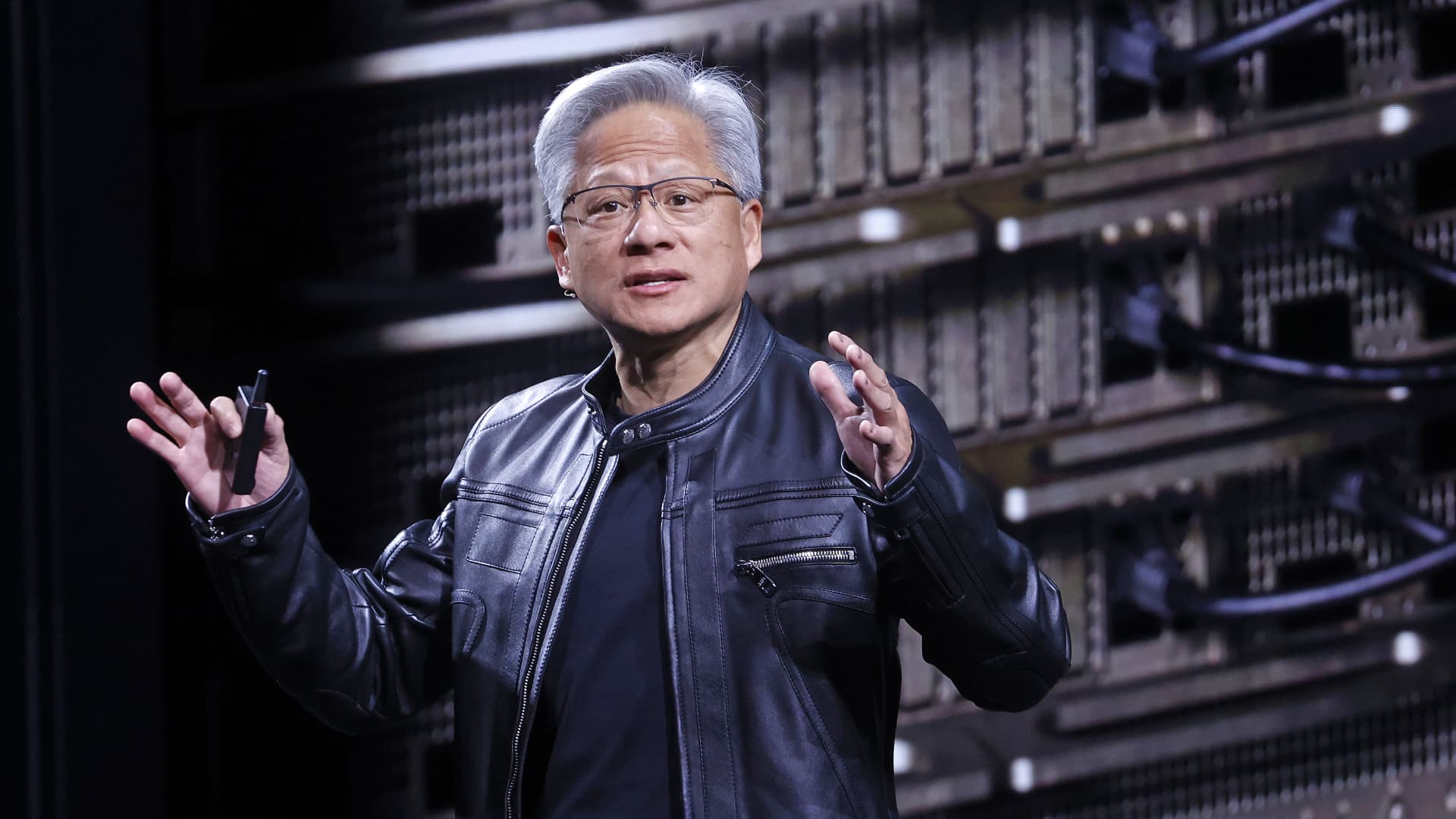

Stocks @ Night is a daily newsletter delivered after hours, giving you a first look at tomorrow and last look at today. Sign up for free to receive it directly in your inbox. Here’s what CNBC TV’s producers were watching on Tuesday and what’s on the radar for Wednesday’s session. Cracker Barrel They’re bringing the old logo . Late Tuesday, CNBC’s David Sucherman scored the statement from the fast casual restaurant chain that’s been under fire for changing the logo. The company’s statement said, “We thank our guests for sharing your voices and love for Cracker Barrel. We said we would listen, and we have. Our new logo is going away and our “Old Timer” will remain. At Cracker Barrel, it’s always been – and always will be – about serving up delicious food, warm welcomes, and the kind of country hospitality that feels like family. As a proud American institution, our 70,000 hardworking employees look forward to welcoming you to our table soon.” Cracker Barrel stock is up about 7% this evening. Including tonight’s move, the stock is now flat since the big change that captured a nation’s attention back on Aug. 19. CBRL 1M mountain Cracker Barrel shares over the past month. Nvidia Get ready, the tech giant reports tomorrow after the bell. Since last reporting three months ago, a lot has happened. The stock is up 38% since May. The VanEck Semiconductor ETF (SMH) is up 25% in the same time period. Nvidia is now 1.5% from the 52-week high. Boeing The stock is on track for its fifth-straight monthly gain. According to CNBC’s Adrian van Hauwermeiren, that would be Boeing’s longest monthly up streak since 2018. Shares are 3.2% from the 52-week high. Boeing will part of CNBC’s Sectornomics coverage on Wednesday when we focus on the industrials, which is the second best performing S & P sector in 2025. BA YTD mountain Boeing shares year to date. The Great American consumer stocks Kohl ‘s reports in the morning. The stock up 74% since last reporting three months ago. It is 39% from its 52-week high. JM Smucker also reports in the morning. Its shares are down 2% since its last report. The stock is down 12% from its November high.