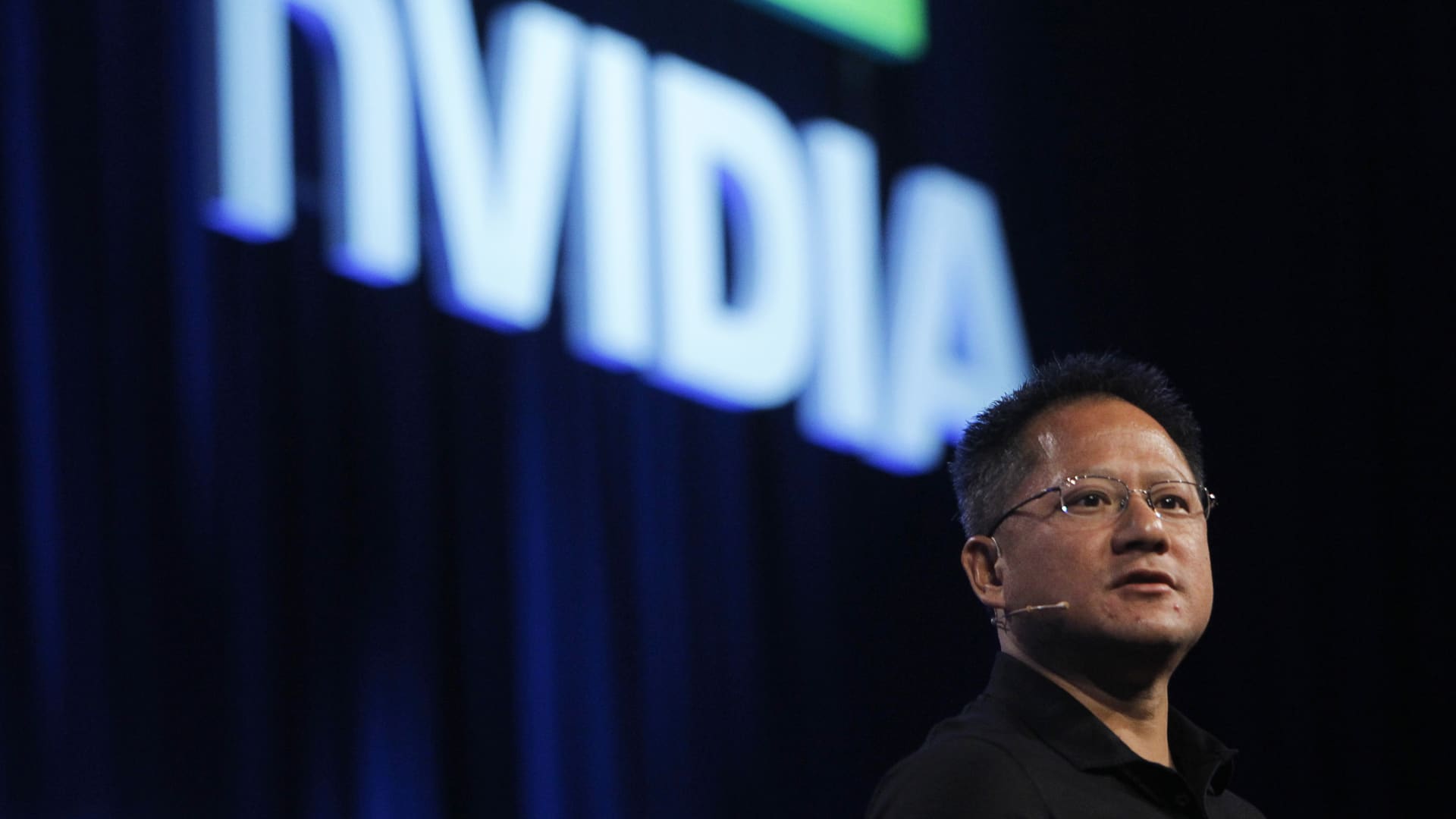

Here are Monday’s biggest calls on Wall Street: Bernstein reiterates Nvidia as outperform Bernstein said shares of Nvidia are compelling. “We are not sure where NVDA (or anything else) will bottom in the near term. But we do believe the AI narrative is still real. And once things do settle down (hopefully soon!) the stock at these levels is probably worth a look. We rate NVDA Outperform.” Wedbush reiterates Apple as outperform Wedbush lowered its price target on the stock to $250 per share from $325. “At the current situation we do not expect most tech companies to give any guidance on the 1Q conference calls over the next month including Apple given too much uncertainty.” Jefferies reiterates Microsoft and Meta as buy Jefferies lowered its price target on Microsoft to $475 per share from $500 but said it’s sticking with the stock. Jefferies also lowered its price target on Meta to $600 per share from $725 but says it’s sticking with the stock. “We cut our current fiscal year ests. for top-line and bottom-line by 1% and 2% respectively across our covered Software and Internet companies. Companies with the biggest est cuts are those that are more exposed to macro pressures like META, GOOGL, SONO, and UPWK. Companies who we view as more insulated are MSFT, INTU, ROP, and WDAY.” Wedbush reiterates Tesla as outperform Wedbush lowered its price target on the stock to $315 per share from $550. ” Tesla is less exposed to tariffs than other US automakers such as GM, Ford, and Stellantis as well as foreign autos…although Tesla still derives a considerable amount of its parts/batteries from sources outside the US including China.” Citi upgrades Dollar General to neutral from sell Citi said it sees a more balanced risk/reward. “In the near-term DG does not have the same tariff risk as most others in our retail universe, and may benefit from consumers trading down (given its mindshare for value).” Citi upgrades Dollar Tree to buy from hold Citi called the retailer a “dark horse winner” in a tariff world. “We are upgrading DLTR from Neutral to Buy. With ~50% of its product subject to significantly higher tariffs, the market reaction and investor instinct was extremely and unsurprisingly negative.” Baird upgrades Fifth Third and KeyCorp to outperform from neutral The firm upgraded several regional banks on Monday and says shares are compelling at current levels. “Risk/reward getting quite attractive given recent weakness, upgrading FITB / KEY /FHN to Outperform, adding fresh picks on COF/HBAN.” Redburn Atlantic Equities upgrades Roku to buy from neutral The firm said the stock has “defensive attributes.” ” Roku has reached a level of financial maturity where it can now be valued on EBITDA and FCF multiples, for the first time providing a valuation floor to the stock.” Baird downgrades Starbucks to neutral from outperform Baird said it sees too much “macro” uncertainty. “With the probabilities of an economic slowdown seemingly rising following the ‘shock’ of last week’s tariff announcement, we are lowering near term comps/EPS estimates and price targets for our coverage while also tactically stepping to the sidelines on SBUX and PTLO.” Raymond James upgrades JetBlue to outperform from market perform Raymond James said it’s making a tactical upgrade of the airline. “We are tactically upgrading JBLU from Market Perform to Outperform following the recent selloff (alongside the market in response to reciprocal tariff announcements) given our view of low bankruptcy risk and an M & A floor, especially against a backdrop of negative buy-side and sell-side sentiment. Jefferies upgrades Scotts Miracle-Gro to buy from hold Jefferies said the fertilizer company is defensive. “In ’25, we see stocks w/ little int’l sourcing exposure & defensive biz models as quality ‘hide-outs’ for alpha, and SMG checks those boxes.” Raymond James upgrades Ameriprise to strong buy from outperform The firm said the financial services company’s shares are attractive. “Upgrading Ameriprise Financial (AMP) to Strong Buy. We see the (21)% pull back in the stock in 2025 year-to-date as a compelling buying opportunity for a company with an outstanding track record of execution.” JPMorgan upgrades Five Below to neutral from underweight JPMorgan said it’s getting more constructive on Five Below after meeting with management. “Executing on a more consistent in-store experience with labor investments starting in August 2024 and continuing through 2Q (w/ associates manning self-checkout).” Bernstein downgrades General Motors to underperform from market perform Bernstein downgraded the automaker as uncertainty reigns with tariffs. “As tariff pressures intensify and consumer sentiment weakens, we expect GM’ s shares to remain under pressure, leading us to downgrade the stock to Underperform with a price target of $35.” UBS downgrades Delta and United to neutral from buy The firm downgraded Delta and United citing too much macro uncertainty. “The current backdrop of a weaker economic outlook + the sharp move up in tariffs appears likely to cause deterioration in both international and premium segments which is a significant risk for these names.” UBS downgrades Caterpillar to sell from neutral The firm said it sees too many negative catalysts not yet priced in. “We’ve lowered our price target for CAT to $243 from $385, and downgraded CAT to Sell. We think there’s more earnings downside related to macroeconomic headwinds that is not yet priced in.” Citi upgrades Diamondback Energy to buy from neutral Citi said the energy company is undervalued. “FANG remains a top-tier E & P as reflected in a break-even oil price at just ~$36/bbl, the lowest amongst our coverage, enabling free cash generation even when crude prices as depressed.” Truist initiates Reddit as buy Truist said the social media company has a differentiated offering. “We’re initiating coverage of RDDT at Buy with a FY25 YE PT of $150.” RBC initiates BeiGene as outperform RBC said the biotech company is an oncology “powerhouse.” “We view ONC’s prolific oncology pipeline, proven R & D capabilities and a fast-to-execution mindset as key ingredients for the company’s emerging position as a global oncology powerhouse that could drive market capitalization expansion.” Morgan Stanley downgrades Goldman Sachs to equal weight from overweight Morgan Stanley said the bank is too exposed to investment banking revenue. ” GS is the most exposed Large Cap Bank to investment banking revenues, which we view as having the fastest twitch response within the Financials sector to recession risk and deteriorating market conditions, much faster than loan growth at traditional commercial banks.” Morgan Stanley upgrades Bank of America to overweight from equal weight The firm said investor should buy the dip on the stock. “Upgrading BAC to Overweight on valuation as the stock is trading at only 8x our 2026 EPS and 0.8x BVPS against a 2026 ROE of 11%. Morgan Stanley downgrades Synchrony to equal weight from underweight Morgan Stanley said it’s concerned about a recession risk for Synchrony. “Downgrading SYF to EW, BFH to UW as recession risks put low-income consumers/discretionary spend at risk.” Baird downgrades Target to neutral from outperform The firm said it sees better value elsewhere. “While exposure to less discretionary categories like grocery/health and wellness should help, TGT’s discretionary categories like home and apparel tend to play meaningful roles in attracting incremental trips/spend.” Wolfe adds Netflix to the Alpha List The firm said the stock has pricing power. “We see upside potential to expectations for advertising growth and profitability, and in a stressed economy, we prefer Netflix’s subscription revenues and pricing power for highly predictable compounding.” UBS upgrades Sealed Air to buy from neutral The firm said it sees an attractive entry point for the air packaging company. “We upgrade SEE to Buy from Neutral. With shares off 30% from mid-Jan, we see this as a good opportunity to Buy. ” Raymond James downgrades Pinterest to market perform from outperform The firm said it doesn’t like the social media company’s tariff exposure. “We follow-up our soft CPG [consumer packaged goods] checks with an analysis of ~35 CPG companies/proxies and tariff exposure and come away incrementally cautious on PINS expectations, which prompts a downgrade to Market Perform despite our overall favorite disposition on the management team/shopping strategy.”