Nvidia on Wednesday evening delivered a better-than-expected fiscal 2025 fourth quarter driven by a $2 billion revenue beat on data center sales. Forward guidance also exceeded estimates. Despite the enormous anticipation of the results, shares dropped 1.5% in after-hours trading. But given the volatile nature of the stock, a bigger move — in either direction — could materialize come Thursday’s opening bell. Revenue grew 78% year over year to $39.33 billion, outpacing the $38.05 billion the Street was looking for, according to estimates compiled by data provider LSEG. Adjusted earnings per share increased to 89 cents, exceeding the consensus estimate of 84 cents, LSEG data showed. Why we own it Nvidia’s high-performance graphic processing units (GPUs) are the key driver behind the AI revolution, powering the accelerated data centers being rapidly built around the world. But Nvidia is more than just a hardware story. Through its Nvidia AI Enterprise service, Nvidia is building out its software business. Competitors : Advanced Micro Devices and Intel Most recent buy : Aug 31, 2022 Initiation : March 2019 Bottom line The magnitude of Nvidia’s beats and raises have come down in size over the past year, which could explain why the stock has been about flat from where it traded last June. However, any other company would gladly take Nvidia’s latest $1 billion revenue beat and $1 billion beat on the guide. While the impact of claims of a more efficient artificial intelligence model from Chinese startup DeepSeek muddied the waters nearly one month ago to the day, we just learned from Nvidia and its big tech clients in recent weeks that the AI spending cycle is far from over due to scaling laws and rapid advancements in the technology. We also know Nvidia has the best hardware and software platform in the market with its new Blackwell chip system, which CEO Jensen Huang described as “designed” for this moment due to its ability to transition from AI pre-training, post-training, and test-time scaling applications. It also provides customers with the lowest total cost of ownership and higher return on investment. NVDA 1Y mountain Nvidia 1 year As long as the secular trend continues with no deviations in spending patterns from the larger cloud service providers, which make up about half of Nvidia’s data center revenue, then we remain “own it, don’t trade it” on a company that has shown time and time again that it’s a once-in-generation enterprise run by a true visionary. As always, however, “own it, don’t trade it” does not prevent us from periodically taking profits in acknowledgment of risks like we did at the start of 2025 . For now, we’re reiterating our 2 rating and $165-per-share price target. The stock remains below its Jan. 24 close around $142, the Friday before all the DeepSeek turmoil started. Commentary Coming into earnings , we wanted to hear Jensen and company’s thoughts on four different topics: the Hopper to Blackwell transition, DeepSeek’s implications for Nvidia’s business, the overall health of hyperscaler demand, and the ability to sell chips into China amid export controls. 1. Blackwell : The debate around Nvidia’s next-generation Blackwell superchip called GB200, the successor to the Hopper lineup, wasn’t about whether there would be enough demand. Rather, it centered on the company’s ability to ship the product to customers. Blackwell started full production last fall but ran into manufacturing and installation challenges with the full server rack version, known as the GB200 NVL72 . In the quarter, Nvidia delivered $11 billion of Blackwell architecture, exceeding the company’s expectations. Management sounded confident in its outlook for Blackwell in the quarters ahead and that they’ve moved past supply chain issues. The platform is expanding in customer adoptions — and accordingly, Nvidia is rapidly increasing supply. Although these big chip platforms are complicated to make, Nvidia can apply lessons learned from the Blackwell ramp to future product iterations. 2. DeepSeek : At the heart of the DeepSeek debate was a concern that an efficient, lower-cost AI model would reduce the number of advanced chips needed to train future models and run inference applications. Adding to the anxieties of Nvidia shareholders was a worry that the company’s chip edge was in training and that hyperscalers could use other options like custom silicon to power their inferencing applications. Addressing this debate head-on, Jensen gave a clear explanation of how this innovation will increase the demand for compute, which is ultimately positive for Nvidia. “DeepSeek-R1 has ignited global enthusiasm. It’s an excellent innovation. But even more importantly, it has open-sourced a world-class reasoning AI model,” he said on the post-earnings call. “Nearly every AI developer is applying R1 or chain of thought and reinforcement learning techniques like R1 to scale their model’s performance.” “We now have three scaling laws, scaling laws of AI remains intact. Foundation models are being enhanced with multi-modality and pre-training is still growing. But it’s no longer enough,” he said “We have two additional scaling dimensions. Post-training scaling, where reinforcement learning, fine-tuning, model distillation requires orders of magnitude more compute than pre-training alone.” In a CNBC interview Wednesday evening following the release, Jensen said AI has to do “100 times more” computer computations now than when ChatGPT was released. Microsoft-backed OpenAI launched its generative AI chatbot in late 2022, which quickly went viral and touched off the current artificial intelligence boom. 3. Hyperscalers : As for demand from hyperscalers, also known as cloud service providers, or CSPs, the narrative this week has been that they overbuilt their data center capacity based on a report that suggested Club name Microsoft had canceled some data center leases in the United States. We’re conscious that at some point the hyperscalers will reign in spending, but we disagree with this immediate conclusion because all the big cloud providers – Microsoft’s Azure, Amazon Web Services, and Google Cloud, have talked about supply constraints. (The Club also owns positions in Amazon and Alphabet .) Jensen does, too. On the call, he sounded confident that strong data center sales will continue into next year based on the demand signals he sees. “We have a fairly good line of sight of the amount of capital investment that data centers are building out towards. We know that going forward, the vast majority of software is going to be based on machine learning. And so accelerated computing and generative AI, reasoning AI, are going to be the type of architecture you want in your data center. We have, of course, forecasts and plans from our top partners.” He added there are many different forms of AI being developed, requiring higher levels of investment. “Another way to think about that is we’ve really only tapped consumer AI and search and some amount of consumer generative AI, advertising, recommenders, kind of the early days of software. The next wave is coming, agentic AI for enterprise, physical AI for robotics, and sovereign AI as different regions build out their AI for their own ecosystems.” 4. China : There’s a lot of uncertainty about Nvidia’s ability to ship chips into the world’s second-largest economy due to U.S. trade restrictions, which started under former President Joe Biden and could tighten under current President Donald Trump . Due to these rules, China is not as big of a market for Nvidia as it once was, with data center sales there at about half the levels from before the onset of export controls. In the absence of future changes in regulations, Nvidia expects China shipments will remain roughly at the current percentage of total data center sales. Guidance Looking at Nvidia’s fiscal 2026 first quarter, management’s outlook was solid. Revenue was guided slightly higher than the consensus at the midpoint, though the magnitude of the beat has been coming down. The company’s adjusted gross margin forecast was a touch below consensus, and the adjusted operating expense outlook was well above the estimates, implying a miss on operating margins. According to an earnings snapshot note from Truist, Nvidia’s implied EPS guidance is 92 cents at the midpoint and a penny higher than the 91-cent consensus. Revenue of $43 billion, plus or minus 2%, ahead of the $42.07 billion FactSet consensus estimate. That implies a year-over-year growth rate of approximately 65.1%. Adjusted gross margins are expected to be 71%, plus or minus 50 basis points, slightly below of estimates of the 71.84% estimate. Expectations for adjusted operating expenses in the fiscal fourth quarter of $5.2 billion are well above expectations of about $3.7 billion. Although adjusted gross margins have come down from their recent highs, CFO Colette Kress said on the call that she continues to expect margins to improve and return to the mid-70s late in fiscal 2026 after Blackwell is fully ramped. (Jim Cramer’s Charitable Trust is long NVDA, MSFT, AMZN, and GOOGL. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

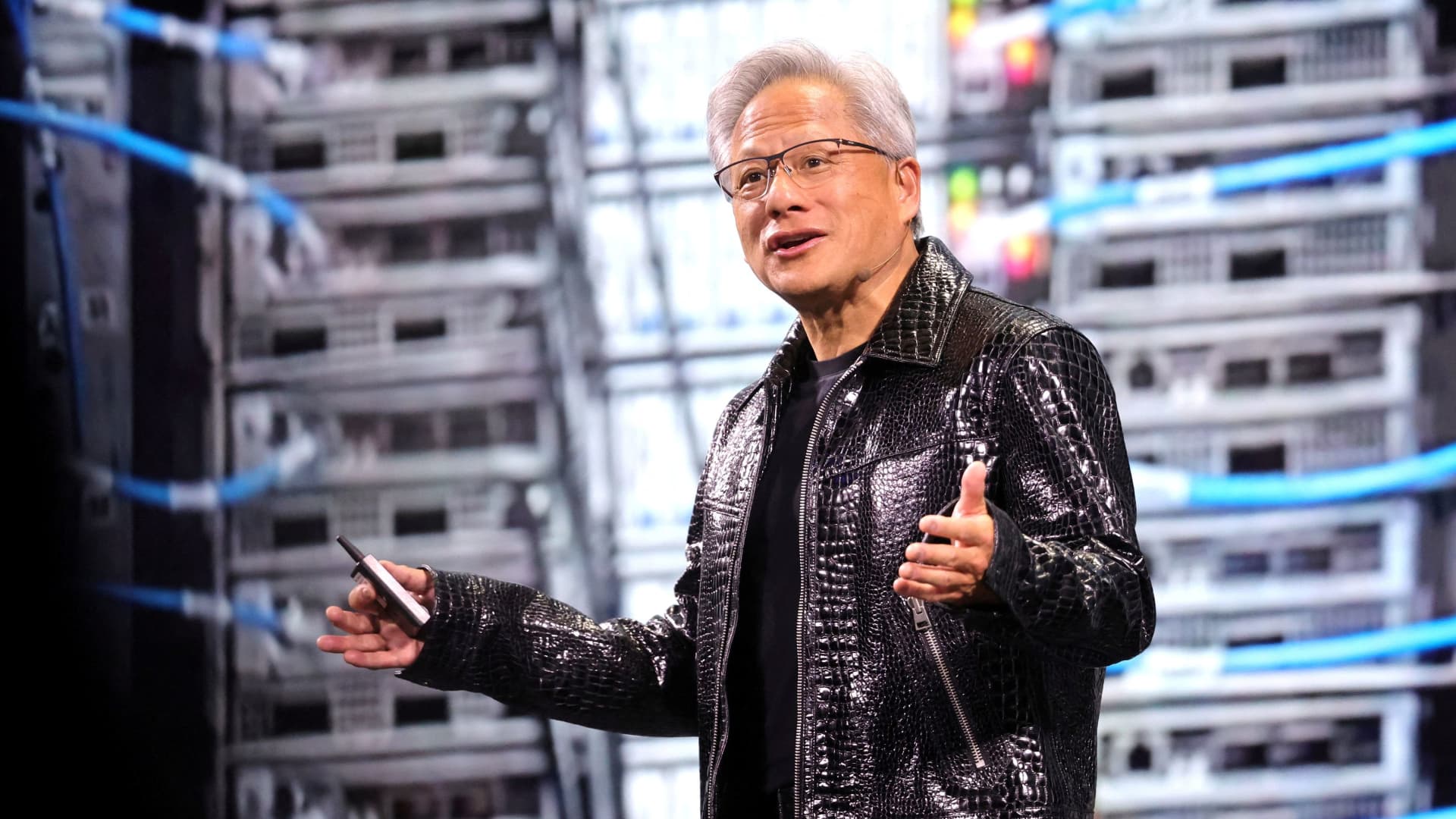

Nvidia CEO Jensen Huang gives a keynote address at CES 2025, an annual consumer electronics trade show, in Las Vegas, Nevada, U.S. Jan. 6, 2025.

Steve Marcus | Reuters

Nvidia on Wednesday evening delivered a better-than-expected fiscal 2025 fourth quarter driven by a $2 billion revenue beat on data center sales. Forward guidance also exceeded estimates. Despite the enormous anticipation of the results, shares dropped 1.5% in after-hours trading. But given the volatile nature of the stock, a bigger move — in either direction — could materialize come Thursday’s opening bell.