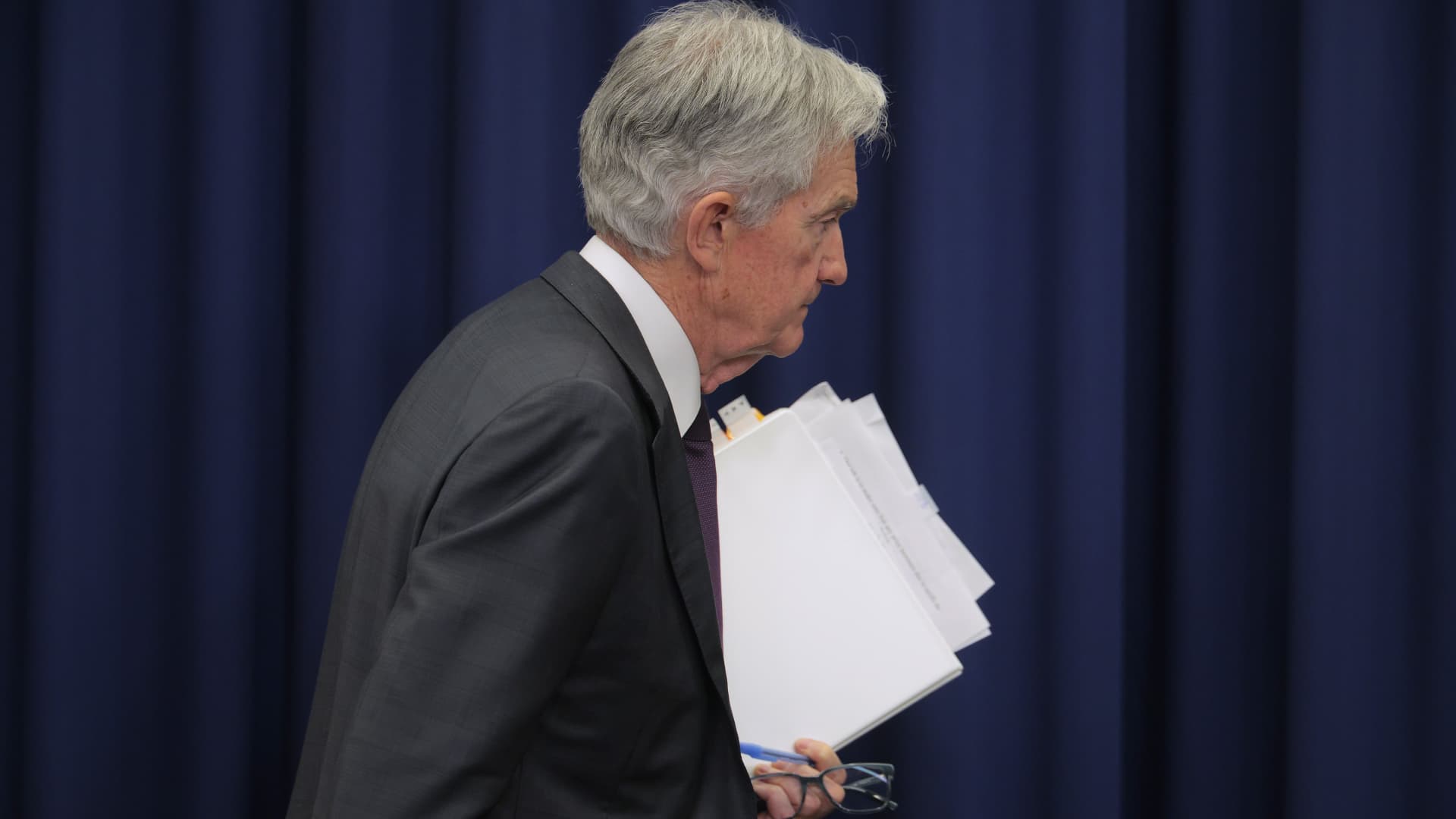

President Donald Trump’s short list to replace Jerome Powell as Federal Reserve chair has turned into a long list of nearly a dozen possible candidates.

Among them are current and former Fed officials, prominent economists and a couple market-focused hopefuls, each with ideas about where the central bank should be headed at a critical juncture for monetary policy.

For most of them, the views coalesce around a need to lower the Fed’s benchmark interest rate, and some believe the changes must go beyond that and into the fundamental way it does business.

In CNBC interviews that stretch back days, weeks and even months, the candidates have talked in depth about where they think the Fed should go.

(See the video above for the key comments from those in the Fed chair race.)

Former Governor Kevin Warsh has called for “regime change.” Market strategists David Zervos and Rick Rieder think rates can be lowered aggressively.

Former St. Louis Fed President James Bullard stressed Fed independence and commitment to core central bank goals, while National Economic Council Director Kevin Hassett bemoaned the lack of transparency behind the Federal Open Market Committee’s decisions.

Governor Michelle Bowman spoke on the importance of listening to a wide range of views, including Trump’s, economist Marc Sumerlin called the Fed’s benchmark rate “just too high,” and former Governor Larry Lindsey said the lack of “intellectual diversity” has led the FOMC to be “consistently wrong” in its decisions.

As the candidates jockey, Trump has not publicly set a timetable for a decision to replace Powell, whose term as chair ends in May 2026. The president previously has said he will nominate economist Stephen Miran for a current board vacancy.