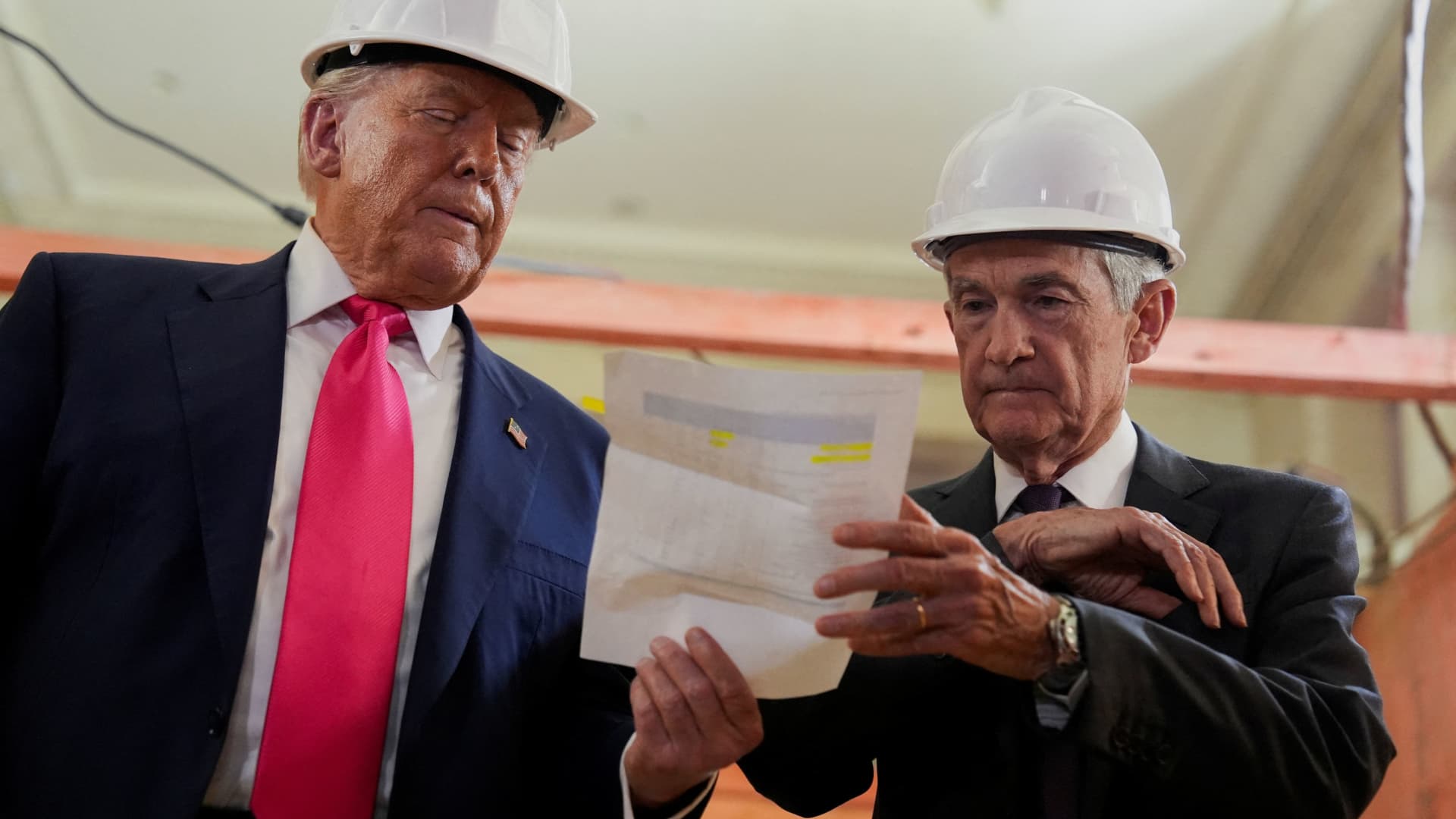

U.S. President Donald Trump passes a document to Federal Reserve Chair Jerome Powell to fact-check the numbers during a tour of the Federal Reserve Board building, which is currently undergoing renovations, in Washington, D.C., U.S., July 24, 2025.

Kent Nishimura | Reuters

President Donald Trump’s actions relative to the Federal Reserve amount to an effort to limit or eliminate the central bank’s independence, according to 82% of respondents to the September CNBC Fed Survey.

Those actions, according to majorities of the 29 respondents, will result in weaker growth, higher inflation and unemployment and a lower value for the dollar.

The survey found that 41% of the economists, fund managers and strategists surveyed believe that the President’s actions are directly aimed at eliminating the Fed’s independence, with 41% saying they are designed to limit them. Just 10% say the president is moving to support the Fed’s independence.

“The Trump administration is likely to continue its attempts to reduce the independence of the Fed with an objective being to pressure the Fed to reduce short-term interest rates meaningfully and boost economic growth even at the expense of placing some upward pressure on inflation,” said Hugh Johnson, chairman and chief economist, Hugh Johnson Economics.

Joel Naroff of Naroff Economics added, “By appointing loyalists to the Fed, Trump expects to gain effective control over policy while maintaining plausible deniability if, or more likely when, the policies go awry.”

But Thomas Simons, chief U.S. economist with Jefferies, says he thinks the threat to Fed independence is “overblown.” He says he does not expect Trump appointees “to have concentrated power to sway the consensus of the FOMC. The de-centralized power within the committee to make decisions is the key to ensuring that policy is not unduly influenced by the president.”

Still, a 68% majority think the president’s actions will put upward pressure on inflation; and 57% say it will result in higher unemployment; and 54% see lower economic growth; 74% believe it will lower the value of the U.S. dollar.

Yet respondents are divided overall on the effect on interest rates, with 39% believing the president action’s will result in lower rates and the same percentage forecasting higher rates as a result.

Fed decision Wednesday

The Fed meets this week with agreement among respondents that it will cut by a quarter point, but substantial disagreement over what the Fed should do. While 97% say the Fed will cut by a quarter point, just 41% think that’s the right move. The rest are evenly divided, with 28% favoring a half-point rate cut and 28% supporting no cut at all — likely reflecting a similar debate on the FOMC.

On average, respondents forecast a bigger decline in the Fed Funds rate this year, with the rate dropping from the current level of 4.38% to 3.66%, roughly reflecting three quarter point cuts this year, or one additional cut compared to the July survey. Next year, the Funds rate is forecast to drop to 3.13% compared to a 3.46% in the July survey.

That outlook could reflect renewed concerned about growth and unemployment.

“The labor market is weak, consumers have not yet noticed tariff-driven inflation, and inflation pressures are likely to really be transitory,” said Drew T. Matus, chief market strategist, MetLife Investment Management. “It is time for the Fed to begin a rate cutting cycle – the path, not a single move, is what matters.”

Respondents raised their recession concerns for the first time in 4 months, with the recession probability jumping to 40% from 31% in the prior survey. 55% see a moderate recession, if one happens, lasting 10 months, up from 38% in July. The rise comes with a forecast for a sharper increase in unemployment this year and next, but the growth outlook unchanged at 1.5% for 2025, bouncing back to 2% in 2026. Forecasts for the consumer price index rose a bit to 3.05% for 2025 but declined for 2026 to 2.8%, which would keep the Fed above its 2% inflation target.

“Tariffs and uncertainty remain the major threat to growth, however, a reduction in Fed independence could add to these risks,” wrote John Ryding, chief economic advisor, Brean Capital, LLC. “Monetary policy works best when central banks are free from political interference.”

Respondents have a bit more confidence in the economic effects of tariffs than they did in the July survey, but a majority still say they are uncertain. That could be because 86% still see price increases to come from tariffs, with half of those believing that substantial price increases remain on the way. Asked who is shouldering the cost of tariffs, the average respondent says 31% is paid by the consumer, 29% by wholesalers and importers, and 23% by retailers. Just 18% of the tariff burden is judged to be borne by exporters, contradicting the administration’s claim that Americans are not paying the tax.

“Economists, myself included, over-estimated the near-term inflationary impact of tariffs because we didn’t anticipate companies eating the tariffs and squeezing margins,” said Richard Bernstein, CEO, Richard Bernstein Advisors. “However, the recent sizable weakness in employment seems the direct result of those squeezed margins.”

Tariffs were judged to be the No. 1 threat to the economic expansion, followed by uncertainty around the administration’s policy. The president’s efforts to limit or eliminate the Fed’s independence was seen as the third biggest risk followed by immigration policy.