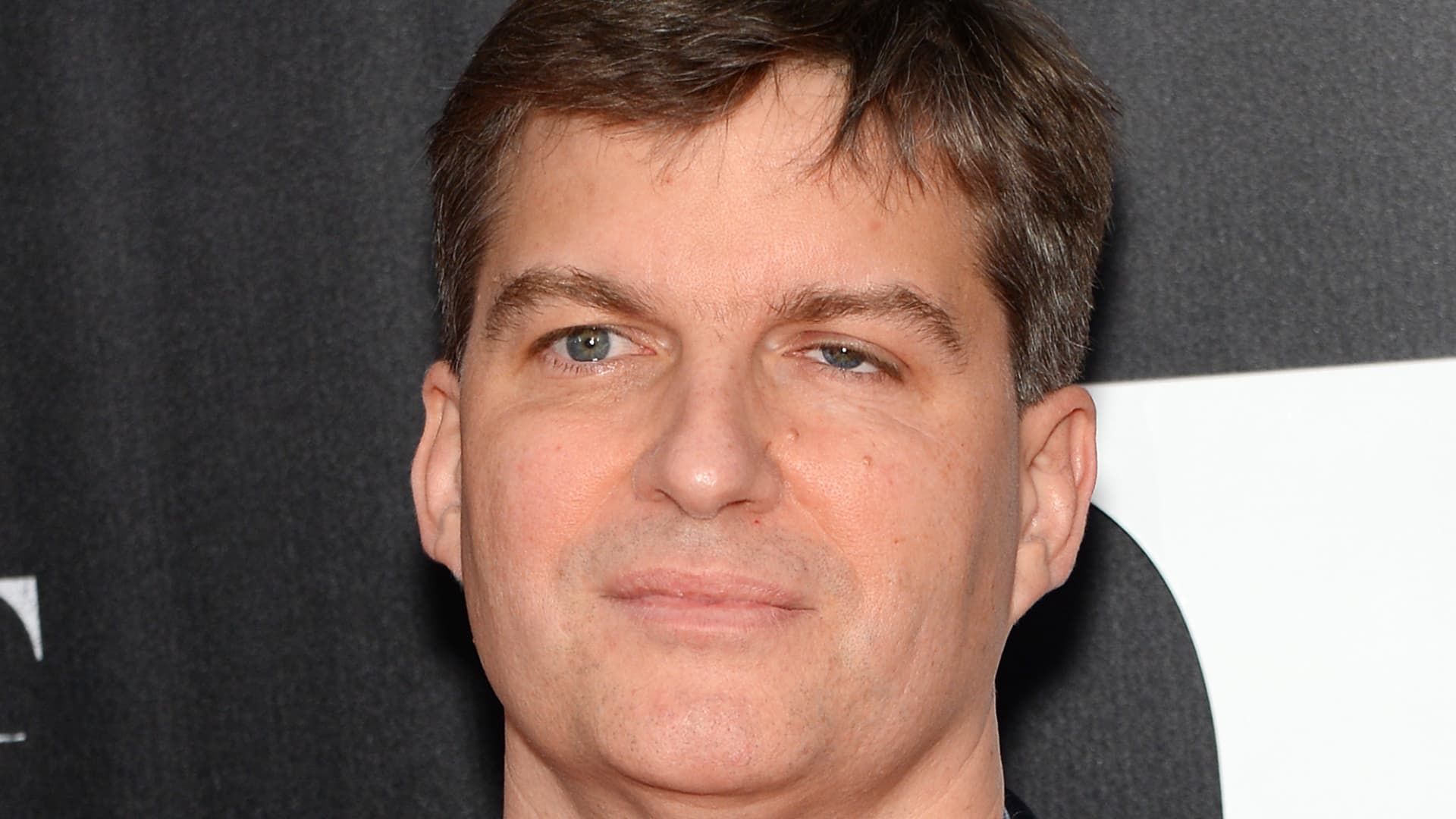

Hedge fund manager Michael Burry, who shot to fame by calling the subprime mortgage crisis, piled into shares and call options of the beaten-down UnitedHealth , a stock that Warren Buffett ‘s Berkshire Hathaway also purchased. Burry’s Scion Asset Management owned call contracts against 350,000 shares of UnitedHealth at the end of June, with unknown value, strike price or expiry, according to the filing. The notional value of the shares involved was more than $109 million at the end of the second quarter. Investors profit from calls when the underlying securities rise in price, but it’s not known if Burry still holds the position. The stake in UnitedHealth’s common stock is small with just 20,000 shares, worth about $6 million at the end of June. UnitedHealth attracted other buyers last quarter, most notable being the “Oracle of Omaha.” His conglomerate bought more than 5 million shares in the health insurer, putting it as the 18th biggest position in the Berkshire portfolio behind Amazon and Constellation Brands. UnitedHealthcare has become the poster child for problems with the U.S. health insurance industry and the nation’s sprawling health-care system. Shares are down 46% this year following a string of setbacks for the company, including the CEO’s exit . Burry added a few consumer names in the second quarter, taking sizable stakes in Lululemon , Estee Lauder and e-commerce name MercadoLibre . Burry became well-known after he successfully bet against mortgage-backed securities before the 2008 global financial crisis . Burry was depicted in Michael Lewis’ book ” The Big Short ” and the subsequent Oscar-winning movie of the same name. It’s also unclear if Burry took any bearish bets last quarter, as short positions are not disclosed in these reports. He didn’t have any put options in the latest filing. Money managers with more than $100 million in assets under management are required to disclose long positions with the Securities and Exchange Commission 45 days after a quarter ends. Active traders such as Burry could have already changed their positions by the time filings come out.