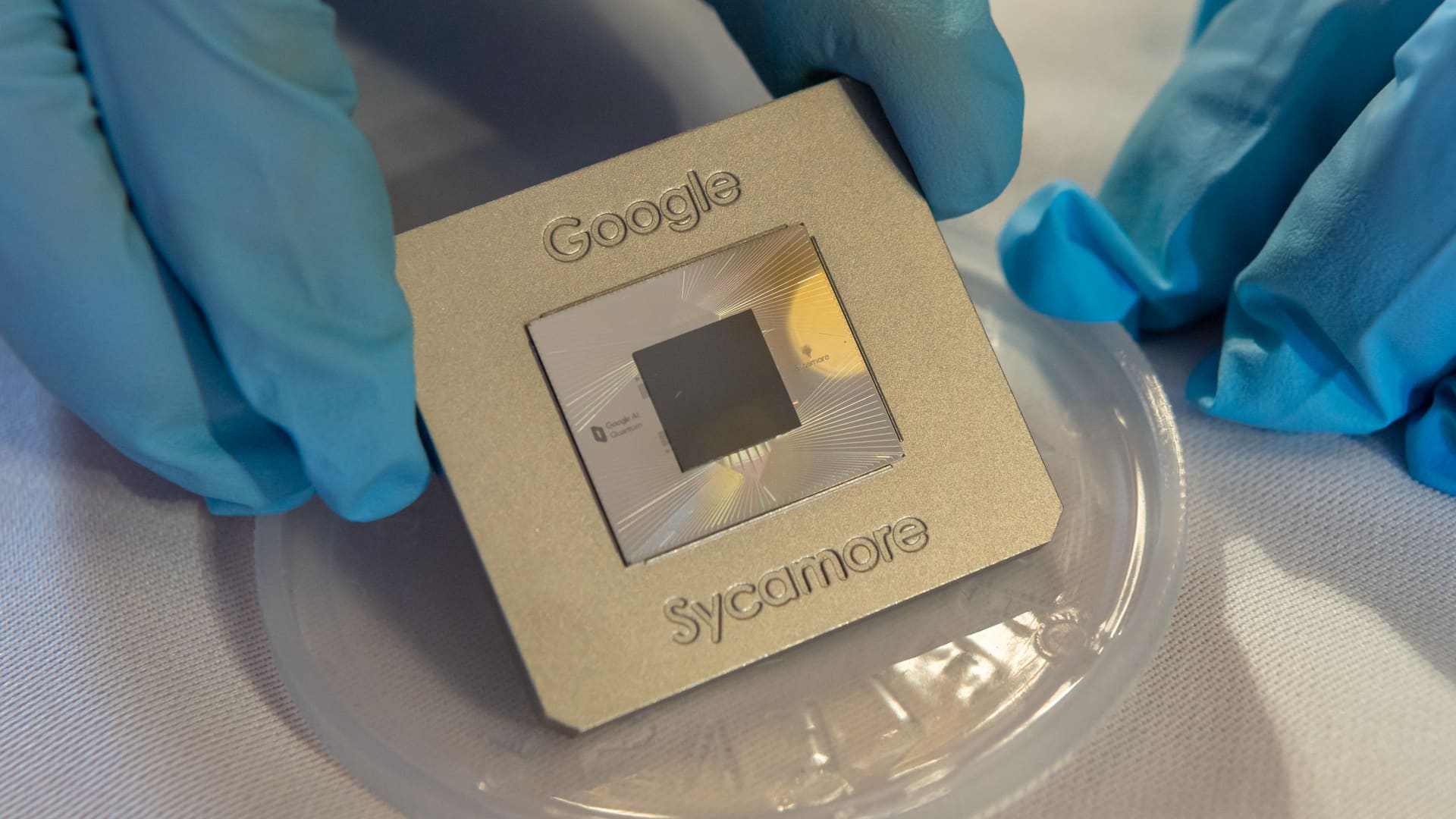

Quantum computing stocks took off this year as Google made strides in the space, but investors say it’s still too soon to reap the rewards of the burgeoning trend. Since the launch of artificial intelligence craze with ChatGPT’s late 2022 debut , investors have been on the hunt for the next big technology trend. Many investors assumed they found that contender this month, when quantum computing stocks surged after Google said its Willow chip performed better than its 2019 predecessor and “can reduce errors exponentially as we scale up using more qubits.” A qubit is a quantum bit unit to encode data. RGTI YTD mountain Share performance in 2024 The news pushed up shares of Rigetti Computing , IonQ , D-Wave Quantum and other connected names — and that excitement hasn’t dwindled . In the weeks since, those stocks have continued to rally, with the Defiance Quantum ETF (QTUM) tracking the space up 17% in December and 52% on the year. Rigetti has surged 272% this month and more than 1,000% year to date, while D-Wave has skyrocketed 163% month to date and more than 800% in 2024. While many view quantum computing as the next big technology trend to disrupt Wall Street and the sector, it’s too early to decipher the big winners in the space or see any real-world applications. “Any kind of evidence that impacts financials is way, way, way out in the future,” said Paul Meeks, chief investment officer at Harvest Portfolio Management. “What are they going to use it for and is it really a money maker? That’s going to drive the results and valuation.” Too soon to reap the rewards Despite making headway in recent weeks, quantum computing is no new phenomenon to hit Wall Street. In fact, Meeks notes that industries have been discussing quantum computing for at least a decade. Many companies and AI experts view it as a potential solution to help power extensive data centers, but say real use cases for the technology remain years — if not decades — in the future. Given this setup, many portfolio managers don’t view 2025 as the year of quantum computing, although investors could begin seeing some breakthroughs in 2026 and 2027, according to AXS Investments CEO Greg Bassuk. QBTS YTD mountain Shares this year. Anjali Bastianpillai, senior client portfolio manager at Pictet Asset Management, also noted that fund exposure to quantum computing appears very early stage, with many pure-play names residing in the private sector. She notes that some companies have gone public as of late through SPAC mergers. Despite the long-term potential, many on Wall Street remain cautious, equating the rise in quantum computing stocks to the pop in loosely connected artificial intelligence names at the onslaught of the revolution in late 2022 and early 2023. Meeks notes that many of those smaller names ended up as popular short candidates and remain significant short bets. “This whole quantum group is in the speculation overexuberance stage,” said Baird’s technology desk sector strategist Ted Mortonson. “If you wipe out what they did and the speculation around the shiny object. This is going to be a very big boy, free cash flow game. The same thing that the Gen AI cycle was.” Stick with the megacaps Against this backdrop, portfolio managers say the best strategy for getting in on the early stages of the trend is through megacap names with other business ventures. “When you have this huge investment cycle on next generation technology, you have to play companies that have massive free cash flow, or a monopoly in their core business,” Mortonson explained. That includes Alphabet . As the company works on its quantum computing initiative with Willow, it also offers investors robust digital advertising and growing artificial intelligence businesses. Shares have surged 40% this year and 16% in December. GOOGL YTD mountain Shares this year Amazon , Microsoft and China-based names such as Tencent and Baidu also offer some exposure to quantum computing, but the percentage of revenue remains small, said Pictet’s Bastianpillai. Many portfolio managers also expect IBM to potentially triumph a long-term winner in the space, said Bassuk. “This is going to be one of the times when they’re going to come back with a vengeance,” he said. “They’ve got a lot of investment right now in quantum computing, and they’ve got a very strong team internally.”