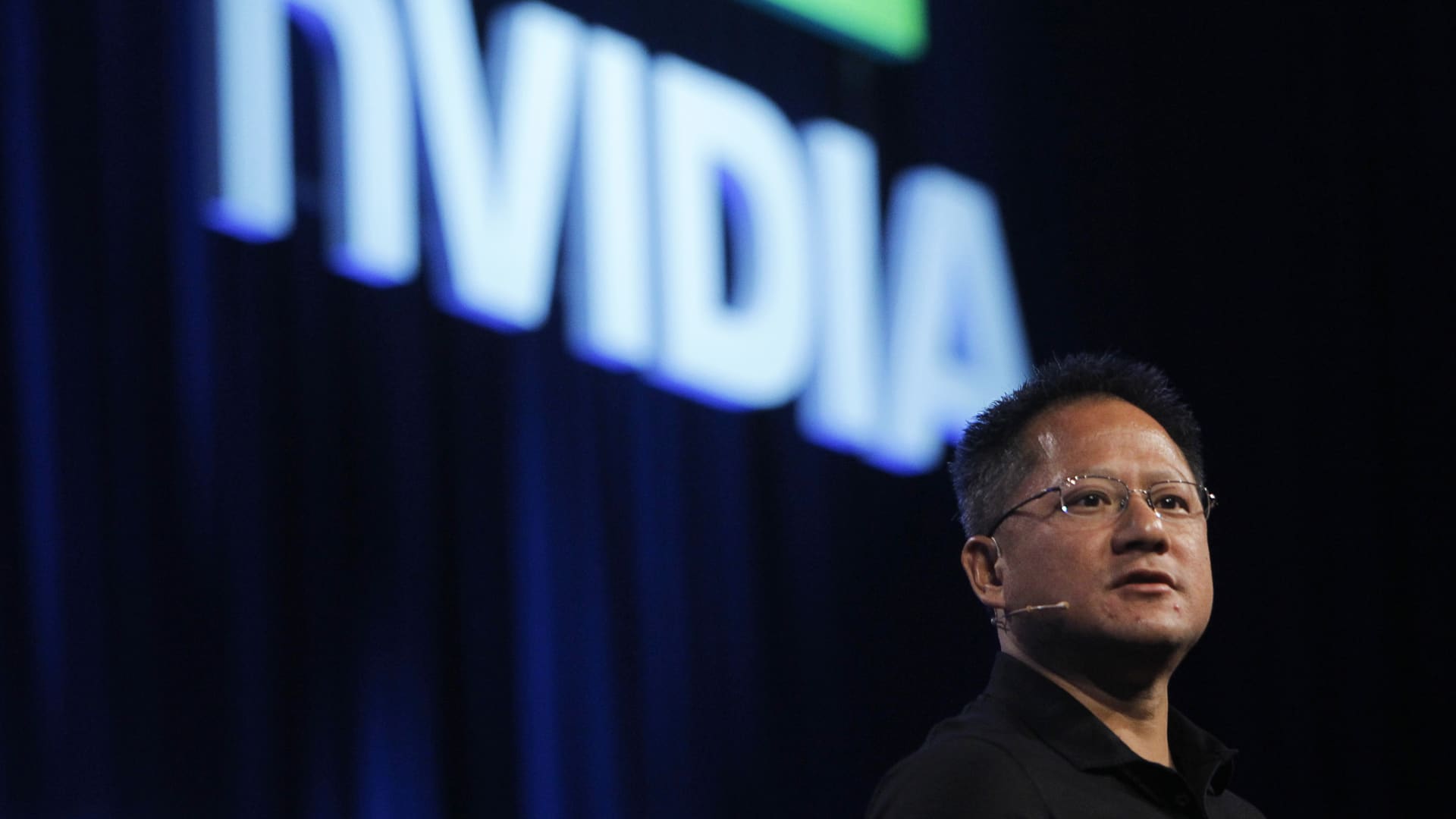

Here are Monday’s biggest calls on Wall Street: Bank of America reiterates Nvidia as buy The firm said it sees a robust “beat/raise” when Nvidia reports earnings in late August. “Solid capex trends with n-t China boost.” Compass Point downgrades Coinbase to sell from neutral Compass said in its downgrade of the stock that it sees an “extended valuation into crypto sell-off.” “We are downgrading COIN to Sell from Neutral and reducing our PT to $248 (-$82). While we remain constructive on the current crypto cycle, we expect a choppy 3Q alongside weak August/September seasonality and waning retail interest in crypto treasury stocks.” Read more. UBS initiates Pony AI as buy UBS said the China robotaxi company is “best positioned.” “We initiate coverage with a Buy rating and a PT of US$20, implying 53% upside potential.” Bank of America reiterates DoorDash as buy The firm raised its price target on the stock to $285 per share from $245 ahead of earnings later this week. “We rate DoorDash Buy. DoorDash is the leading delivery app in terms of US bookings and US revenue and a market share gainer from 2018 to 2021.” Evercore ISI reiterates Amazon as outperform Evercore ISI said it’s bullish on Amazon’s Alexa+. “We reiterate our Outperform on AMZN in the wake of our proprietary research into Alexa+, Amazon’s AI Agent currently being rolled out to its Echo platform devices. We have tested Alexa+ on and off for two weeks now and have run our own proprietary survey of 1,350 current Smart Device owners.” UBS reiterates Berkshire Hathaway as buy UBS raised its price target on the stock to $597 per share from $595 following Saturday’s earnings. “We continue to believe BRK’ s shares are an attractive in an uncertain macro environment with defensive businesses, a strong cash position and growth improving at GEICO.” Bank of America reiterates Apple as buy Bank of America said it remains bullish on shares of Apple . “Our Buy rating on Apple is based on 1) expected strong iPhone upgrade cycle in F25, F26 driven by the need for latest hardware to enable Gen AI features, 2) higher growth in Services revenue, 3) higher margins from more internally developed silicon…” Piper Sandler reiterates Tesla as outperform Piper said it’s sticking with shares of Tesla. “On Friday, when a jury in Florida found Tesla partially liable for a 2019 crash, headlines began proliferating, referring to a ‘stunning rebuke’, a ‘massive blow’, and a $243M obligation. In our view, these headlines paint an unrealistically negative picture. In short, we don’t think shareholders should be losing sleep over this.” Oppenheimer upgrades MindMed to outperform from perform Oppenheimer said it sees a slew of positive catalysts ahead for the brain health biotech company. ” MNMD’s 2Q25 cash of ~$238M provides runway through key catalysts, and we forecast ~$2B potential revenues.” JPMorgan upgrades Kimberly Clark to neutral from underweight JPMorgan upgraded Kimberly-Clark following earnings. “Upgrade to Neutral as Share Gains, Volume-Led Sales, and Cost Savings Offset Category Moderation.” Morgan Stanley reinstates Chevron as overweight Morgan Stanley resumed coverage of the stock and says it has more room to run. “The recent closing of the HES deal removes a key overhang and strengthens CVX’s business, enhancing growth and the portfolio duration. While the longer-term outlook is still less clear than peers, this is balanced by leading FCF rate of change into 2026.” UBS initiates Kinross Gold as buy UBS said it’s very bullish on the gold company. “We initiate on Kinross (KGC) with a Buy rating because we remain constructive on gold, forecasting prices to remain elevated at $3,500/oz in 2026.” Baird upgrades Alamo Group to outperform from neutral Baird said in its upgrade of Alamo Group that the vegetation and industrial equipment company is well positioned. “Upgrading to Outperform: Vegetation Bottoming, Solid EPS Growth Potential.” Morgan Stanley reiterates Disney as overweight Morgan Stanley raised its price target on the stock to $140 per share from $120. “If the macro backdrop remains healthy, we see Disney generating healthy double digit adj. EPS growth in the years ahead. Thanks to growth in its Experiences and Streaming businesses, it is poised to have rebuilt its pre-pandemic earnings base and hit new heights by FY27.” Read more. Morgan Stanley reiterates Walmart as overweight Morgan Stanley said its checks show Walmart continues to build membership in Walmart+.” “Membership growth has rebounded from a ’23-’24 slump and shows continued progress in WMT’s strategy to drive its eCommerce flywheel.” TD Cowen upgrades Affiliated Managers to buy from hold The firm upgraded the capital markets company following earnings and sees a slew of positive catalysts. “Post 2Q (see 7/31), we upgrade AMG to Buy from Hold.” Baird upgrades MasTec to outperform from neutral Baird said investors should buy the dip in the infrastructure construction company. “It’s no secret we’ve been searching for opportunity in MTZ . True, 2Q25 earnings weren’t “great” (relative to high expectations/stock outperformance), but we felt Friday’s sell-off was overdone, further pressured by broader market weakness.” UBS initiates WeRide as buy UBS said the robotaxi company has a first mover advantage. “WeRide has a first-mover advantage in expanding L4 [Level 4 autonomous technology] use cases overseas and has entered 10 countries, leveraging diversified use cases and a flexible operating strategy.” William Blair upgrades ViaSat outperform from market perform William Blair said in its upgrade of ViaSat that there’s a slew of positive catalysts ahead for the satellite company. “The Wheels Are in Motion With a Plethora of Positive Catalysts and High Leverage; Upgrading to Outperform”