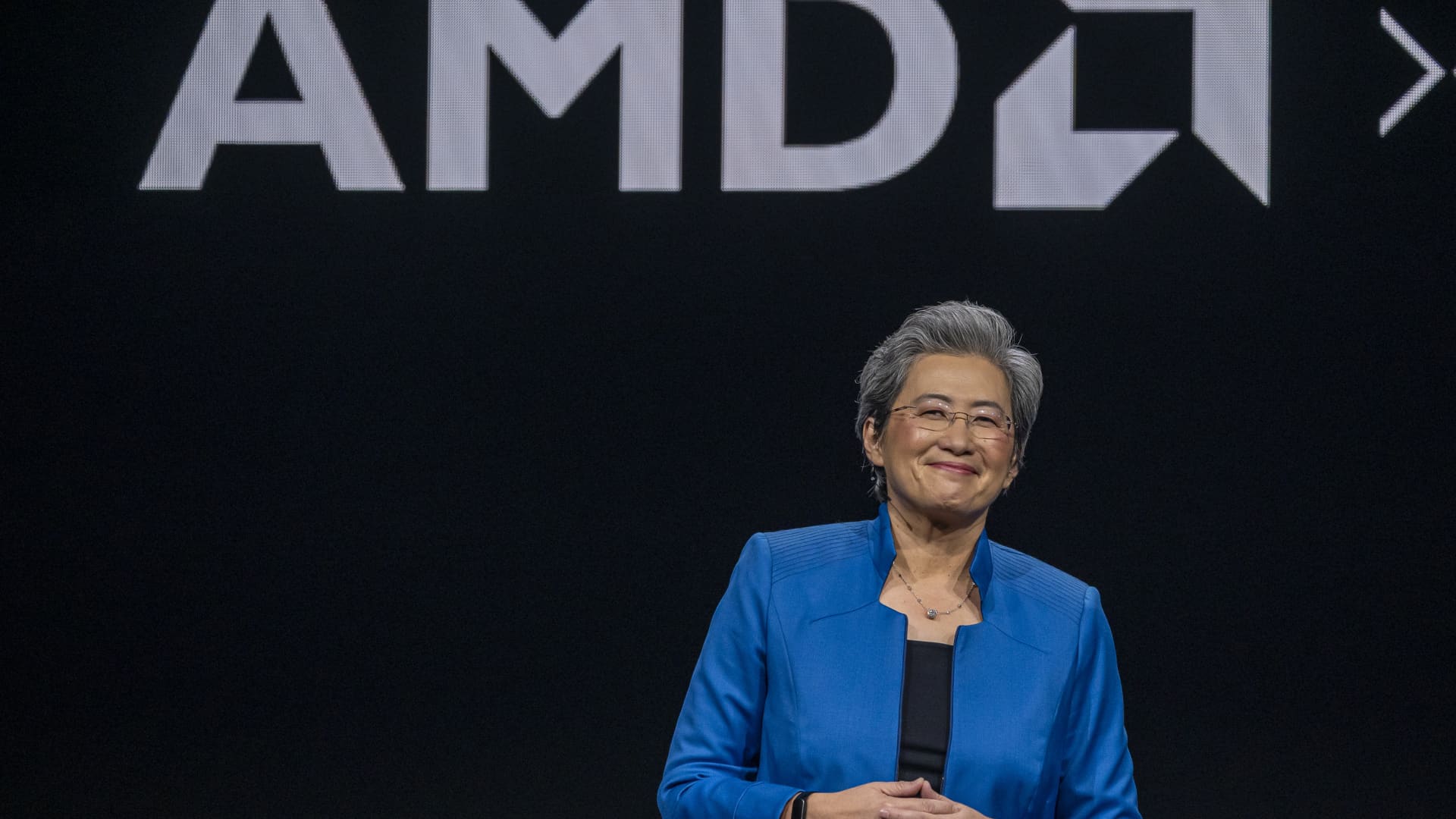

Advanced Micro Devices failed to clear the earnings bar analysts had set for the second quarter. Shares of AMD shed 6% in Wednesday’s premarket trading hours after the chipmaker reported adjusted earnings of 48 cents per share, missing the 49 cents per share analysts polled by LSEG had forecast. “AI business revenue declined year over year as U.S. export restrictions effectively eliminated MI308 sales to China, and we began transitioning to our next generation,” CEO Lisa Su said during a call with analysts. But while the company’s earnings missed the mark, AMD’s $7.69 billion in overall revenue exceeded the expected $7.42 billion. Net income also increased from the year-ago period. Overall, most analysts maintained their ratings on the stock, though some did raise their price targets. Here’s what analysts at some of the biggest shops on Wall Street had to say on the report. Bernstein reiterates market-perform rating and $140 price target Analyst Stacy Rasgon’s target implies about 20% downside from Tuesday’s closing price of $174.31. “AMD’s Q2 results were decent at first glance ($7,685M/$0.48 vs Street $7,428M/$0.49), though the beat was entirely driven by Gaming, with a slight miss in Client and roughly in-line results for Data Center and Embedded. Gross margins as-reported came in slightly stronger than expectations, and roughly inline ex-charges, however overall profitability was impacted by higher than expected opex … Overall AMD’s print wasn’t awful; however it also didn’t show any upside in anything that investors really care about (a problem for any stock that is up almost 80% since their last earnings report).” Goldman Sachs stands by neutral rating, raises price target to $150 from $140 Goldman’s new forecast is 14% below AMD’s current valuation. “We remain constructive on the company’s ability to drive significant market share gains in the PC and enterprise server markets in the near term; however, we are more guarded on the company’s ability to drive significant scale in Datacenter GPUs over time, and think operating leverage is likely to be hampered by the significant OpEx we believe is needed for the company to support its software and systems efforts tied to datacenters.” Deutsche Bank maintains hold rating and lifts price target to $150 per share from $130 “Overall, we remain impressed with AMD’s execution across its array of product lines, expecting solid growth to continue in CPUs and likely accelerate in DC GPUs. However, even with these growth drivers reflected in our model (CY25E EPS ~unchanged, CY26E ~ +10%), we see EPS power in the ~$6-7 range as largely being reflected in a current valuation (~25-30x P/E).” Morgan Stanley keeps equal-weight rating, lowers price objective to $168 from $185 Morgan Stanley’s revised forecast calls for 4% downside. “Quarter was strong across segments, through timing of China resumption is more vague than expected. Lack of strong near term upside in GPU likely needed for stock to continue to maintain its premium, but MI400 is unchanged as a source of 2025 optimism — and key driver of value for the stock.” JPMorgan reiterates neutral rating and hikes price target to $180 from $120 The bank’s new price objective is approximately 3% higher than where shares of AMD closed on Tuesday. “AMD is improving its competitiveness across CPU and GPU products with Ryzen, EPYC, and Radeon Vega platforms and is on track to improve its market share and drive meaningful revenue growth in the near term. Long term, we believe share gains are less certain. AMD will have to invest heavily in operating expense (especially R & D) in order to keep pace with the market leaders, potentially limiting operating leverage. AMD is executing well toward its target financial model, but we remain Neutral as shares appear to be nearly fully valued.” Wells Fargo stands by overweight rating and reiterates $185 price target Analyst Aaron Rakers’ forecast is 6% above AMD’s Tuesday closing price. “View 2Q25 results + 3Q25 as positive; see increasing confidence in materializing 2H25 MI355X ramp and note that 3Q25 guide does not include any MI308X contributions.” Barclays maintains overweight rating, raises price target to $200 from $130 The bank’s revised forecast implies 15% upside ahead. “MI-series moves to ~$2.3B run rate exiting the CY creating a clear path to +$10B in revenue in CY26, which excludes future contributions from China. Client is also showing leverage with ASPs up 42% Y/Y in June and expectations for continued share gains. The company acknowledged Client pull-ins in their prior guide for a flat 2H but is revising expectations for growth in Q3 and a flat Q4 off a higher base. There are multiple ways to win with this name into ’26 as Client and DC both hit their stride.” Bank of America keeps buy rating, $200 price target “AMD continues to execute on its AI GPU pipeline, with the MI355X (Blackwell-compete) on track to volume ramp in 2H at multiple customers and the MI400 Series (Rubin-compete) and its Helios rack system also on track for 2026 launch. AMD now expects ~$1.7bn in Q3 GPU sales even without ~$800mn of lost China revenue, suggesting overall ~$500mn higher outlook excluding China vs. $2.0bn pre-ban consensus. Server CPUs also continue to outperform, gaining share in both cloud and enterprises from incumbent INTC. Overall, we expect AMD to be a consistent ~20%+ FCF generator over time.” UBS reiterates buy rating and $210 per share price target The bank’s forecast corresponds to a 20% upside. “AMD beat (on revenue) and guided above, but only to about where investor expectations were into the print. The bear would say that the beat was largely gaming-driven and while data center GPU is seeing a strong inflection in 2H, this was already baked into expectations and AMD did not raise the full year outlook for data center GPU despite all of the hyperscaler capex increases. In the very near-term, this may carry the day, but we think the path of travel for the business — and ultimately the stock — remains in a positive direction.”