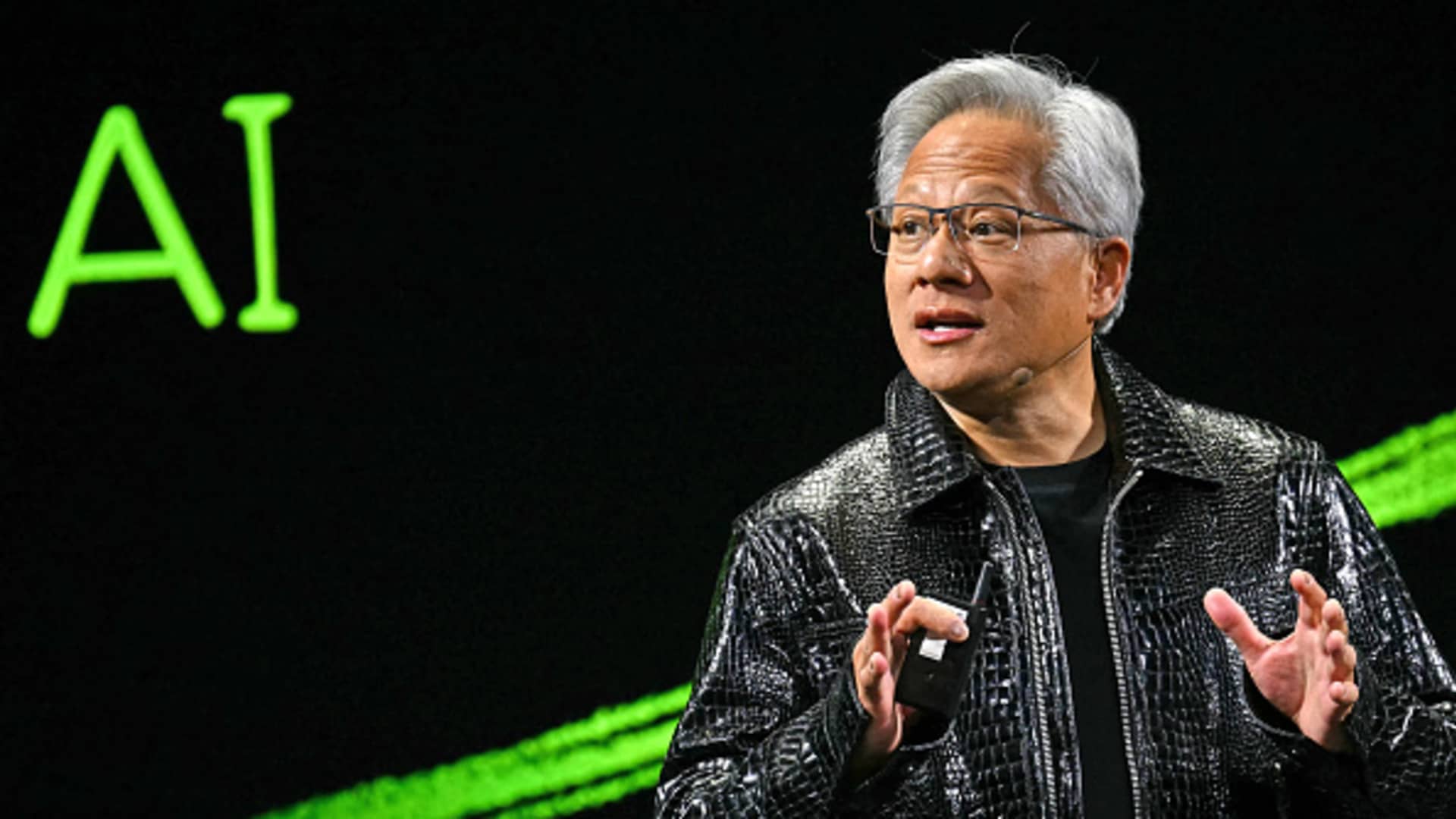

Artificial intelligence will be an investment theme that will continue to grow in 2025 and beyond, according to a tech fund manager that posted 80% gains in 2024. The Hong Kong-listed exchange traded fund Pando CMS Innovation ETF ‘s Chief Investment Officer Beck Lee said the fund relies on proprietary research that combines macroeconomic factors with company fundamentals to make stock picks. “In this ETF, we combine top-down and bottom-up research to construct this portfolio,” Lee told CNBC Pro from Hong Kong. “The top-down approach helps us to identify themes lik e the impact of the [Federal Reserve’s rate decisions], and identify sectors like AI or cryptocurrency,” Lee added. “The bottom-up approach helps us to identify the stocks with solid fundamentals.” 3056-HK 1Y line Lee suggested the fund’s strategy is geared toward long-term gains over short-term moves, especially in AI. The fund has held a stake in Nvidia since its inception in December 2022. See Pando CMS Innovation ETF holdings below. “AI is a long-term trend. Not just one year or two-year thing,” Lee explained. He pointed toward comments from Nvidia CEO Jensen Huang who said AI has evolved over many years to understand vision and text, and is set to enter the physical realm . The ETF manages a highly concentrated portfolio of 17 stocks including Microsoft , chipmaker Taiwan Semi , Spotify , Apple , Amazon , Netflix , Nvidia and Tesla among others, which have made the fund one of the best-performing actively managed ETFs in the world. The 17 stocks, on average, returned 75% last year on an unweighted basis. The fund, which manages $10 million in assets, invests mostly in U.S.-listed companies. Relatively new to the industry yet managing more than $500 million in assets, the fund’s management firm Pando Finance was founded in 2021 in Hong Kong. Its executives, however, have many years of industry experience, including its chief executive and founder Junfei Ren, who was previously an executive at the German stock exchange Deutsche Boerse and ZhenFund, one of China’s largest venture capital funds. The firm also manages ETFs that are focused on companies operating in blockchain technology. CIO Lee said it leveraged its expertise in the cryptocurrency sector to identify MicroStrategy and Coinbase as stocks to hold in the CMS Innovative fund. Shares of MicroStrategy, which gained 358% in 2024, are widely viewed as a Bitcoin proxy due to its leveraged holdings of the cryptocurrency. It’s a top 10 holding in the Pando CMS Innovation ETF and contributed significantly to the fund’s overall performance. Holdings Similarly, Nvidia and Spotify had triple-digit returns in 2024 and are among the top 10 stocks in the fund. Lee said he expects Nvidia to continue to outperform owing to the structural change it’s enabling in the global economy through the widespread use of AI. However, he cautioned that the company will struggle to maintain its current gross profit margins of about 75% in the future as competitors take market share. “I think the high margin of Nvidia is hard to maintain at 75%. I think it will [fall] to high 60[%]. Maybe not next quarter, but maybe next year.” Lee said. “But I think the margin will start to fall.” Microsoft, one of Nvidia’s largest customers, has already begun diversifying the AI processors it uses. Analysts say the company has contracted significantly cheaper AI chips from Broadcom , a California-headquartered chip designer. Microsoft is Pando ETF’s largest holding, with a 9.4% allocation, while Broadcom accounts for 2.9% of the fund. The fund has held the AI chip stock, as well as the chip maker Taiwan Semiconductor, since its inception. Among the fund performance’s detractors were AMD and Adobe , which fell by 18% and 26%, respectively. Both stocks accounted for less than 2% of the fund by the end of 2024.