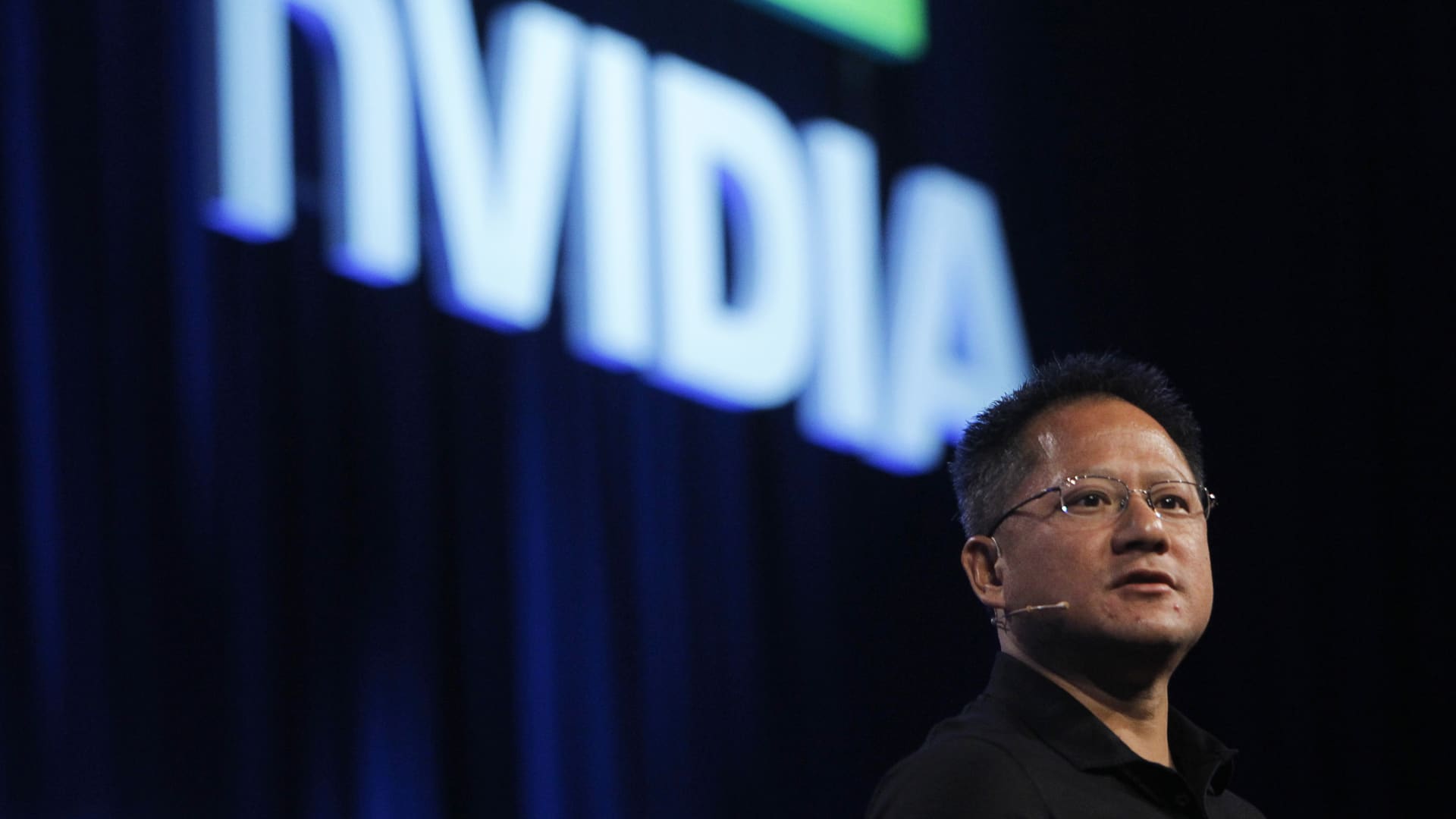

Here are Wednesday’s biggest calls on Wall Street: Wells Fargo reiterates Dell as overweight Wells said shares of Dell have more room to run. “We continue to see Dell as best-positioned AI server momentum story.” Goldman Sachs reiterates Broadcom as buy Goldman raised its price target on Broadcom to $340 per share from $315 ahead of earnings on Sept. 4. “We believe expectations are elevated heading into the quarter, but many investors are positioned cautiously given elevated valuation, Street numbers which incorporate healthy growth in 2026, and few near-term catalysts.” Cantor Fitzgerald initiates Travelers as overweight Cantor said it’s bullish on shares of the insurance company. “The pricing cycle is clearly at a transition point, and in our experience, 1) transition points tend to be tricky, 2) stockpicking opportunities are ample, and 3) the big themes matter – in this case, business/client mix. As a result, we prefer Hartford (OW), Travelers (OW), and WR Berkley (OW), which are geared toward smaller customers and underweight more competitive property lines.” Deutsche Bank upgrades Palo Alto Networks to buy from hold Deutsche raised its price target on the stock to $220 per share from $200. “We upgrade shares of Palo Alto Networks to a Buy rating and raise our DCF-derived TP to $220 given our thoughts on the health of the business, quality of its leadership, and forward prospects for the announced acquisition of CyberArk.” JPMorgan reiterates CoreWeave as overweight JPMorgan said it’s sticking with CoreWeave following earnings on Tuesday. “Despite the reality of lumpiness and volatility in business model, the fundamental drivers and business trends remain very solid, with the company speaking to strong demand that is outstripping supply and conveying robust pipeline momentum.” Goldman Sachs upgrades CACI to buy from sell Goldman said the government IT company is beneficiary of the Trump administration “Since the change in administration, and related change in end-market dynamics, CACI increasingly looks like the best positioned company in the space…” Piper Sandler reiterates Nvidia as overweight Piper raised its price target to $225 per share from $180 ahead of earnings later this month. “We are expecting another positive quarter from NVDA and see upside to numbers for both the July and October quarters.” Read more. Morgan Stanley upgrades AvalonBay to overweight from equal weight The firm said investors should buy the dip in the real estate investment trust. “Upgrade AVB to OW: Worst-performing apartment YTD, but we see best-in-class earnings growth in ’25-’27; we think the market is underestimating development NOI [net operating income].” Morgan Stanley reiterates Nio as overweight Morgan Stanley said in a note to clients that it found several possible reasons for Nio’s selloff but that it’s sticking with the China EV company. “As most EV startups are not yet in self-funding positions, investors are concerned that strong stock outperformance could lead to potential fundraising activity.” JPMorgan upgrades SailPoint Technologies to overweight from neutral JPMorgan called the identity access management company “best of breed.” “SAIL stock has been under pressure ahead of its IPO-related lockup, which expired on August 12, and we see an opportunity with SAIL to own a best-of-breed vendor at a discount as Identity continues to move up the priority stack.” Read more. Barclays upgrades CF Industries and Corteva to overweight from equal weight Barclays upgraded the agribusiness companies following earnings. “We upgrad e CF and CTVA to OW (from EW) following 2Q results.” Barclays downgrades KinderCare to equal weight from overweight Barclays downgraded the child care company following its disappointing earnings report on Tuesday. “KLC’s poor start as a public company is evident in its -45% YTD performance; and unfortunately 2Q25 last night was no different.” Jefferies downgrades On Holding to underperform from hold Jefferies said the shoe company’s valuation is too high. “We believe ’25 will mark the peak in ONON’s sales growth rate as U.S. door count expansion slows and sell-in moderates in ’26 as retailer orders flow back to Nike.” Citi initiates Progressive as buy Citi said the auto insurance company has pricing power. “While the focus of the market is on decelerating top-line, we are focused on how durable Progressive’s margins tend to be following periods of pricing power.” Bank of America upgrades V2X to buy from neutral Bank of America said it sees accelerating growth for the defense company. ” V2X’ s strategy to provide a full lifecycle support to increasingly complex military operations has a strong competitive advantage, particularly considering that incumbents have overlooked at these end-markets.” JPMorgan upgrades Capri to overweight from neutral JPMorgan upgraded the owner of brands like Michael Kors and says the stock is too attractive to ignore. “We see CPRI on a path of multi-year sequential revenue. gross, and operating margin improvement, led by a brand reinvigoration strategy at the Michael Kors brand.” Bank of America reiterates Cava as buy Bank of America said it’s sticking with the Mediterranean restaurant chain following earnings. “We believe CAVA’s growth runway extends well beyond its 1,000 domestic restaurant target, as evidenced by upwardly revised unit economic targets.” Oppenheimer reiterates Walmart as outperform The firm raised its price target on Walmart ahead of earnings on Aug. 21 to $115 per share from $110. “Following a more difficult backdrop to start the year due to unexpected tariff and expense headwinds, we believe a positive guidance revision cycle could again materialize soon.”