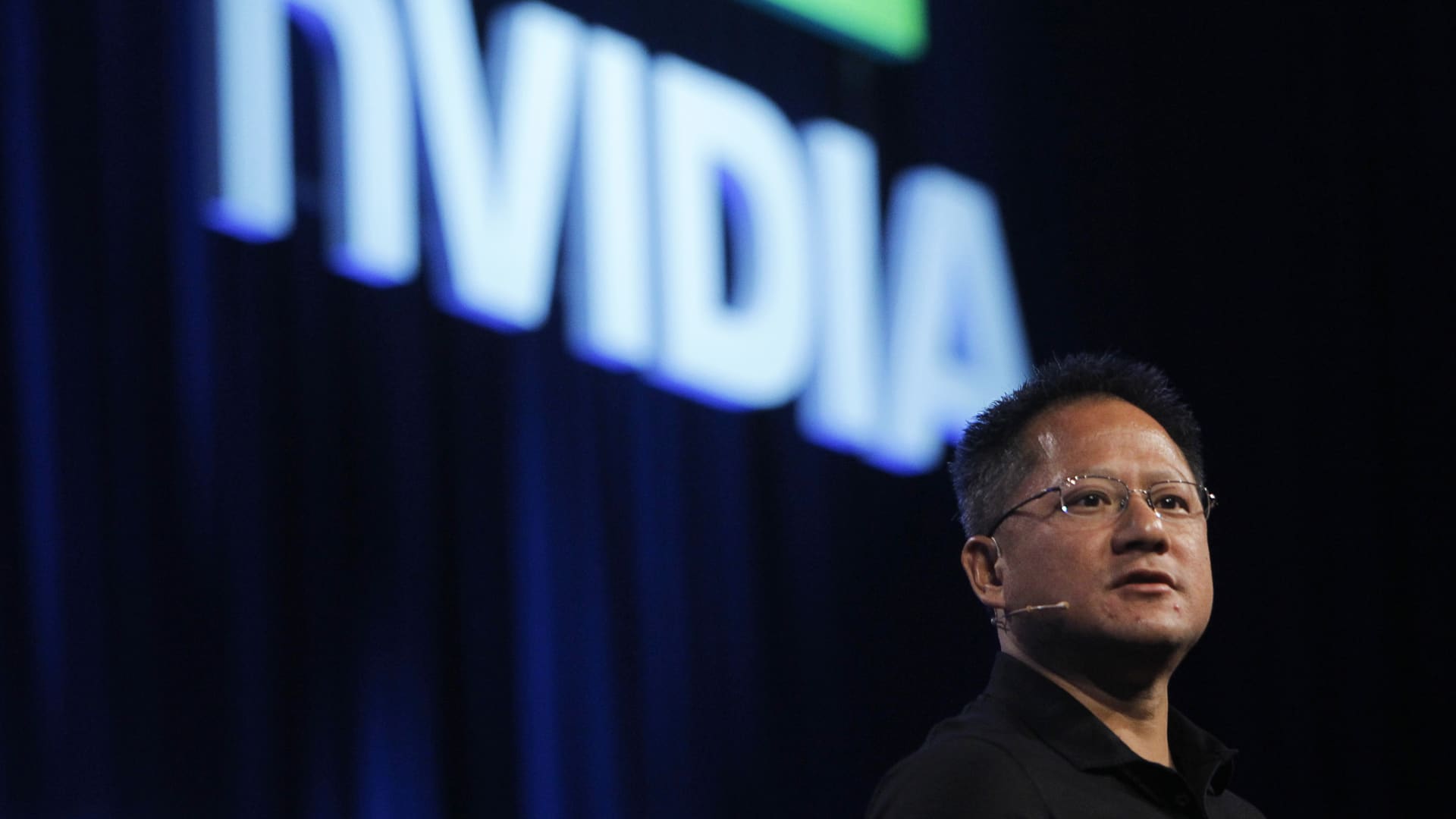

Here are Tuesday’s biggest calls on Wall Street: Goldman Sachs reiterates Tesla as neutral Goldman said China remains Tesla’s largest market and that it’s bullish on the company’s full self driving capabilities but that it’s sticking with its neutral rating right now. “We believe that Tesla’s ability to leverage its Full Self Driving software in China will be important for the stock going forward given the size of the China market for vehicles, the increasingly competitive landscape for ADAS [advanced driver assistance systems] software and robotaxi offerings in the region and the role that future profits from AI enabled products like FSD have for Tesla’s valuation.” BMO initiating Shopify as outperform BMO said in its initiation of the e-commerce platform company that helps businesses that it sees a “substantial runway for growth on several fronts.” “We’ve initiated coverage of Shopify at Outperform with a US$120 target price. JPMorgan downgrades Sweetgreen to neutral from overweight The Wall Street firm said demand is softening and that the value proposition needs improving. “We are downgrading Sweetgreen to Neutral with a $25 Dec-26 price target for several reasons. We see underlying demand trends continue to soften with further impact moving into higher income demographics.” Goldman Sachs reiterates ServiceNow as buy Goldman said the company has “durable” long-term growth potential. “We reiterate our Buy rating and $1,150 price target on ServiceNow after attending the company’s Analyst Day (5/5) in conjunction with Knowledge 2025. It is clear that ServiceNow’s transition from IT-centric workflows to those cutting across multiple applications is well underway.” Susquehanna upgrades Canadian National to positive from neutral Susquehanna said shares of the railway company are attractive at current levels. “We see value in CNI on our view of modest cyclical risk to guidance vs. shares trading near the low end of their historic absolute and rail-relative valuation.” Wells Fargo reiterates Walmart as overweight Wells said the stock remains a “winner no matter what” ahead of earnings next week. “We expect a solid, in-line Q1. The bigger question is how macro/tariff uncertainty impacts guidance; we expect a reiteration and more talk of share capture opportunity. Rich valuation, but WMT’s ability to win regardless of the backdrop keeps us OW.” TD Cowen downgrades Church & Dwight to hold from buy TD Cowen downgraded the consumer products company citing slowing growth. “Given the lack of a positive catalyst for U.S. inflection, low exposure to higher growth international markets, and CHD’s valuation premium to peers, we believe a Hold rating is warranted.” Monness, Crespi, Hardt downgrades Coinbase to neutral from buy The firm said it was making a tactical downgrade of Coinbase ahead of earnings later this week. “We downgrade to Neutral (fr. Buy), cut estimates, and remove our price target on concern 1Q25 likely to be light along with tepid QTD txn [transaction] rev results/2Q25 guide.” Northcoast downgrades McDonald’s to neutral from buy Northcoast said in its downgrade of the stock that it sees margin pressures. “We are lowering our rating on McDonald’s to NEUTRAL, concerned that converting topline sales to earnings will stall as consumers seek value while costs remain a headwind.” Loop reiterates Palantir as buy Loop said it’s standing by the stock following earnings on Monday and that investors should buy the dip. “Bottom line, the market for enterprise AI is enormous, is at a tipping point as small-scale pilot programs move into production and AI use cases grow exponentially across all industries, and we believe PLTR is uniquely positioned as one of the category leaders in the space.” Morgan Stanley reiterates AT & T as a top pick Morgan Stanley said AT & T remains a top idea at the firm. “We believe AT & T and Verizon are best-positioned to benefit from domestic tax policy, which would accelerate FCF and capital return to shareholders Bank of America reiterates Nvidia as buy Bank of America said Nvidia remains one of the most highly owned names in semiconductors but that it’s still “relatively underweight.” “Notably, despite confidence in NVDA’s l-t [long term] growth prospects, the stock’s weighting still remains relatively low at 1.05x, up slightly from the 1.01x level cited in the last update Morgan Stanley reiterates Apple as overweight The firm said concerns about Apple’s lawsuit with Epic Games is overdone. “While last week’s Apple v. Epic injunction bears watching, we think the fundamental EPS and multiple impact is low.” Needham initiates Broadridge Financial as buy Needham said the fintech financial solutions company is a core holding. “We are initiating coverage of Broadridge ( BR) with a Buy rating and a $300 price target. BR is a provider of critical technology operations and communications services.”