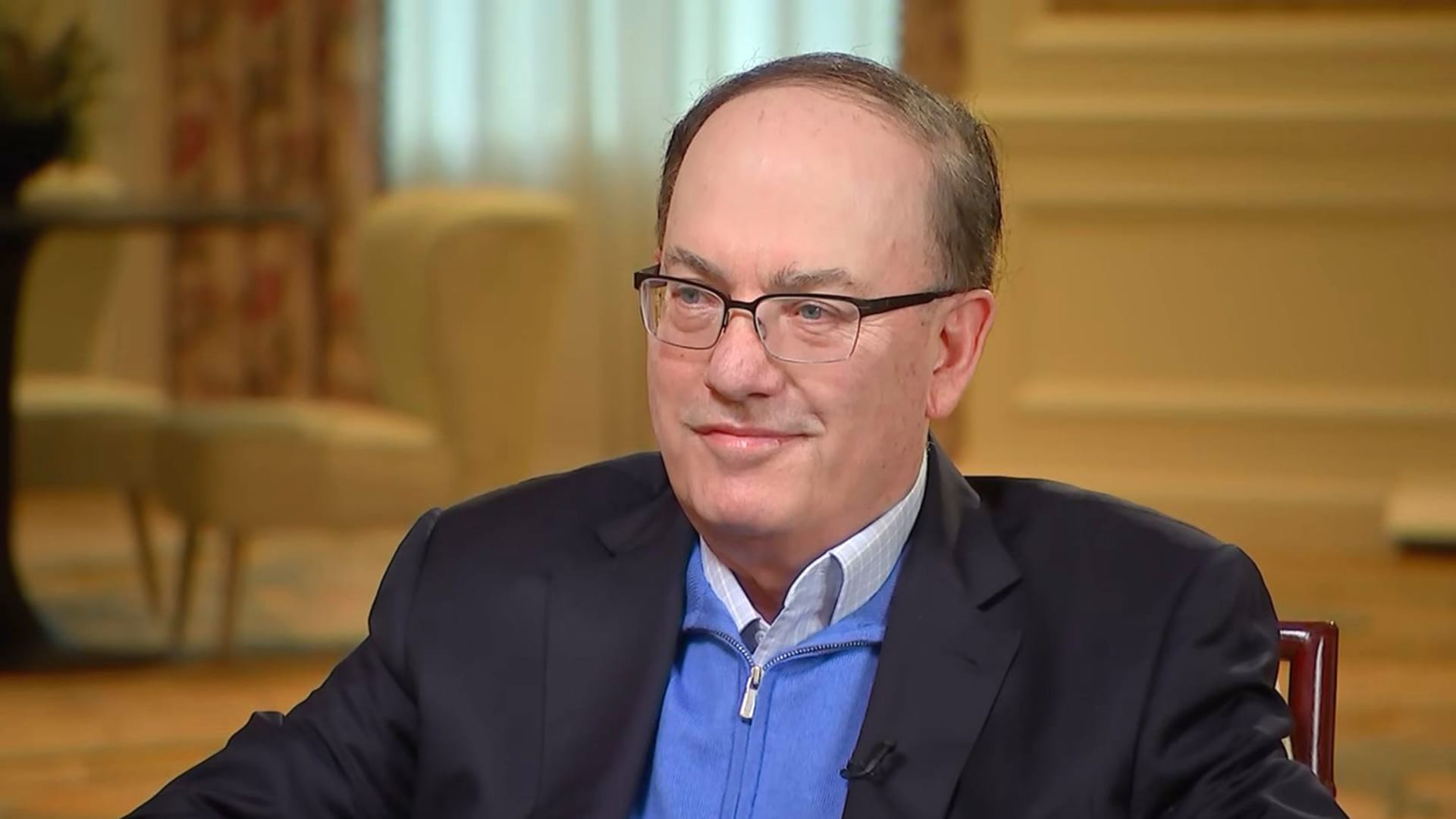

Steve Cohen, chairman and CEO of Point72, speaking to CNBC on April 3, 2024.

CNBC

MIAMI BEACH, Fla. — Billionaire investor Steve Cohen is standing by his long-term bullish view of artificial intelligence despite the wild volatility recently, saying the transformational shift could take decades to realize.

“This is a 10- to 20-year theme. It’s gonna affect everybody in how they conduct their lives, how they do their business,” Cohen said at the iConnections Global Alts conference on Tuesday. “We’re still in the first, second inning of something that’s going to be transformational for the economy and the world. … It is such a dramatic, important shift that to ignore it, I think it’s a mistake.”

The comment from the chairman and CEO of hedge fund Point72 came as young Chinese AI startup DeepSeek sparked a massive rout in U.S. technology stocks Monday. DeepSeek’s highly competitive models made seemingly from a fraction of the cost shook up investor confidence of the AI story and the hype around Nvidia’s chips.

Cohen, who also owns the New York Mets, said the AI boom could see ups and downs and the lack of accurate information could exacerbate volatility around AI-related investments.

“It’s going to be episodic. It’s not going to go in a straight line. There’ll be advances, and then it goes quiet,” Cohen said. “And there’re going to be moments when people are going to doubt it like yesterday. There’s a lot of people who own these stocks who perhaps don’t know what they own and why they own it, other than they know they should own some AI securities. And so you get a lot of misinformation.”

Nvidia, AI’s biggest enabler so far, saw shares tank 17% on Monday, or almost $600 billion in market value, the biggest ever one-day drop in value for a U.S. company. The megacap name rebounded 7% Tuesday.

Cohen also revealed that his firm has raised $1.5 billion for its new AI-focused hedge fund to capitalize on the boom.