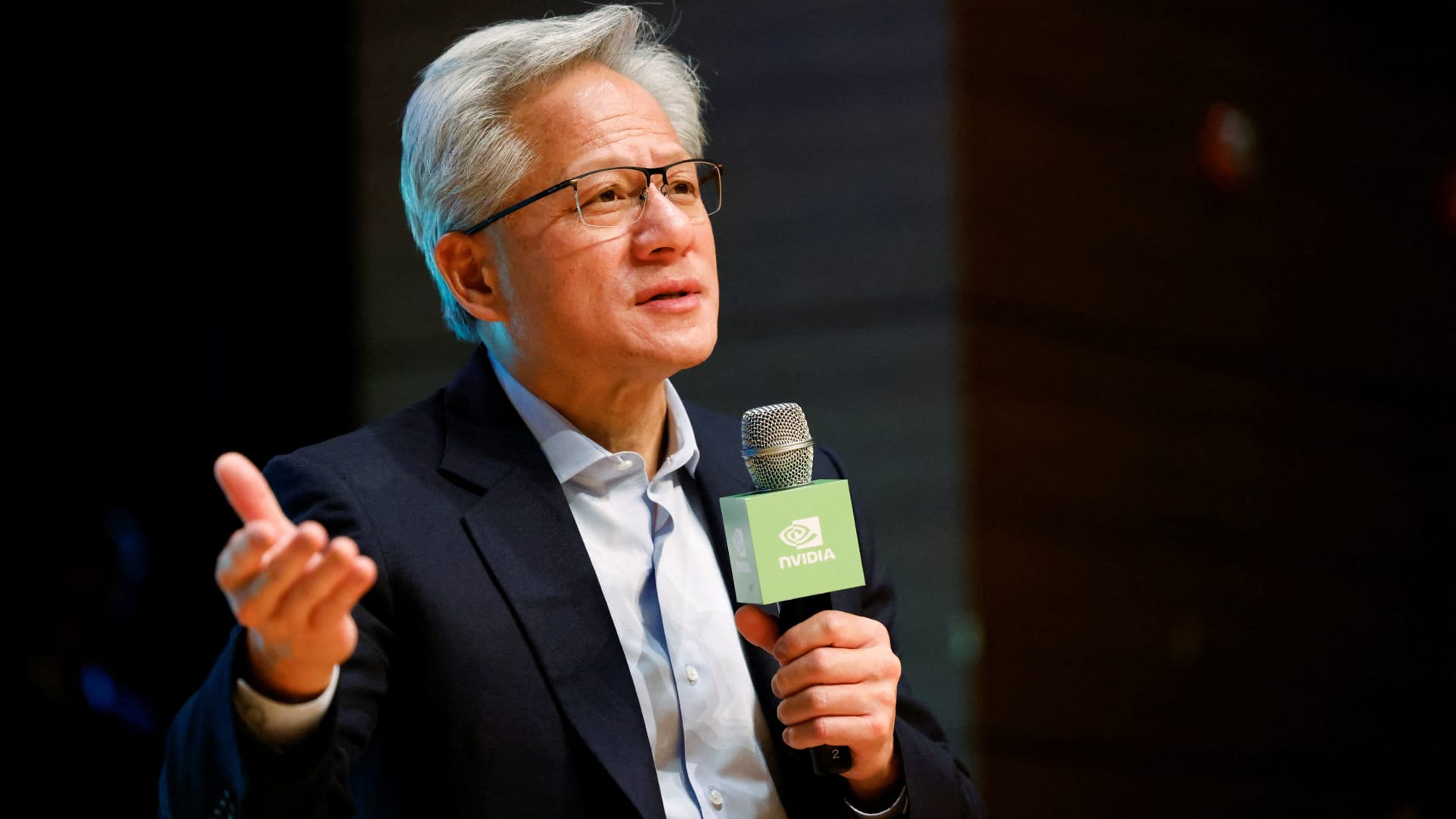

Jensen Huang, CEO of Nvidia, attends a press conference after the 2025 Asia-Pacific Economic Cooperation (APEC) CEO Summit in Gyeongju, South Korea, October 31, 2025.

Kim Soo-hyeon | Reuters

Traders who shorted the S&P 500 — essentially, betting that it would go down — last month were in for a rude surprise. The broad-based index ended the month 2.3% higher, defying “Octoberphobia,” a term that arose because of the market crashes in 1929 and 1987 that happened during the month.

The Nasdaq Composite had an even better month than the S&P 500. The tech-heavy index climbed 4.7%, giving a hint of what helped ward off the arrival of any ill omens: the technology sector.

On Friday, Amazon shares popped 9.6% on robust growth in its cloud-computing unit and as CEO Andy Jassy pointed to “strong demand in AI and core infrastructure.” The news pushed up other artificial intelligence-related stocks such as Palantir and Oracle too.

AI’s ascent in the market wasn’t a one-day event. In October, Nvidia, the poster child of AI, became the first company to reach a valuation of $5 trillion, with CEO Jensen Huang describing the technology as having formed a “virtuous cycle” in which usage growth will lead to an increase in investment, in turn improving AI, which will boost usage, which will… You get the idea.

Indeed, during their earnings disclosures last week, Big Tech companies announced dizzying increases in their capital expenditure, most of which will likely go toward AI infrastructure.

All that is to say that the enthusiasm over AI looks, for now, less like the immediate sugar rush of a candy bar (and the subsequent crash), and more like the sustained energy boost from a fiber-rich pumpkin.

What you need to know today

And finally…

Meta CEO Mark Zuckerberg wears the Meta Ray-Ban Display glasses, as he delivers a speech presenting the new line of smart glasses, during the Meta Connect event at the company’s headquarters in Menlo Park, California, U.S., Sept. 17, 2025.

Carlos Barria | Reuters