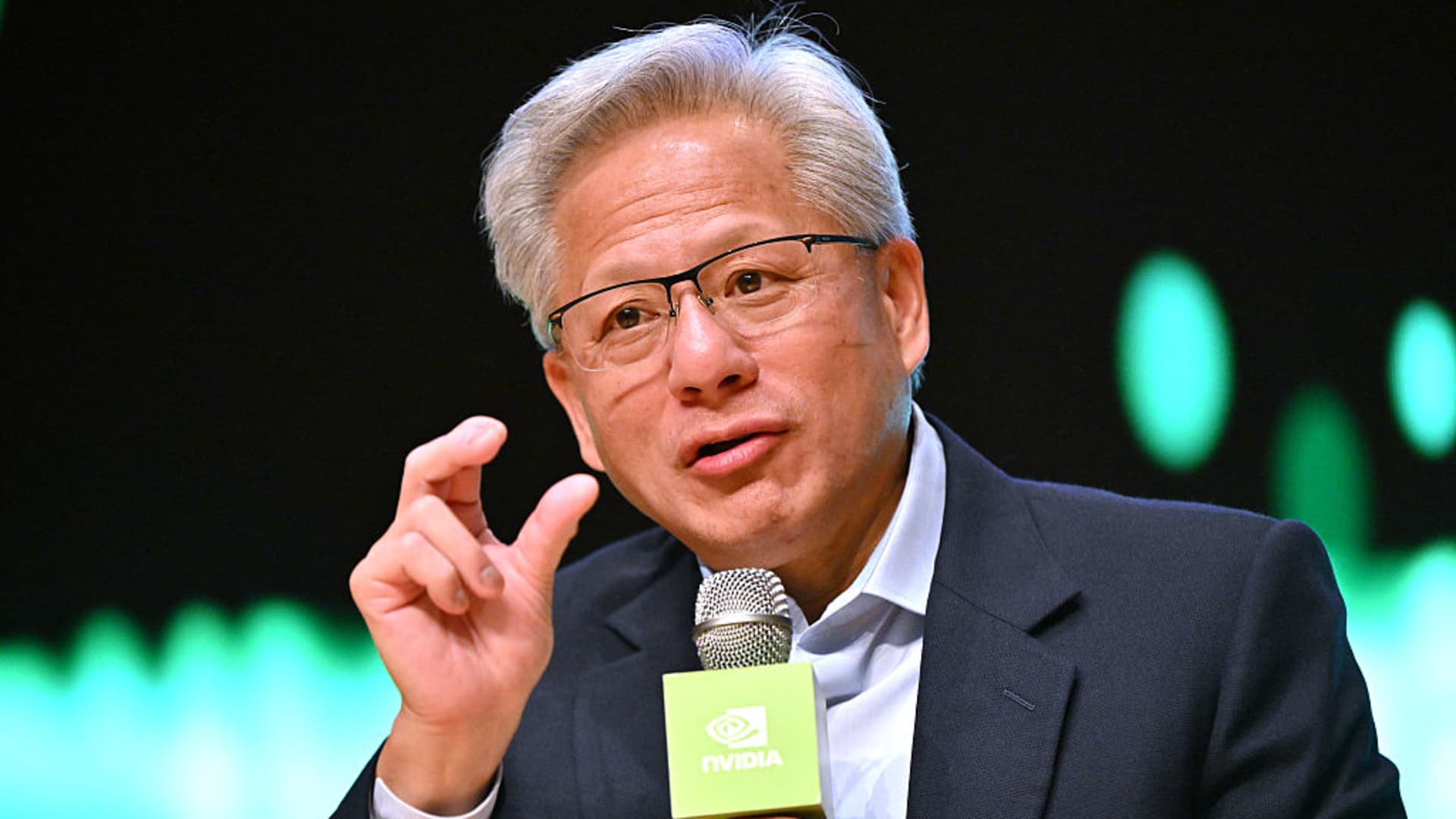

Nvidia founder and CEO Jensen Huang reacts during a press conference at the Asia-Pacific Economic Cooperation (APEC) CEO Summit in Gyeongju on October 31, 2025.

Jung Yeon-je | Afp | Getty Images

Artificial intelligence chipmaker Nvidia is scheduled to report fiscal third-quarter earnings on Wednesday after the market closes.

Here’s what Wall Street is expecting, per LSEG consensus estimates:

- EPS: $1.25

- Revenue: $54.92 billion

Wall Street is expecting the chipmaker to guide in the current quarter to $1.43 in earnings per share on $61.66 billion of revenue. Nvidia typically provides one quarter of revenue guidance.

Anything Nvidia or CEO Jensen Huang says about the company’s outlook and its sales backlog will be closely scrutinized.

He’ll have lots to talk about.

Nvidia is at the center of the AI boom, and it counts counts every major cloud company and AI lab as a customer. All of the major AI labs use Nvidia chips to develop next-generation models, and a handful of companies called hyperscalers have committed hundreds of billions of dollars to construct new data centers around Nvidia technology in unprecedented build-outs.

Last month, Huang said Nvidia had $500 billion in chip orders in calendar 2025 and 2026, including the forthcoming Rubin chip, which will start shipping in volume next year. Analysts will want to know more about what Nvidia sees coming from the AI infrastructure world next year, because all five of the top AI model developers in the U.S. use the company’s chips.

As of Tuesday, analysts polled by LSEG expect Nvidia’s sales to rise 39% in the company’s fiscal 2027, which starts in early 2026.

Investors will want to hear about Nvidia’s equity deals with customers and suppliers, including an agreement to invest in OpenAI, a deal with Nokia and an investment into former rival Intel. Nvidia has kept its pace of deal-making up, agreeing to invest $10 billion into AI company Anthropic earlier this week.

Nvidia management will also be asked about China, and the possibility that the company could gain licenses from the U.S. government to export a version of its current-generation Blackwell AI chip to the country. Analysts say Nvidia’s sales could get a boost of as much as $50 billion per year if it is allowed to sell current-generation chips to Chinese companies.

WATCH: There’s a lot riding on Nvidia’s earnings, says Interactive Brokers’ Sosnick