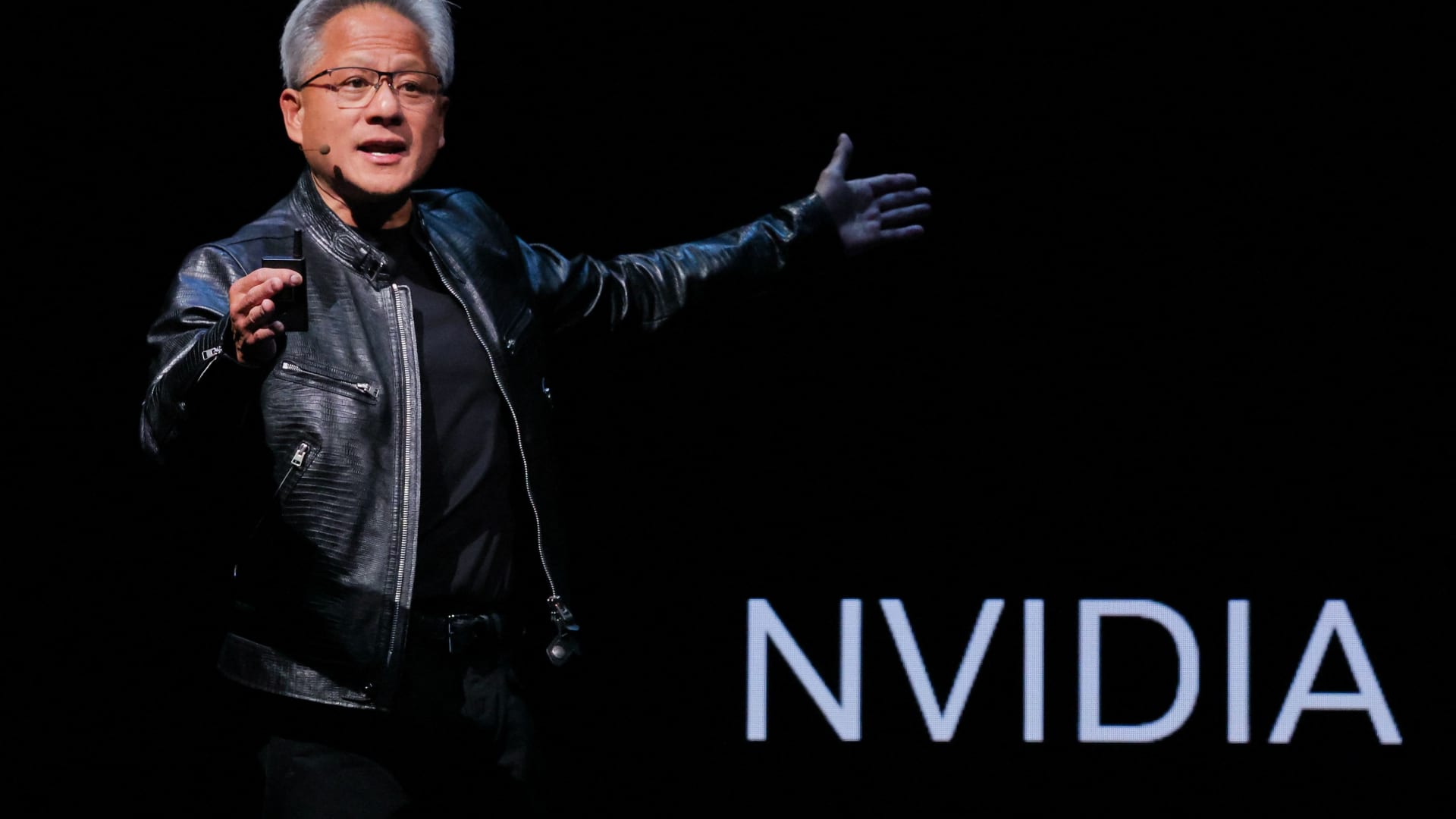

Goldman Sachs named a slew of stocks that remain best positioned heading into year-end. The Wall Street investment bank said companies like Nvidia are compelling, with more room to run. Other buy-rated names screened by CNBC Pro include: Dick’s Sporting Goods , Wynn Resorts, Monster Beverage and Genius Sports. Wynn Goldman says the casino and resort company is firing on all cylinders. Analyst Lizzie Dove added the stock to the firm’s prestigious conviction buy list earlier this week. Dove said Wynn has the right access to attractive the most affluent travelers. “WYNN is exposed to the highest-end customer on the strip,” she wrote. The firm is also bullish on the company’s opportunity overseas. “The launch of Wynn Al Marjan in the UAE in 1Q27, plus WYNN’s best-in-class Las Vegas assets, leverage to a higher-income consumer, a strong 2026 Las Vegas event calendar, and an improving backdrop in Macau should drive transformative upside at WYNN,” she went on to say. The stock is up 46% this year. Dick’s Sporting Goods Shares of the sporting goods company have plenty of room to run, according to the firm. Analyst Kate McShane urged investors to remain calm following Dick’s recent earnings report. McShane sees a robust industry backdrop for sporting goods and praised the company’s relationships with vendors as well its competitive chops. The firm did admit that investors remain conflicted surrounding the company’s acquisition of Foot Locker, but said most investors it speaks with are bullish on the transaction. However, shares of the company are up 2% this year. “We reiterate our Buy rating on DKS as the company likely continues to benefit from an ongoing trend towards health and wellness, strong brand heat, market share gains, and structurally higher margins, with gross margins and EBT remaining well above pre-pandemic levels,” she wrote. Monster Beverage Analyst Bonnie Herzog is feeling more bullish on the beverage stock after a series of investor meetings. “Looking ahead, mgmt struck an upbeat tone as it relates to the category growth outlook next year despite challenging y/y comps…,” she wrote. Herzog, who raised her price target to $83 per share from $80, says the company continues be an innovator which will ultimately help drive revenue to other parts of Monster’s business. “Bottom line — MNST remains one of our preferred stock picks, as we continue to believe it’s one of the most attractive volume-driven growth stories in broader Staples,” she went on to say. The stock is up 40% this year. Nvidia “We reiterate our Buy rating as we continue to believe Nvidia has a sustainable model advantage over peers in AI training applications, we see significant upside to Street estimates, and we view valuation as relatively appealing at current levels.” Genius Sports “We remain confident in our view of Genius Sports as a company: 1) well-positioned to benefit from a number of secular growth tailwinds and a clear product roadmap translating into compounded revenue well into the double-digits; 2) well positioned to produce predictable incremental margins (with better visibility into its multi-year cost structure.” Wynn “WYNN is exposed to the highest-end customer on the strip. … The launch of Wynn Al Marjan in the UAE in 1Q27, plus WYNN’s best-in-class Las Vegas assets, leverage to a higher-income consumers, a strong 2026 Las Vegas event calendar, and an improving backdrop in Macau should drive transformative upside at WYNN.” Dick’s “We reiterate our Buy rating on DKS as the company likely continues to benefit from an ongoing trend towards health and wellness, strong brand heat, market share gains, and structurally higher margins, with gross margins and EBT remaining well above pre-pandemic levels.” Monster Beverage “Looking ahead, mgmt struck an upbeat tone as it relates to the category growth outlook next year despite challenging y/y comps. … Bottom line — MNST remains one of our preferred stock picks, as we continue to believe it’s one of the most attractive volume-driven growth stories in broader Staples.”